Cricket Wireless 2010 Annual Report Download - page 88

Download and view the complete annual report

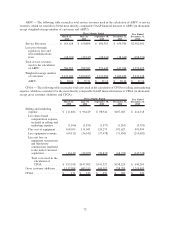

Please find page 88 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pricing observability and are generally measured at fair value using valuation models that require more judgment.

These valuation techniques involve some level of management estimation and judgment, the degree of which is

dependent on the price transparency or market for the asset or liability and the complexity of the asset or liability.

We have categorized our assets and liabilities measured at fair value into a three-level hierarchy in accordance with

the guidance for fair value measurements. Assets and liabilities that use quoted prices in active markets for identical

assets or liabilities are generally categorized as Level 1, assets and liabilities that use observable market-based inputs or

unobservable inputs that are corroborated by market data for similar assets or liabilities are generally categorized as

Level 2 and assets and liabilities that use unobservable inputs that cannot be corroborated by market data are generally

categorized as Level 3. Such Level 3 assets and liabilities have values determined using pricing models and indicative

bids from potential purchasers for which the determination of fair value requires judgment and estimation. As of

December 31, 2010, none of our financial assets required fair value to be measured using Level 3 inputs.

Generally, our results of operations are not significantly impacted by our assets and liabilities accounted for at

fair value due to the nature of each asset and liability.

We continue to report our long-term debt obligations at amortized cost and disclose the fair value of such

obligations.

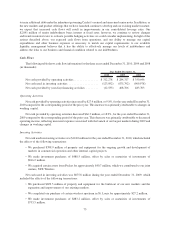

Capital Expenditures and Other Asset Acquisitions

Capital Expenditures

During the year ended December 31, 2010, we made approximately $398.9 million in capital expenditures.

These capital expenditures were primarily for the ongoing growth and development of markets in commercial

operation and other internal capital projects. Capital expenditures for fiscal year 2011 are primarily expected to

reflect expenditures required to enhance network capacity in our existing markets, begin deployment of next-

generation LTE network technology, with a commercial trial market scheduled to be launched in late 2011, and

support other internal capital projects.

During the years ended December 31, 2009 and 2008, we made approximately $699.5 million and

$795.7 million, respectively, in capital expenditures. These capital expenditures were primarily for the build-

out of new markets, including related capitalized interest, expansion and improvement of our existing wireless

networks, and other planned capital projects.

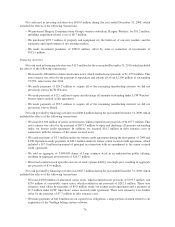

STX Wireless Joint Venture

Cricket service is offered in South Texas by its joint venture STX Operations. Cricket controls STX Operations

through a 75.75% controlling membership interest in its parent company STX Wireless. In October 2010, we and

Pocket contributed substantially all of our respective wireless spectrum and operating assets in the South Texas

region to STX Wireless to create a joint venture to provide Cricket service in the South Texas region. In exchange

for such contributions, Cricket received a 75.75% controlling membership interest in the STX Wireless and Pocket

received a 24.25% non-controlling membership interest. Additionally, in connection with the transaction, we made

payments to Pocket of approximately $40.7 million in cash.

The joint venture strengthens our presence and competitive positioning in the South Texas region. Commencing

October 1, 2010, STX Operations began providing Cricket service to approximately 700,000 customers, of which

approximately 323,000 were contributed by Pocket, with a network footprint covering approximately 4.4 million POPs.

The joint venture is controlled and managed by Cricket under the terms of the amended and restated limited

liability company agreement of STX Wireless, or the STX LLC Agreement. Under the STX LLC Agreement, Pocket

has the right to put, and we have the right to call, all of Pocket’s membership interests in STX Wireless, which rights

are generally exercisable on or after April 1, 2014. In addition, in the event of a change of control of Leap, Pocket is

obligated to sell to us all of its membership interests in STX Wireless. The purchase price for Pocket’s membership

interests would be equal to 24.25% of the product of Leap’s enterprise value-to-revenue multiple for the four most

recently completed fiscal quarters multiplied by the total revenues of STX Wireless and its subsidiaries over that same

period, payable in either cash, Leap common stock or a combination thereof, as determined by Cricket in its discretion

(provided that, if permitted by Cricket’s debt instruments, at least $25 million of the purchase price must be paid in

cash). We have the right to deduct from or set off against the purchase price certain distributions made to Pocket, as

82