Delta Airlines 2002 Annual Report Download - page 132

Download and view the complete annual report

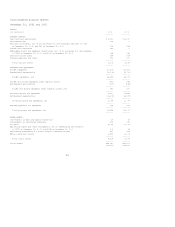

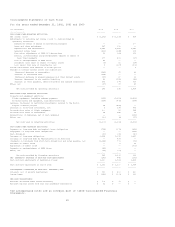

Please find page 132 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liabilities and Shareowners' Equity

(in millions, except share data) 2002 2001

------- -------

CURRENT LIABILITIES:

Current maturities of long-term debt $ 666 $ 260

Short-term obligations -- 765

Current obligations under capital leases 27 31

Accounts payable, deferred credits and other accrued liabilities 1,921 1,617

Air traffic liability 1,270 1,224

Taxes payable 862 1,049

Accrued salaries and related benefits 1,365 1,121

Accrued rent 344 336

------- -------

Total current liabilities 6,455 6,403

------- -------

NONCURRENT LIABILITIES:

Long-term debt 9,576 7,781

Long-term debt issued by Massachusetts Port Authority (Note 6) 498 498

Capital leases 100 68

Postretirement benefits 2,282 2,292

Accrued rent 739 781

Deferred income taxes -- 465

Pension and related benefits 3,242 359

Other 93 105

------- -------

Total noncurrent liabilities 16,530 12,349

------- -------

DEFERRED CREDITS:

Deferred gains on sale and leaseback transactions 478 519

Deferred revenue and other credits 100 310

------- -------

Total deferred credits 578 829

------- -------

COMMITMENTS AND CONTINGENCIES (NOTES 3, 4, 6, 7, 8 AND 9)

EMPLOYEE STOCK OWNERSHIP PLAN PREFERRED STOCK:

Series B ESOP Convertible Preferred Stock, $1.00 par value, $72.00 stated and

liquidation value; 6,065,489 shares issued and outstanding at December 31,

2002, and 6,278,210 shares issued and outstanding at December 31, 2001 437 452

Unearned compensation under Employee Stock Ownership Plan (173) (197)

------- -------

Total Employee Stock Ownership Plan Preferred Stock 264 255

------- -------

SHAREOWNERS' EQUITY:

Common stock, $1.50 par value; 450,000,000 shares authorized; 180,903,373 shares issued

at December 31, 2002, and 180,890,356 shares issued at December 31, 2001 271 271

Additional paid-in capital 3,263 3,267

Retained earnings 1,639 2,930

Accumulated other comprehensive income (loss) (1,562) 25

Treasury stock at cost, 57,544,168 shares at December 31, 2002, and 57,644,690

shares at December 31, 2001 (2,718) (2,724)

------- -------

Total shareowners' equity 893 3,769

------- -------

Total liabilities and shareowners' equity $24,720 $23,605

======= =======

The accompanying notes are an integral part of these Consolidated Financial

Statements.

27