Cricket Wireless 2010 Annual Report Download - page 82

Download and view the complete annual report

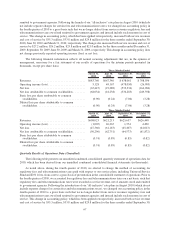

Please find page 82 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net cash used in investing activities was $910.0 million during the year ended December 31, 2008, which

included the effects of the following transactions:

• We purchased Hargray Communications Group’s wireless subsidiary, Hargray Wireless, for $31.2 million,

including acquisition-related costs of $0.7 million.

• We purchased $795.7 million of property and equipment for the build-out of our new markets and the

expansion and improvement of our existing markets.

• We made investment purchases of $598.0 million, offset by sales or maturities of investments of

$532.5 million.

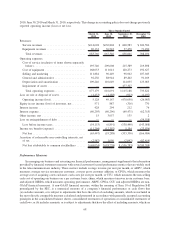

Financing Activities

Net cash used in financing activities was $12.5 million for the year ended December 31, 2010, which included

the effects of the following transactions:

• We issued $1,200 million of unsecured senior notes, which resulted in net proceeds of $1,179.9 million. This

note issuance was offset by the payment to repurchase and redeem all of our $1,100 million of outstanding

9.375% senior notes due 2014.

• We made payments of $24.2 million to acquire all of the remaining membership interests we did not

previously own in LCW Wireless.

• We made payments of $12.1 million to repay and discharge all amounts outstanding under LCW Wireless’

former senior secured credit agreement.

• We made payments of $53.5 million to acquire all of the remaining membership interests we did not

previously own in Denali.

Net cash provided by financing activities was $408.8 million during the year ended December 31, 2009, which

included the effects of the following transactions:

• We issued $1,100 million of senior secured notes, which resulted in net proceeds of $1,057.5 million. This

note issuance was offset by the payment of $875.3 million to repay and discharge all amounts outstanding

under our former credit agreement. In addition, we incurred $16.2 million in debt issuance costs in

connection with the issuance of the senior secured notes.

• We made payments of $2.3 million under our former credit agreement during the first quarter of 2009 and

LCW Operations made payments of $20.3 million under its former senior secured credit agreement, which

included a $17.0 million repayment of principal in connection with an amendment to the senior secured

credit agreement.

• We sold an aggregate of 7,000,000 shares of Leap common stock in an underwritten public offering,

resulting in aggregate net proceeds of $263.7 million.

• We issued common stock upon the exercise of stock options held by our employees, resulting in aggregate

net proceeds of $3.4 million.

Net cash provided by financing activities was $483.7 million during the year ended December 31, 2008, which

included the effects of the following transactions:

• We issued $300 million of unsecured senior notes, which resulted in net proceeds of $293.3 million, and

$250 million of convertible senior notes, which resulted in net proceeds of $242.5 million. These note

issuances were offset by payments of $9.0 million under our former credit agreement and a payment of

$1.5 million under LCW Operations’ senior secured credit agreement. These note issuances were further

offset by the payment of $7.7 million in debt issuance costs.

• We made payments of $41.8 million on our capital lease obligations, a large portion of which related to our

acquisition of the VeriSign billing system software.

76