Cricket Wireless 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

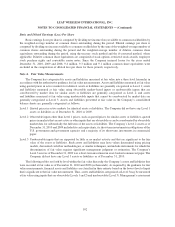

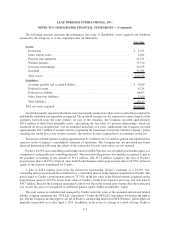

(1) Accounts receivable, consists primarily of amounts billed to third-party dealers for devices and accessories and

amounts due from service providers related to interconnect and roaming agreements, net of an allowance for

doubtful accounts.

(2) As of December 31, 2010 and 2009, approximately $8.5 million of assets were held by the Company under

capital lease arrangements. Accumulated amortization relating to these assets totaled $4.0 million and

$3.8 million as of December 31, 2010 and 2009, respectively.

(3) Deferred service revenue consists primarily of cash received from customers in advance of their service period.

(4) Deferred equipment revenue relates to devices sold to third-party dealers.

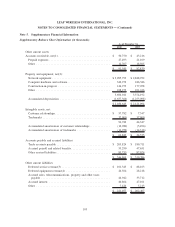

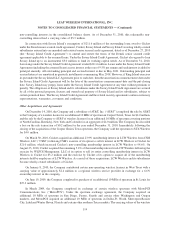

Supplementary Cash Flow Information (in thousands):

2010 2009 2008

December 31,

Cash paid for interest ............................ $(244,123) $(223,343) $(178,880)

Cash paid for income taxes ........................ $ (2,810) $ (1,950) $ (1,914)

Supplementary disclosure of non-cash investing activities:

Contribution of wireless licenses .................... $ 2,381 $ — $ —

Consideration provided for the acquisition of Pocket’s

business .................................... $ (99,894) $ — $ —

Supplementary disclosure of non-cash financing activities:

Note assumed as consideration for purchase of remaining

interest in Denali.............................. $ 45,500 $ — $ —

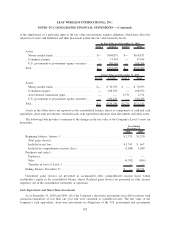

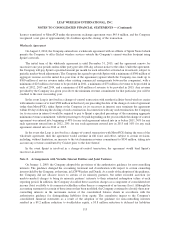

Note 6. Goodwill and Wireless Licenses

Goodwill

As of December 31, 2010, goodwill of $31.1 million represented the excess of the purchase price over the fair

value of the assets acquired (net of liabilities assumed, including the related deferred tax effects), in the formation of

STX Wireless. As of December 31, 2009, goodwill primarily represented the excess of the Company’s

reorganization value over the fair value of identified tangible and intangible assets recorded in connection with

fresh-start reporting as of July 31, 2004. The following table summarizes the changes in the carrying amount of the

Company’s goodwill as of and for the years ended December 31, 2010 and 2009 (in thousands):

2010 2009

Year Ended December 31,

Beginning balance, January 1 ................................... $430,101 $430,101

Goodwill impairment charge .................................. (430,101) —

Goodwill acquired ......................................... 31,094 —

Ending balance, December 31 .................................. $ 31,094 $430,101

During the third quarter of each year, the Company assesses its goodwill for impairment at the reporting unit

level by applying a fair value test. This fair value test involves a two-step process. The first step is to compare the

carrying value of the Company’s net assets to its fair value. If the fair value is determined to be less than carrying

value, a second step is performed to measure the amount of the impairment, if any.

In connection with its annual impairment test, the Company bases its determination of fair value primarily

upon its average market capitalization for the month of August, plus a control premium. Average market

capitalization is calculated based upon the average number of shares of Leap common stock outstanding

during such month and the average closing price of Leap common stock during such month. The Company

106

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)