Cricket Wireless 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

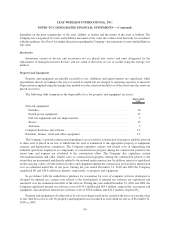

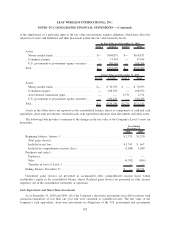

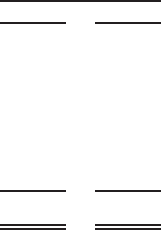

The following table summarizes the Company’s asset retirement obligations as of and for the years ended

December 31, 2010 and 2009 (in thousands):

2010 2009

Year Ended

December 31,

Asset retirement obligations, beginning of year ........................ $25,749 $16,997

Liabilities incurred ........................................... 270 7,434

Liabilities assumed by STX Wireless in connection with the formation of

thejointventure ........................................... 3,272 —

Accretion expense ............................................ 2,503 1,888

Decommissioned sites ......................................... (131) (570)

Asset retirement obligations, end of year ............................. $31,663 $25,749

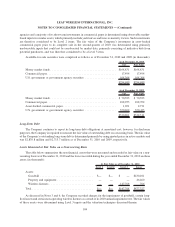

Debt Issuance Costs

Debt issuance costs are amortized and recognized as interest expense using the effective interest method over the

expected term of the related debt. Unamortized debt issuance costs related to extinguished debt are expensed at the time

the debt is extinguished and recorded in loss on extinguishment of debt in the consolidated statements of operations.

Unamortized debt issuance costs are recorded in other assets or as a reduction of the respective debt balance, as

applicable, in the consolidated balance sheets.

Advertising Costs

Advertising costs are expensed as incurred. Advertising costs totaled $137.6 million, $151.2 million and

$101.0 million for the years ended December 31, 2010, 2009 and 2008, respectively.

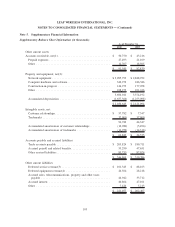

Share-based Compensation

The Company accounts for share-based awards exchanged for employee services in accordance with the

authoritative guidance for share-based payments. Under the guidance, share-based compensation expense is

measured at the grant date, based on the estimated fair value of the award, and is recognized as expense, net of

estimated forfeitures, over the employee’s requisite service period. Compensation expense is amortized on a straight-line

basis over the requisite service period for the entire award, which is generally the maximum vesting period of the award.

No share-based compensation was capitalized as part of inventory or fixed assets prior to or during 2010.

Income Taxes

The Company calculates income taxes in each of the jurisdictions in which it operates. This process involves

calculating the current tax expense or benefit and any deferred income tax expense or benefit resulting from temporary

differences arising from differing treatments of items for tax and accounting purposes. These temporary differences

result in deferred tax assets and liabilities. Deferred tax assets are also established for the expected future tax benefits to

be derived from net operating loss (“NOL”) carryforwards, capital loss carryforwards and income tax credits.

The Company periodically assesses the likelihood that its deferred tax assets will be recoverable from future

taxable income. To the extent the Company believes it is more likely than not that its deferred tax assets will not be

recovered, it must establish a valuation allowance. As part of this periodic assessment for the year ended

December 31, 2010, the Company weighed the positive and negative factors and, at this time, does not believe

there is sufficient positive evidence to support a conclusion that it is more likely than not that all or a portion of its

deferred tax assets will be realized, except with respect to the realization of a $2.0 million Texas Margins Tax

(“TMT”) credit. Accordingly, at December 31, 2010 and 2009, the Company recorded a valuation allowance

offsetting substantially all of its deferred tax assets. The Company will continue to monitor the positive and negative

factors to assess whether it is required to continue to maintain a valuation allowance. At such time as the Company

determines that it is more likely than not that all or a portion of the deferred tax assets are realizable, the valuation

100

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)