Cricket Wireless 2010 Annual Report Download - page 131

Download and view the complete annual report

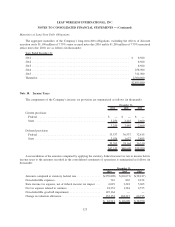

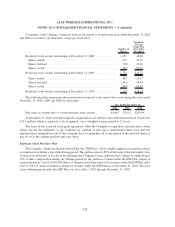

Please find page 131 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.federal and state taxable losses, respectively. During the year ended December 31, 2009, the Company recorded a

$117.8 million increase to its valuation allowance, which primarily consisted of $104.2 million and $8.5 million

related to the impact of 2009 federal and state taxable losses, respectively.

At December 31, 2010, the Company estimated it had federal and state NOL carryforwards of approximately

$2.1 billion (which begin to expire in 2022 for federal income tax purposes and of which $0.3 million will expire at

the end of 2011 for state income tax purposes) In addition, the Company had federal capital loss carryforwards of

approximately $8.0 million (which begin to expire in 2012). Included in the Company’s federal and state net

operating loss carryforwards are $24.1 million of losses which, when utilized, will increase additional paid-in

capital by approximately $9.2 million.

In accordance with the authoritative guidance for business combinations, which became effective for the

Company on January 1, 2009, any reduction in the valuation allowance, including the valuation allowance

established in fresh-start reporting, will be accounted for as a reduction of income tax expense.

Note 11. Stockholders’ Equity

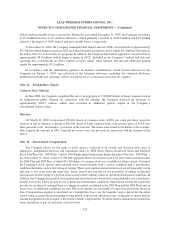

Common Stock Offering

In June 2009, the Company completed the sale of an aggregate of 7,000,000 shares of Leap common stock in

an underwritten public offering. In connection with the offering, the Company received net proceeds of

approximately $263.7 million, which were recorded in additional paid-in capital in the Company’s

consolidated balance sheet.

Warrants

On March 23, 2009, Leap issued 309,460 shares of common stock, $.0001 par value per share, upon the

exercise in full of warrants to purchase 600,000 shares of Leap common stock at an exercise price of $16.83 per

share pursuant to the “net issuance” provisions of the warrants. The shares were issued to the holder of the warrants,

who acquired the warrants in 2004. Leap did not receive any cash proceeds in connection with the issuance of the

shares.

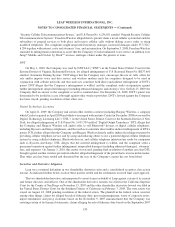

Note 12. Share-based Compensation

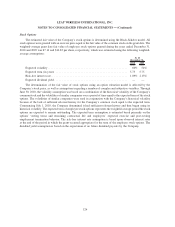

The Company allows for the grant of stock options, restricted stock awards and deferred stock units to

employees, independent directors and consultants under its 2004 Stock Option, Restricted Stock and Deferred

Stock Unit Plan (the “2004 Plan”) and its 2009 Employment Inducement Equity Incentive Plan (the “2009 Plan”).

As of December 31, 2010, a total of 9,700,000 aggregate shares of common stock were reserved for issuance under

the 2004 Plan and 2009 Plan, of which 813,459 shares of common stock were available for future awards. Certain of

the Company’s stock options and restricted stock awards include both a service condition and a performance

condition that relates only to the timing of vesting. These stock options and restricted stock awards generally vest in

full four to five years from the grant date. These awards also provide for the possibility of annual accelerated

performance-based vesting of a portion of the awards if the Company achieves specified performance conditions. In

addition, the Company has granted stock options and restricted stock awards that vest periodically over a fixed term,

usually four years. These awards do not contain any performance conditions. Share-based awards also generally

provide for accelerated vesting if there is a change in control (as defined in the 2004 Plan and the 2009 Plan) and, in

some cases, if additional conditions are met. The stock options are exercisable for up to ten years from the grant

date. Compensation expense is amortized on a straight-line basis over the requisite service period for the entire

award, which is generally the maximum vesting period of the award, and if necessary, is adjusted to ensure that the

amount recognized is at least equal to the vested (earned) compensation. No share-based compensation expense has

been capitalized as part of inventory or fixed assets.

125

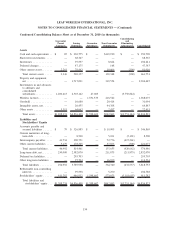

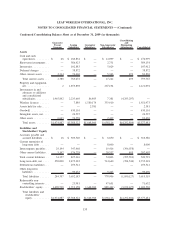

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)