Cricket Wireless 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

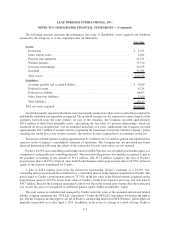

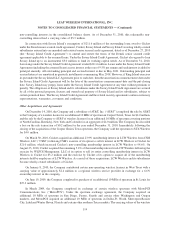

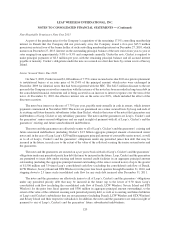

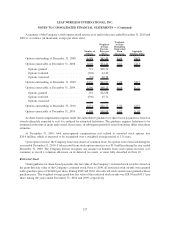

Values of Redeemable Non-controlling Interests

The following table provides a summary of the changes in the values of the Company’s redeemable non-

controlling interests (in thousands):

2010 2009 2008

Year Ended December 31,

Beginning balance ................................... $ 71,632 $71,879 $61,868

Purchases of membership units of non-controlling interests . . . (123,163) — —

Non-controlling interest contributions ................... 43,902 — 1,423

Accretion of redeemable non-controlling interests, before tax . . 108,030 (247) 8,588

Other........................................... 4,387 — —

Ending balance ...................................... $104,788 $71,632 $71,879

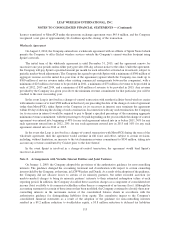

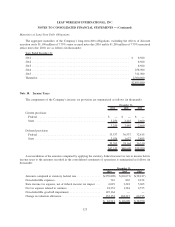

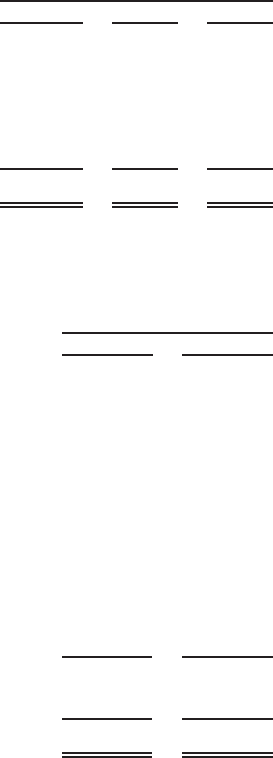

Note 9. Long-Term Debt

Long-term debt as of December 31, 2010 and 2009 was comprised of the following (in thousands):

2010 2009

As of December 31,

Unsecured senior notes due 2014 and 2015....................... $ 300,000 $1,400,000

Unamortized premium on $350 million unsecured senior notes due

2014 ................................................. — 15,111

Senior secured notes due 2016 ................................ 1,100,000 1,100,000

Unamortized discount on $1,100 million senior secured notes due 2016. . (34,962) (39,889)

Convertible senior notes due 2014 ............................. 250,000 250,000

Unsecured senior notes due 2020 .............................. 1,200,000 —

Unamortized discount on $1,200 million unsecured senior notes due

2020 ................................................. (19,968) —

Non-negotiable promissory note due 2015 ....................... 45,500 —

Term loans under LCW senior secured credit agreement ............. — 18,096

2,840,570 2,743,318

Current maturities of long-term debt ............................ (8,500) (8,000)

$2,832,070 $2,735,318

Senior Notes

Discharge of Indenture and Loss on Extinguishment of Debt

On November 4, 2010, the Company launched a tender offer to purchase, for cash, any and all of its

$1,100 million in aggregate principal amount of outstanding 9.375% senior notes due 2014. Concurrently with the

tender offer, the Company also solicited consents from the holders of the notes to eliminate certain covenants in and

amend certain provisions of the indenture governing the notes. The Company accepted tenders on November 19,

2010 and December 6, 2010 for approximately $915.8 million in aggregate principal amount of the notes in

connection with the tender offer. The holders of the accepted notes received total consideration of $1,050.63 per

$1,000 principal amount of notes tendered prior to the early settlement date, which included a $20 consent payment

per $1,000 principal amount of notes tendered, and $1,030.63 per $1,000 principal amount of notes tendered

thereafter. The total cash payment to purchase the tendered notes, including accrued and unpaid interest up to, but

117

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)