Cricket Wireless 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.well as any obligations owed to us by Pocket. Under the STX LLC Agreement, we are permitted to purchase Pocket’s

membership interests in STX Wireless over multiple closings in the event that the block of shares of Leap common

stock issuable to Pocket at the closing of the purchase would be greater than 9.9% of the total number of shares of Leap

common stock then issued and outstanding. To the extent the redemption price for Pocket’s non-controlling

membership interest exceeds the value of Pocket’s net interest in STX Wireless at any period, the value of such

interest is accreted to the redemption price for such interest with a corresponding adjustment to additional paid-in

capital. As of December 31, 2010, we accreted approximately $48.1 million to reflect the change in the redemption

value of such interest. We have recorded this obligation to purchase all of Pocket’s membership interests in STX

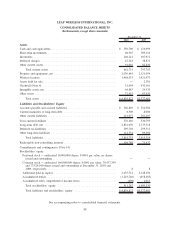

Wireless as a component of redeemable non-controlling interests in the consolidated balance sheets. As of

December 31, 2010, this redeemable interest had a carrying value of $99.5 million.

At the closing of the formation of the joint venture, STX Wireless entered into a loan and security agreement

with Pocket pursuant to which, commencing in April 2012, STX Wireless agreed to make quarterly limited-

recourse loans to Pocket out of excess cash in an aggregate principal amount not to exceed $30 million, which loans

are secured by Pocket’s membership interests in STX Wireless. Such loans will bear interest at 8.0% per annum,

compounded annually, and will mature on the earlier of October 2020 and the date on which Pocket ceases to hold

any membership interests in STX Wireless. We have the right to set off all outstanding principal and interest under

this loan and security agreement against the payment of the purchase price for Pocket’s membership interests in

STX Wireless in the event of a put, call or mandatory buyout following a change of control of Leap.

We are implementing a plan for STX Wireless to integrate the Cricket and Pocket operating assets in the South

Texas region so that the combined network and retail operations of the new joint venture will operate more

efficiently. These changes and integrations are expected to occur through the third quarter of 2011 and we may incur

significant restructuring charges to integrate STX Wireless’ network and retail operations during this time period.

Denali and Savary Island Transactions

Cricket service is offered in the upper Midwest by Denali Operations. Denali Operations and its parent company,

Denali, are wholly-owned subsidiaries of Cricket. We originally acquired an 82.5% non-controlling membership interest

in Denali in 2006. Denali was formed as a “very small business” designated entity under FCC regulations and purchased

a wireless license in Auction #66 covering the upper Midwest portion of the U.S. On December 27, 2010, we purchased

the remaining 17.5% controlling membership interest in Denali that we did not previously own in Denali for

$53.5 million in cash and a five-year $45.5 million promissory note. Interest on the outstanding principal balance

of the note varies from year-to-year at rates ranging from approximately 5.0% to 8.3% and compounds annually. Under

the note, we are required to make principal payments of $8.5 million per year, with the remaining principal balance and

all accrued interest payable at maturity. Our obligations under the note are secured on a first-lien basis by certain assets of

Savary Island. In connection with the acquisition, we also paid $11 million to the FCC in unjust enrichment payments.

Effective as of the closing of our acquisition of the remaining membership interest in Denali, the management services

agreement, senior secured credit agreement and related agreements among Cricket and Denali and its subsidiaries were

terminated and all remaining outstanding indebtedness (including accrued interest) under the Denali senior secured

credit agreement (other than indebtedness assumed by Savary Island, see below) was cancelled.

Immediately prior to our purchase of the remaining membership interest in Denali, Denali contributed all of its

wireless spectrum outside of its Chicago and Southern Wisconsin operating markets and a related spectrum lease to

Savary Island, a newly formed venture, in exchange for an 85% non-controlling membership interest. Savary Island

acquired this spectrum as a “very small business” designated entity under FCC regulations. Ring Island Wireless,

LLC, or Ring Island, contributed $5.1 million of cash to Savary Island in exchange for a 15% controlling

membership interest. In connection with the contribution of assets by Denali, Savary Island assumed $211.6 million

of the outstanding loans owed to us under the Denali senior secured credit agreement, and we entered into an

amended and restated senior secured credit agreement with Savary Island and its subsidiaries to amend and restate

the terms of the Denali senior secured credit agreement applicable to the assume loans (see “Part I — Item 1.

Business” above.) Under the Savary Island LLC Agreement, Ring Island has the right to put its entire membership

interest in Savary Island to Cricket as early as mid-2012 (based on current FCC rules). Savary Island has guaranteed

Cricket’s put obligations under the Savary Island LLC Agreement, which guaranty is secured on a first-lien basis by

certain assets of Savary Island. At the closing, Savary Island entered into a management services agreement with us,

pursuant to which Cricket provides management services to Savary Island in exchange for a management fee.

83