Cricket Wireless 2010 Annual Report Download - page 63

Download and view the complete annual report

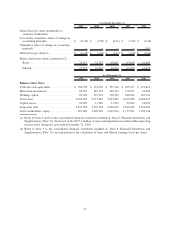

Please find page 63 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.While we do not anticipate significant changes to the purchase price allocation, some items such as post-closing

purchase price adjustments are preliminary and subject to change.

As of December 31, 2010, we evaluated whether any triggering events or changes in circumstances had

occurred subsequent to our annual impairment test conducted in the third quarter of 2010. As part of this evaluation,

we considered additional qualitative factors, including whether there had been any significant adverse changes in

legal factors or in our business climate, adverse action or assessment by a regulator, unanticipated competition, loss

of key personnel or likely sale or disposal of all or a significant portion of our reporting unit. Based on this

evaluation, we concluded that there had not been any triggering events or changes in circumstances that indicated an

impairment condition existed as of December 31, 2010. Had we concluded that a triggering event had occurred as of

such date, the first step of the goodwill impairment test would have resulted in a determination that the fair value of

our company (based upon our market capitalization, plus a control premium) exceeded the carrying value of our net

assets, and thus would not have required any further impairment evaluation.

If competition in markets in which we operate continues to intensify, or if competition or other factors cause

significant changes in our actual or projected financial or operating performance, such factors could constitute a

triggering event which would require us to perform an interim goodwill impairment test prior to our next annual

impairment test, possibly as soon as the first quarter of 2011. If the first step of the interim impairment test were to

indicate that a potential impairment existed, we would be required to perform the second step of the goodwill

impairment test, which would require us to determine the fair value of our net assets and could require us to

recognize a material non-cash impairment charge that could reduce all or a portion of the carrying value of our

goodwill of $31.1 million.

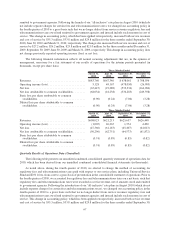

Share-based Compensation

We account for share-based awards exchanged for employee services in accordance with the authoritative

guidance for share-based payments. Under the guidance, share-based compensation expense is measured at the

grant date, based on the estimated fair value of the award, and is recognized as expense, net of estimated forfeitures,

over the employee’s requisite service period. Compensation expense is amortized on a straight-line basis over the

requisite service period for the entire award, which is generally the maximum vesting period of the award. No share-

based compensation was capitalized as part of inventory or fixed assets prior to or during 2010.

The determination of the fair value of stock options using an option valuation model is affected by our stock

price, as well as assumptions regarding a number of complex and subjective variables. Through June 30, 2010, the

volatility assumption was based on a combination of the historical volatility of Leap common stock and the

volatilities of similar companies over a period of time equal to the expected term of the stock options. The

volatilities of similar companies were used in conjunction with our historical volatility because of the lack of

sufficient relevant history for our common stock equal to the expected term. Commencing July 1, 2010, we

determined that we had sufficient relevant history and thus began using our own historical volatility. The expected

term of employee stock options represents the weighted-average period the stock options are expected to remain

outstanding. The expected term assumption is estimated based primarily on the options’ vesting terms and

remaining contractual life and employees’ expected exercise and post-vesting employment termination behavior.

The risk-free interest rate assumption is based upon observed interest rates during the period appropriate for the

expected term of the employee stock options. The dividend yield assumption is based on the expectation of no future

dividend payouts by us.

As share-based compensation expense under the guidance for share-based payments is based on awards

ultimately expected to vest, it is reduced for estimated forfeitures. The guidance requires forfeitures to be estimated

at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from those estimates.

At December 31, 2010, total unrecognized compensation cost related to unvested stock options was

$24.9 million, which is expected to be recognized over a weighted-average period of 1.8 years. At

December 31, 2010, total unrecognized compensation cost related to unvested restricted stock awards was

$31.5 million, which is expected to be recognized over a weighted-average period of 2.4 years.

57