Cricket Wireless 2010 Annual Report Download - page 72

Download and view the complete annual report

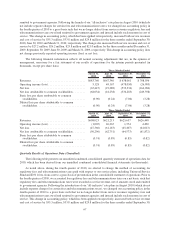

Please find page 72 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.effective state income tax rate resulted in an increase in our net deferred tax liability as of December 31, 2010 and a

corresponding increase in our income tax expense. For the year ended December 31, 2009, our effective state

income tax rate decreased which was primarily attributable to state tax law changes. This decrease resulted in a

decrease to our net deferred tax liability as of December 31, 2009 and a corresponding decrease in our income tax

expense. An increase in our effective state income tax rate during the year ended December 31, 2008 resulted in an

increase to our net deferred tax liability and a corresponding increase in our income tax expense. The increase in our

effective state income tax rate at December 31, 2008 was primarily attributable to subsidiary entity restructuring.

During the years ended December 31, 2010, 2009 and 2008, we recorded zero, $2.4 million in income tax

expense and a $1.7 million income tax benefit, respectively, to the consolidated statement of operations with a

corresponding amount recorded to other comprehensive income in the consolidated balance sheet resulting from

interest rate hedges and marketable securities activity within other comprehensive income.

We record deferred tax assets and liabilities arising from differing treatments of items for tax and accounting

purposes. Deferred tax assets are also established for the expected future tax benefits to be derived from net

operating loss, or NOL carryforwards, capital loss carryforwards and income tax credits. We must then periodically

assess the likelihood that our deferred tax assets will be recovered from future taxable income, which assessment

requires significant judgment. Included in our deferred tax assets as of December 31, 2010, we estimated that we

had federal and state NOL carryforwards of approximately $2.1 billion (which begin to expire in 2022 for federal

income tax purposes and of which $0.3 million will expire at the end of 2011 for state income tax purposes), which

could be used to offset future ordinary taxable income and reduce the amount of cash required to settle future tax

liabilities. To the extent we believe it is more likely than not that our deferred tax assets will not be recovered, we

must establish a valuation allowance. As part of our periodic assessment of recoverability, we have weighed the

positive and negative factors with respect to recoverability and, at this time, we do not believe there is sufficient

positive evidence and sustained operating earnings to support a conclusion that it is more likely than not that all or a

portion of the deferred tax assets will be realized, except with respect to the realization of a $2.0 million Texas

Margins Tax credit. We will continue to closely monitor the positive and negative factors to assess whether we are

required to maintain a valuation allowance. At such time as we determine that it is more likely than not that all or a

portion of the deferred tax assets are realizable, the valuation allowance will be reduced or released in its entirety,

with the corresponding benefit reflected in our tax provision.

Since we have recorded a valuation allowance against the majority of our deferred tax assets, we carry a net

deferred tax liability on our balance sheet. During the year ended December 31, 2010, we recorded a $176.7 million

increase to our valuation allowance, which primarily consisted of $152.2 million and $13.3 million related to the

impact of 2010 federal and state taxable losses, respectively. During the year ended December 31, 2009, we

recorded a $117.8 million increase to our valuation allowance, which primarily consisted of $104.2 million and

$8.5 million related to the impact of 2009 federal and state taxable losses, respectively.

In accordance with the authoritative guidance for business combinations, which became effective for us on

January 1, 2009, any reduction in the valuation allowance, including the valuation allowance established in fresh-

start reporting, will be accounted for as a reduction of income tax expense.

Our unrecognized income tax benefits and uncertain tax positions have not been material in any period.

Interest and penalties related to uncertain tax positions are recognized by us as a component of income tax expense;

however, such amounts have not been material in any period. All of our tax years from 1998 to 2010 remain open to

examination by federal and state taxing authorities. In July 2009, the federal examination of our 2005 tax year,

which was limited in scope, was concluded and the results did not have a material impact on the consolidated

financial statements.

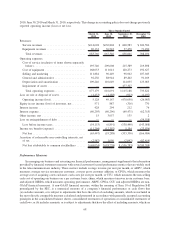

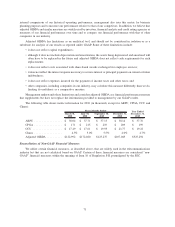

Quarterly Financial Data (Unaudited)

As noted above, during the fourth quarter of 2010, we elected to change the method of accounting for

regulatory fees and telecommunications taxes paid with respect to our service plans, including Universal Service

Fund and E-911 fees, from a net to a gross basis of presentation in the consolidated statements of operations. Prior to

the fourth quarter of 2010, we accounted for regulatory fees and telecommunications taxes on a net basis, such that

regulatory fees and telecommunications taxes were recorded as service revenue, net of the amounts owed and

66