Delta Airlines 2002 Annual Report Download - page 151

Download and view the complete annual report

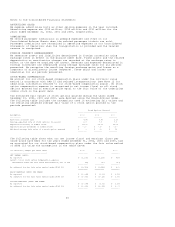

Please find page 151 of the 2002 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.combined effect of (1) the anticipated need to record at December 31, 2002, a

substantial non-cash charge to equity relating to our defined benefit pension

plans (see Note 11); (2) our increased debt levels; and (3) our continuing

losses since 2001. In consideration for these changes, we:

- Agreed to comply with a new cash maintenance covenant that was added to

the Reimbursement Agreement. See the Covenants and Change in Control

Provisions section below.

- Agreed that the Reimbursement Agreement and the letters of credit

issued thereunder would terminate on June 8, 2003. These letters of

credit were originally scheduled to expire between June 8, 2003 and

December 4, 2003.

- Terminated in October 2002 a reimbursement agreement with Bayerische

Hypo-Und Vereinsbank AG and a group of banks (HVB Agreement) and the

related letter of credit that supported our obligations with respect to

the Series C Guaranteed Serial ESOP Notes (ESOP Notes). Several of the

banks that are parties to the Reimbursement Agreement also participated

in the HVB Agreement. The HVB Agreement was originally scheduled to

expire on May 19, 2003. See the ESOP Notes section below.

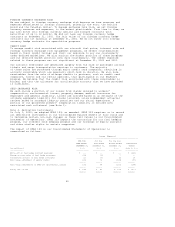

The Reimbursement Agreement generally provides that, if there is a drawing under

a letter of credit to purchase bonds that have been tendered, we may convert our

repayment obligation to a loan that becomes due and payable on the earlier of

(1) the date the related bonds are remarketed or (2) June 8, 2003.

Unless the letters of credit issued under the Reimbursement Agreement are

extended in a timely manner, we will be required to purchase on June 3, 2003,

five days prior to the expiration of the letters of credit, the related $403

million principal amount of tax-exempt municipal bonds. In these circumstances,

we could seek, but there is no assurance we would be able, to (1) sell the bonds

without a letter of credit enhancement at then prevailing fixed interest rates

or (2) replace the expiring letters of credit with a new letter of credit from

an alternate credit provider and remarket the related bonds.

ESOP NOTES

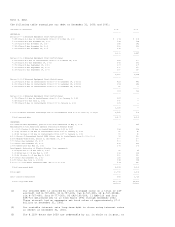

We guarantee the ESOP Notes issued by the Delta Family-Care Savings Plan. The

holders of the ESOP Notes were entitled to the benefits of an unconditional,

direct-pay letter of credit issued under the HVB Agreement. Required payments of

principal, interest and make-whole premium amounts on the ESOP Notes were paid

under the letter of credit. As part of the amendment to the Reimbursement

Agreement discussed above, we terminated the HVB Agreement on October 21, 2002.

To effect the termination of the HVB Agreement, on September 30, 2002, we

provided the required advance notice of our decision to terminate early the

letter of credit issued under that agreement. As a result of this action, each

holder of the ESOP Notes had the right to require us to purchase its ESOP Notes

before the termination of the letter of credit. Some, but not all, of the

holders of the ESOP Notes exercised this right. On October 15, 2002, we

purchased ESOP Notes for $215 million, covering $169 million principal amount of

ESOP Notes, $4 million of accrued interest and $42 million of make-whole

premium. The $42 million loss recognized for the make-whole premium related to

this extinguishment of debt was recorded in other income (expense) on our

Consolidated Statements of Operations.

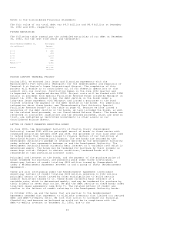

As a result of the termination of the letter of credit issued under the HVB

Agreement, the holders of the remaining $92 million principal amount of ESOP

Notes that we did not purchase on October 15, 2002, had the right to tender

their ESOP Notes for purchase by January 26, 2003. Some, but not all, of the

remaining holders of the ESOP Notes exercised this right. On January 26, 2003,

we incurred an obligation to purchase on February 25, 2003, ESOP Notes for $74

million, covering $57 million principal amount of ESOP Notes, $3 million of

accrued interest and $14 million of make-whole premium. The $14 million loss

recognized for the make-whole premium related to this extinguishment of debt

will be recorded during the March 2003 quarter in other income (expense) on our

Consolidated Statements of Operations. Subsequent to our purchase of these ESOP

Notes, $35 million principal amount of ESOP Notes is held by third parties.

45