Cricket Wireless 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The information required by this item regarding directors and corporate governance is incorporated by

reference to our definitive Proxy Statement to be filed with the SEC in connection with the Annual Meeting of

Stockholders to be held in 2011, or the “2011 Proxy Statement,” under the headings “Election of Directors,” “Board

of Directors and Board Committees” and “Section 16(a) Beneficial Ownership Reporting Compliance.”

Information regarding executive officers is set forth in Item 1 of Part I of this Report under the caption

“Executive Officers of the Registrant.” We have adopted a Code of Business Conduct and Ethics that applies

to all of our directors, officers and employees, including our principal executive officer, principal financial officer

and principal accounting officer. Our Code of Business Conduct and Ethics is posted on our website,

www.leapwireless.com.

Item 11. Executive Compensation

The information required by this item is incorporated by reference to the 2011 Proxy Statement under the

headings “Compensation Discussion and Analysis,” “Compensation Committee Interlocks and Insider

Participation” and “Compensation Committee Report.”

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters

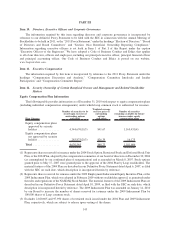

Equity Compensation Plan Information

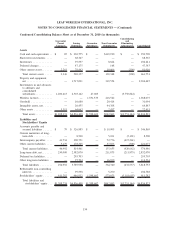

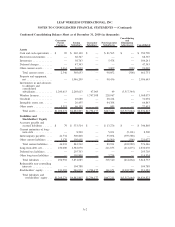

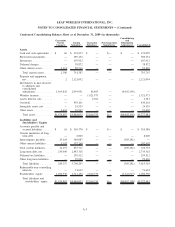

The following table provides information as of December 31, 2010 with respect to equity compensation plans

(including individual compensation arrangements) under which Leap common stock is authorized for issuance.

Plan Category

Number of securities to be

issued upon exercise of

outstanding options

and rights

Weighted-average

exercise price of

outstanding

options

and rights

Number of securities

remaining available for future

issuance under equity

compensation plans

Equity compensation plans

approved by security

holders .............. 4,344,670(1)(3) $41.67 1,165,431(4)

Equity compensation plans

not approved by security

holders .............. 285,875(2)(3) $26.39 16,175

Total ................. 4,630,545 $40.73 1,181,606

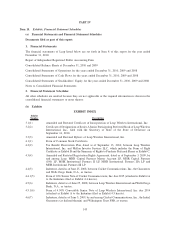

(1) Represents shares reserved for issuance under the 2004 Stock Option, Restricted Stock and Deferred Stock Unit

Plan, or the 2004 Plan, adopted by the compensation committee of our board of directors on December 30, 2004

(as contemplated by our confirmed plan of reorganization) and as amended on March 8, 2007. Stock options

granted prior to May 17, 2007 were granted prior to the approval of the 2004 Plan by Leap stockholders. The

material features of the 2004 Plan are described in our Definitive Proxy Statement dated April 6, 2007, as filed

with the SEC on such date, which description is incorporated herein by reference.

(2) Represents shares reserved for issuance under the 2009 Employment Inducement Equity Incentive Plan, or the

2009 Inducement Plan, which was adopted in February 2009 without stockholder approval, as permitted under

the rules and regulations of the NASDAQ Stock Market. The material features of the 2009 Inducement Plan are

described in our Definitive Proxy Statement dated April 10, 2009, as filed with the SEC on such date, which

description is incorporated herein by reference. The 2009 Inducement Plan was amended on January 14, 2010

by our Board to increase the number of shares reserved for issuance under the 2009 Inducement Plan by

100,000 shares of Leap common stock.

(3) Excludes 2,020,605 and 97,950 shares of restricted stock issued under the 2004 Plan and 2009 Inducement

Plan, respectively, which are subject to release upon vesting of the shares.

143