Cricket Wireless 2010 Annual Report Download - page 120

Download and view the complete annual report

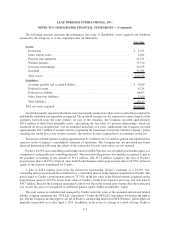

Please find page 120 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.non-controlling interests in the consolidated balance sheets. As of December 31, 2010, this redeemable non-

controlling interest had a carrying value of $5.3 million.

In connection with Savary Island’s assumption of $211.6 million of the outstanding loans owed to Cricket

under the Denali senior secured credit agreement, Cricket, Savary Island and Savary Island’s existing wholly-owned

subsidiaries entered into an amended and restated senior secured credit agreement, dated as of December 27, 2010

(the “Savary Island Credit Agreement”) to amend and restate the terms of the Denali senior secured credit

agreement applicable to the assumed loans. Under the Savary Island Credit Agreement, Cricket also agreed to loan

Savary Island up to an incremental $5.0 million to fund its working capital needs. As of December 31, 2010,

borrowings under the Savary Island Credit Agreement totaled $211.6 million. Loans under the Savary Island Credit

Agreement (including the assumed loans) accrue interest at the rate of 9.5% per annum and such interest is added to

principal annually. All outstanding principal and accrued interest is due in May 2021. Outstanding principal and

accrued interest are amortized in quarterly installments commencing May 2018. However, if Ring Island exercises

its put under the Savary Island LLC Agreement prior to such date, then the amortization commencement date under

the Savary Island Credit Agreement will be the later of the amortization commencement date and the put closing

date. Savary Island may prepay loans under the Savary Island Credit Agreement at any time without premium or

penalty. The obligations of Savary Island and its subsidiaries under the Savary Island Credit Agreement are secured

by all of the personal property, fixtures and owned real property of Savary Island and its subsidiaries, subject to

certain permitted liens. The Savary Island Credit Agreement and the related security agreements contain customary

representations, warranties, covenants and conditions.

Other Acquisitions and Agreements

On December 14, 2010, the Company and a subsidiary of AT&T, Inc. (“AT&T”) completed the sale by AT&T

to the Company of a wireless license for an additional 10 MHz of spectrum in Corpus Christi, Texas for $4.0 million,

and the sale by the Company to AT&T of wireless licenses for an additional 10 MHz of spectrum covering portions

of North Carolina, Kentucky, New York and Colorado for an aggregate of $4.0 million. The Company has recorded

a loss on the sale transaction of $0.2 million for the year ended December 31, 2010. Immediately following the

closing of the acquisition of the Corpus Christi, Texas spectrum, the Company sold the spectrum to STX Wireless

for $4.0 million.

On March 30, 2010, Cricket acquired an additional 23.9% membership interest in LCW Wireless from CSM

Wireless, LLC (“CSM”) following CSM’s exercise of its option to sell its interest in LCW Wireless to Cricket for

$21.0 million, which increased Cricket’s non-controlling membership interest in LCW Wireless to 94.6%. On

August 25, 2010, Cricket acquired the remaining 5.4% of the membership interests in LCW Wireless following the

exercise by WLPCS Management, LLC of its option to sell its entire controlling membership interest in LCW

Wireless to Cricket for $3.2 million and the exercise by Cricket of its option to acquire all of the membership

interests held by employees of LCW Wireless. As a result of these acquisitions, LCW Wireless and its subsidiaries

became wholly-owned subsidiaries of Cricket.

On January 8, 2010, the Company contributed certain non-operating wireless licenses in West Texas with a

carrying value of approximately $2.4 million to a regional wireless service provider in exchange for a 6.6%

ownership interest in the company.

On June 19, 2009, the Company completed its purchase of an additional 10 MHz of spectrum in St. Louis for

$27.2 million.

In March 2009, the Company completed its exchange of certain wireless spectrum with MetroPCS

Communications, Inc. (“MetroPCS”). Under the spectrum exchange agreement, the Company acquired an

additional 10 MHz of spectrum in San Diego, Fresno, Seattle and certain other Washington and Oregon

markets, and MetroPCS acquired an additional 10 MHz of spectrum in Dallas-Ft. Worth, Shreveport-Bossier

City, Lakeland-Winter Haven, Florida and certain other northern Texas markets. The carrying values of the wireless

114

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)