Cricket Wireless 2010 Annual Report Download - page 103

Download and view the complete annual report

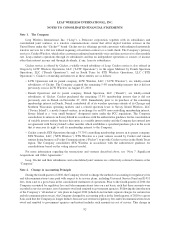

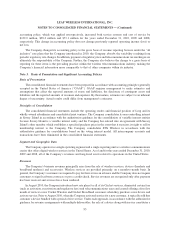

Please find page 103 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Impairment of Long-Lived Assets

The Company assesses potential impairments to its long-lived assets, including property and equipment and

certain intangible assets, when there is evidence that events or changes in circumstances indicate that the carrying

value may not be recoverable. An impairment loss may be required to be recognized when the undiscounted cash

flows expected to be generated by a long-lived asset (or group of such assets) is less than its carrying value. Any

required impairment loss would be measured as the amount by which the asset’s carrying value exceeds its fair value

and would be recorded as a reduction in the carrying value of the related asset and charged to results of operations.

As a result of the sustained decrease in its market capitalization, and in conjunction with the annual assessment

of its goodwill, the Company tested its long-lived assets for potential impairment during the third quarter of 2010.

As the Company’s long-lived assets do not have identifiable cash flows that are largely independent of other asset

groupings, the Company completed this assessment at the enterprise level. As required by the authoritative guidance

for impairment testing, the Company compared its total estimated undiscounted future cash flows to the carrying

value of its long-lived and indefinite-lived assets at September 30, 2010. Under this analysis, the Company’s total

estimated undiscounted future cash flows were determined to have exceeded the total carrying value of the

Company’s long-lived and indefinite-lived assets. If the Company’s total estimated undiscounted future cash flows

calculated in this analysis were 10% less than those determined, they would continue to exceed the total carrying

value of the Company’s long-lived and indefinite-lived assets. The Company estimated its future cash flows based

on projections regarding its future operating performance, including projected customer growth, customer churn,

average monthly revenue per customer and costs per gross additional customer. If the Company’s actual results were

to materially differ from those projected, that difference could have a significant adverse effect on the Company’s

estimated undiscounted future cash flows and could ultimately result in an impairment of its long-lived assets.

In connection with the analysis described above, the Company evaluated certain network design, site

acquisition and capitalized interest costs relating to the expansion of its network which had been accumulated

in construction-in-progress. In August 2010, the Company entered into a wholesale agreement which permits the

Company to offer Cricket wireless services outside of its current network footprint. The Company believes that this

agreement will allow it to strengthen and expand its distribution and provides it with greater flexibility with respect

to its network expansion plans. As a result, the Company determined to spend an increased portion of its planned

capital expenditures on the future deployment of next-generation LTE technology and to defer its previously

planned network expansion activities. As a result of these developments, the costs previously accumulated in

construction-in-progress were determined to be impaired and the Company recorded an impairment charge of

$46.5 million during the third quarter of 2010.

The Company evaluated whether any triggering events or changes in circumstances occurred that would

indicate an impairment condition may have existed subsequent to its 2010 annual impairment test of long-lived

assets. This evaluation included consideration of whether there had been any significant adverse change in legal

factors or in the Company’s business climate, adverse action or assessment by a regulator, unanticipated

competition, loss of key personnel or likely sale or disposal of all or a significant portion of an asset group.

Based upon this evaluation, the Company concluded that no triggering events or changes in circumstances had

occurred.

Wireless Licenses

The Company operates networks under Personal Communications Services (“PCS”) and Advanced Wireless

Services (“AWS”) wireless licenses granted by the FCC that are specific to a particular geographic area on spectrum

that has been allocated by the FCC for such services. Wireless licenses are recorded at cost when acquired and are

not amortized. Although FCC licenses are issued with a stated term (ten years in the case of PCS licenses and fifteen

years in the case of AWS licenses), wireless licenses are considered to be indefinite-lived intangible assets because

the Company expects to provide wireless service using the relevant licenses for the foreseeable future, PCS and

AWS licenses are routinely renewed for either no or a nominal fee and management has determined that no legal,

97

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)