Cricket Wireless 2010 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

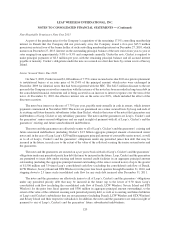

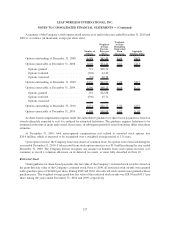

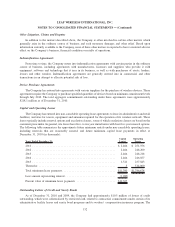

Maturities of Long-Term Debt Obligations

The aggregate maturities of the Company’s long-term debt obligations, excluding the effects of discount

accretion on its $1,100 million of 7.75% senior secured notes due 2016 and its $1,200 million of 7.75% unsecured

senior notes due 2020, are as follows (in thousands):

Years Ended December 31:

2011 .............................................................. $ 8,500

2012 .............................................................. 8,500

2013 .............................................................. 8,500

2014 .............................................................. 258,500

2015 .............................................................. 311,500

Thereafter . . ........................................................ 2,300,000

$2,895,500

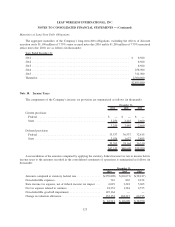

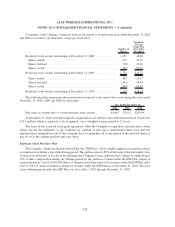

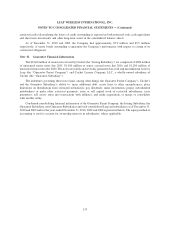

Note 10. Income Taxes

The components of the Company’s income tax provision are summarized as follows (in thousands):

2010 2009 2008

December 31,

Current provision:

Federal ........................................... $ — $ — $ —

State............................................. 3,250 2,445 2,660

3,250 2,445 2,660

Deferred provision:

Federal ........................................... 35,337 36,537 32,415

State............................................. 3,926 1,627 3,895

39,263 38,164 36,310

$42,513 $40,609 $38,970

A reconciliation of the amounts computed by applying the statutory federal income tax rate to income before

income taxes to the amounts recorded in the consolidated statements of operations is summarized as follows (in

thousands):

2010 2009 2008

December 31,

Amounts computed at statutory federal rate ............... $(259,890) $ (69,073) $(38,217)

Non-deductible expenses ............................. 716 865 2,474

State income tax expense, net of federal income tax impact . . . 6,019 3,218 5,603

Net tax expense related to ventures ..................... 18,352 1,384 2,375

Non-deductible goodwill impairment .................... 125,164 — —

Change in valuation allowance ......................... 152,152 104,215 66,735

$ 42,513 $ 40,609 $ 38,970

123

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)