Delta Airlines 2002 Annual Report Download - page 125

Download and view the complete annual report

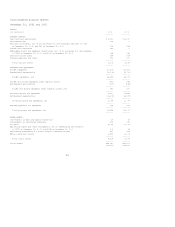

Please find page 125 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management's Discussion and Analysis of Financial Condition and Results of

Operations

Our estimated pension funding is approximately $80 million for 2003 and between

$350 million and $450 million for 2004. These funding estimates are based on

various assumptions, including actual market performance of our plan assets and

future 30-year U.S. Treasury bond yields. Our 2004 estimate could change

significantly prior to the funding date and funding beyond 2004 is not

reasonably estimable at this time. Pension funding requirements are governed by

ERISA and subject to certain federal tax regulations. See Note 11 of the Notes

to the Consolidated Financial Statements for additional information about our

pension plans.

In addition, we have contractual obligations related to our contract carrier

agreements with SkyWest Airlines, Atlantic Coast Airlines and Chautauqua

Airlines. We estimate that our obligations under these contracts will total

approximately $780 million in 2003. Costs beyond 2003 under these agreements

will be impacted by certain variable operating costs that cannot be reasonably

determined at this time. See Note 9 of the Notes to the Consolidated Financial

Statements for additional information about these agreements.

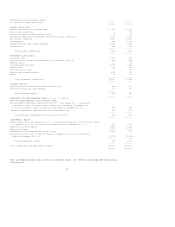

OFF-BALANCE SHEET ARRANGEMENTS

SALE OF RECEIVABLES

We are a party to an agreement under which we sell a defined pool of our

accounts receivable, on a revolving basis, through a special-purpose, wholly

owned subsidiary to a third party. In accordance with accounting principles

generally accepted in the United States of America (GAAP), we do not consolidate

this subsidiary in our Consolidated Financial Statements. This agreement is

scheduled to terminate on March 31, 2003. If the agreement is not renewed prior

to this date, we will be required to repurchase outstanding receivables which

totaled $250 million at December 31, 2002. This amount is not included on our

Consolidated Balance Sheets. See Note 8 of the Notes to the Consolidated

Financial Statements for additional information about this agreement.

OTHER

LEGAL CONTINGENCIES

We are involved in legal proceedings relating to antitrust matters, employment

practices, environmental issues and other matters concerning our business. We

cannot reasonably estimate the potential loss for certain legal proceedings

because, for example, the litigation is in its early stages or the plaintiff

does not specify damages being sought. Although the ultimate outcome of these

matters cannot be predicted with certainty, we believe that the resolution of

these actions will not have a material adverse effect on our Consolidated

Financial Statements.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with GAAP requires

management to make certain estimates and assumptions. We periodically evaluate

these estimates and assumptions, which are based on historical experience,

changes in the business environment and other factors that management believes

to be reasonable under the circumstances. Actual results may differ materially

from these estimates.

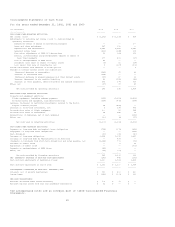

Rules proposed by the Securities and Exchange Commission define critical

accounting estimates as those accounting estimates which (1) require management

to make assumptions about matters that are highly uncertain at the time the

estimate is made and (2) would have resulted in material changes to our

Consolidated Financial Statements if different estimates, which we reasonably

could have used, were made. Our critical accounting estimates are briefly

described below. Additional information about these estimates and our

significant accounting policies are included in Notes 1, 5, 10 and 11 of the

Notes to the Consolidated Financial Statements.

GOODWILL

On January 1, 2002, we adopted SFAS 142, which addresses financial accounting

and reporting for goodwill and other intangible assets, including when and how

to perform impairment tests of recorded balances.

We have three reporting units that have assigned goodwill: Delta-mainline,

Atlantic Southeast Airlines, Inc. (ASA) and Comair. Quoted stock market prices

are not available for these individual reporting units. Accordingly, consistent

with SFAS 142, our methodology for estimating the fair value of each reporting

unit primarily considers discounted future cash flows. In applying this

methodology, we (1) make assumptions about each reporting unit's future cash