Cricket Wireless 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Litigation, Claims and Disputes

In addition to the matters described above, the Company is often involved in certain other matters which

generally arise in the ordinary course of business and seek monetary damages and other relief. Based upon

information currently available to the Company, none of these other matters is expected to have a material adverse

effect on the Company’s business, financial condition or results of operations.

Indemnification Agreements

From time to time, the Company enters into indemnification agreements with certain parties in the ordinary

course of business, including agreements with manufacturers, licensors and suppliers who provide it with

equipment, software and technology that it uses in its business, as well as with purchasers of assets, lenders,

lessors and other vendors. Indemnification agreements are generally entered into in commercial and other

transactions in an attempt to allocate potential risk of loss.

Device Purchase Agreements

The Company has entered into agreements with various suppliers for the purchase of wireless devices. These

agreements require the Company to purchase specified quantities of devices based on minimum commitment levels

through July 2012. The total aggregate commitments outstanding under these agreements were approximately

$218.1 million as of December 31, 2010.

Capital and Operating Leases

The Company has entered into non-cancelable operating lease agreements to lease its administrative and retail

facilities, and sites for towers, equipment and antennae required for the operation of its wireless network. These

leases typically include renewal options and escalation clauses, some of which escalation clauses are based on the

consumer price index. In general, site leases have five- to ten-year initial terms with four five-year renewal options.

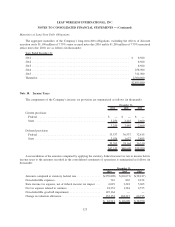

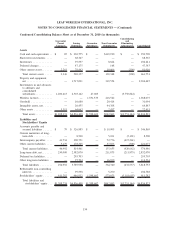

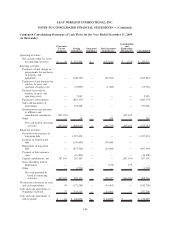

The following table summarizes the approximate future minimum rentals under non-cancelable operating leases,

including renewals that are reasonably assured, and future minimum capital lease payments in effect at

December 31, 2010 (in thousands):

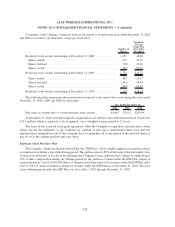

Years Ended December 31:

Capital

Leases

Operating

Leases

2011 ..................................................... $ 2,466 $ 251,556

2012 ..................................................... 2,466 248,200

2013 ..................................................... 2,466 248,218

2014 ..................................................... 2,466 246,857

2015 ..................................................... 1,521 237,843

Thereafter ................................................. 5 514,000

Total minimum lease payments .................................. $11,390 $1,746,674

Less amount representing interest ................................ (1,083)

Present value of minimum lease payments ......................... $10,307

Outstanding Letters of Credit and Surety Bonds

As of December 31, 2010 and 2009, the Company had approximately $10.5 million of letters of credit

outstanding, which were collateralized by restricted cash, related to contractual commitments under certain of its

administrative facility leases and surety bond programs and its workers’ compensation insurance program. The

132

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)