Cricket Wireless 2010 Annual Report Download - page 69

Download and view the complete annual report

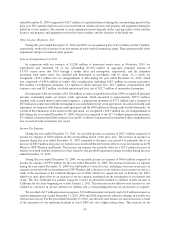

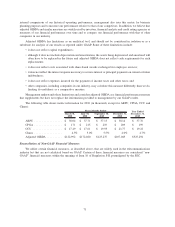

Please find page 69 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.decreased to 16.7% from 18.4% in the prior year period. This percentage decrease was largely attributable to a 0.8%

decrease in media and advertising costs as a percentage of service revenues reflecting higher spending in the prior

year period in connection with the launch of our two largest markets during 2009, and increases in service revenues

and consequent benefits of scale, slightly offset by increased advertising costs related to our August 2010 initiatives.

Selling and marketing expenses increased $116.6 million, or 39.6%, for the year ended December 31, 2009

compared to the corresponding period of the prior year. As a percentage of service revenues, such expenses

increased to 18.4% from 16.5% in the prior year period. This percentage increase was largely attributable to costs

associated with the launch of our two largest markets during 2009 and the costs associated with the expansion of our

Cricket Broadband and Cricket PAYGo service offerings.

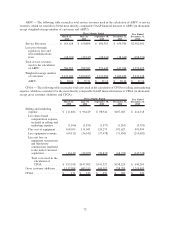

General and Administrative Expenses

General and administrative expenses increased $3.1 million, or 0.9%, for the year ended December 31, 2010

compared to the corresponding period of the prior year. As a percentage of service revenues, such expenses

decreased to 14.6% from 16.0% in the prior year period primarily due to the increase in service revenues and

consequent benefits of scale and continued benefits realized from our cost-management initiatives.

General and administrative expenses increased $26.8 million, or 8.1%, for the year ended December 31, 2009

compared to the corresponding period of the prior year. As a percentage of service revenues, such expenses

decreased to 16.0% from 18.6% in the prior year period primarily due to the increase in service revenues and

consequent benefits of scale.

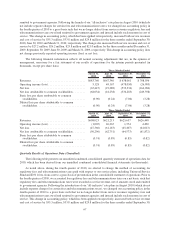

Depreciation and Amortization

Depreciation and amortization expense increased $46.3 million, or 11.3%, for the year ended December 31,

2010 compared to the corresponding period of the prior year. The increase in depreciation and amortization expense

was due primarily to an increase in property and equipment in connection with the expansion and upgrade of our

networks in existing markets.

Depreciation and amortization expense increased $79.2 million, or 23.9%, for the year ended December 31,

2009 compared to the corresponding period of the prior year. The increase in depreciation and amortization expense

was due primarily to an increase in property and equipment, in connection with the build-out and launch of our new

markets and the improvement and expansion of our networks in existing markets.

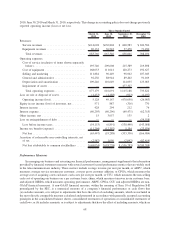

Impairment of Assets

As more fully described above, as a result of our annual impairment testing of our goodwill conducted during

the third quarter of 2010, we recorded a goodwill impairment charge of $430.1 million during the year ended

December 31, 2010. No goodwill impairment charges were recorded during the year ended December 31, 2009.

As a result of our annual impairment testing of our wireless licenses conducted during the third quarters of

2010 and 2009, we recorded impairment charges of $0.8 million and $0.6 million, respectively, to reduce the

carrying values of certain non-operating wireless licenses to their fair values. No such impairment charges were

recorded with respect to our operating wireless licenses for either period, as the aggregate fair values of these

licenses exceeded their aggregate carrying value.

As a result of our determination to spend an increased portion of our planned capital expenditures on the future

deployment of next-generation LTE technology and to defer our previously planned network expansion activities,

we also recorded an impairment charge of $46.5 million relating to long-lived assets during the year ended

December 31, 2010. These costs were previously included in construction-in-progress, for certain network design,

site acquisition and interest costs capitalized during the construction period. No such impairment charges were

recorded during the year ended December 31, 2009.

Loss on Sale or Disposal of Assets

During the year ended December 31, 2010, we recognized losses of $5.1 million primarily related to the

disposal of certain of our property and equipment.

63