Cricket Wireless 2010 Annual Report Download - page 57

Download and view the complete annual report

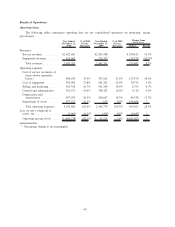

Please find page 57 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Principles of Consolidation

The consolidated financial statements include the operating results and financial position of Leap and its

wholly-owned subsidiaries as well as the operating results and financial position of Savary Island and STX Wireless

and their wholly-owned subsidiaries. We consolidate our non-controlling membership interest in Savary Island in

accordance with the authoritative guidance for the consolidation of variable interest entities because Savary Island

is a variable interest entity and we have entered into an agreement with Savary Island’s other member which

establishes a specified purchase price in the event that it exercises its right to sell its membership interest to us. We

consolidate STX Wireless in accordance with the authoritative guidance for consolidations based on the voting

interest model. All intercompany accounts and transactions have been eliminated in the consolidated financial

statements.

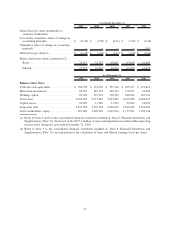

Change in Accounting Principle

During the fourth quarter of 2010, we elected to change the method of accounting for regulatory fees and

telecommunications taxes paid with respect to our service plans, including Universal Service Fund and E-911 fees,

from a net to a gross basis in the consolidated statements of operations. Prior to the fourth quarter of 2010, we

accounted for regulatory fees and telecommunications taxes on a net basis, such that regulatory fees and

telecommunications taxes were recorded as service revenue, net of amounts owed and remitted to government

agencies. Following the introduction of our “all-inclusive” rate plans in August 2010 (which do not include separate

charges for certain fees and telecommunications taxes), we changed our accounting policy in the fourth quarter of

2010 to a gross basis such that we no longer deduct from service revenues regulatory fees and telecommunications

taxes owed and remitted to government agencies and instead include such amounts in cost of service. This change in

accounting policy, which has been applied retrospectively, increased both service revenue and cost of service by

$139.9 million, $98.2 million, $73.1 million, $71.4 million and $64.6 million for the years ended December 31,

2010, 2009, 2008, 2007 and 2006, respectively. This change in accounting policy does not change previously

reported operating income (loss) or net loss.

We changed our accounting policy to the gross basis of revenue reporting because under the “all inclusive” rate

plans that we introduced in 2010, we absorb the variability resulting from periodic regulatory rate changes. In

addition, payment of the regulatory fees and telecommunications tax surcharges is ultimately our responsibility.

Further, we also believe that the gross basis of reporting is the prevailing practice within the wireless

telecommunications industry, which will make our financial information more comparable to that of other

companies within our industry. See Note 2 to our consolidated financial statements.

Revenues

Our business revenues principally arise from the sale of wireless services, devices (handsets and broadband

modems) and accessories. Wireless services are provided primarily on a month-to-month basis. In general, our

customers are required to pay for their service in advance and we do not require customers to sign fixed-term

contracts or pass a credit check. Service revenues are recognized only after payment has been received and services

have been rendered.

In August 2010, we introduced new rate plans for all of our Cricket services, eliminated certain fees (such as

activation, reactivation and regulatory fees) and telecommunications taxes and ceased offering a free first month of

service to new Cricket Wireless and Cricket Broadband customers when they purchase a new device and activate

service. Prior to August 2010, when we activated service for a new customer, we typically sold that customer a

device bundled with a free period of service. Under each approach, in accordance with the authoritative guidance for

revenue arrangements with multiple deliverables, the sale of a device along with service constitutes a multiple

element arrangement. Under this guidance, once a company has determined the fair value of the elements in the

sales transaction, the total consideration received from the customer must be allocated among those elements on a

relative fair value basis. Applying the guidance to these transactions results in us recognizing the total consideration

received, less amounts allocated to the wireless service period (generally the customer’s monthly rate plan), as

equipment revenue.

51