Cricket Wireless 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

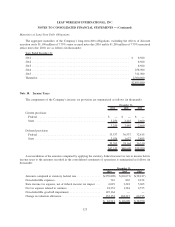

Stock Options

The estimated fair value of the Company’s stock options is determined using the Black-Scholes model. All

stock options were granted with an exercise price equal to the fair value of the common stock on the grant date. The

weighted-average grant date fair value of employee stock options granted during the years ended December 31,

2010 and 2009 was $7.14 and $14.83 per share, respectively, which was estimated using the following weighted-

average assumptions:

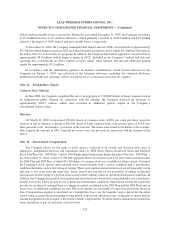

2010 2009

As of

December 31,

Expected volatility ................................................... 60% 54%

Expected term (in years) . ............................................. 5.75 5.75

Risk-free interest rate................................................. 1.89% 2.15%

Expected dividend yield . . ............................................. — —

The determination of the fair value of stock options using an option valuation model is affected by the

Company’s stock price, as well as assumptions regarding a number of complex and subjective variables. Through

June 30, 2010, the volatility assumption was based on a combination of the historical volatility of the Company’s

common stock and the volatilities of similar companies over a period of time equal to the expected term of the stock

options. The volatilities of similar companies were used in conjunction with the Company’s historical volatility

because of the lack of sufficient relevant history for the Company’s common stock equal to the expected term.

Commencing July 1, 2010, the Company determined it had sufficient relevant history and thus began using its

historical volatility. The expected term of employee stock options represents the weighted-average period the stock

options are expected to remain outstanding. The expected term assumption is estimated based primarily on the

options’ vesting terms and remaining contractual life and employees’ expected exercise and post-vesting

employment termination behavior. The risk-free interest rate assumption is based upon observed interest rates

at the end of the period in which the grant occurred appropriate for the term of the employee stock options. The

dividend yield assumption is based on the expectation of no future dividend payouts by the Company.

126

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)