Cricket Wireless 2010 Annual Report Download - page 76

Download and view the complete annual report

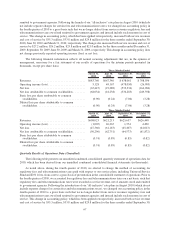

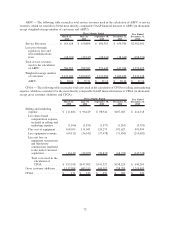

Please find page 76 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of devices to existing customers, costs associated with device replacements and repairs (other than warranty costs

which are the responsibility of the device manufacturers) and commissions paid to third parties for certain activities

related to the continuing service of customers), divided by the weighted-average number of customers, divided by

the number of months during the period being measured. CCU does not include any depreciation and amortization

expense. Prior to the fourth quarter of 2010, we accounted for regulatory fees and telecommunications taxes paid

with respect to our service plans, including Universal Service Fund and E-911 fees, on a net basis in the

consolidated statement of operations, such that these fees and taxes were recorded as service revenue, net of

amounts remitted to government agencies. We no longer bill and collect these fees and taxes from customers on the

new “all-inclusive” service plans we launched in August 2010. As a result, during the fourth quarter of 2010, we

elected to change the method of accounting for regulatory fees and telecommunications taxes from a net to a gross

basis of presentation. As a result of this change, we no longer deduct from service revenues regulatory fees and

telecommunications taxes owed and remitted to government agencies and instead include such amounts in cost of

service. For purposes of calculating CCU, we have deducted from cost of service pass-through regulatory fees and

telecommunications taxes that we bill and collect from our customers with respect to our previously-offered non-

“all-inclusive” service plans, which we remit on their behalf. This change has been applied retrospectively to our

CCU results presented below. We have made a corresponding adjustment in our calculation of ARPU, described

above. Management uses CCU as a tool to evaluate the non-selling cash expenses associated with ongoing business

operations on a per customer basis, to track changes in these non-selling cash costs over time, and to help evaluate

how changes in our business operations affect non-selling cash costs per customer. In addition, CCU provides

management with a useful measure to compare our non-selling cash costs per customer with those of other wireless

communications providers. We believe investors use CCU primarily as a tool to track changes in our non-selling

cash costs over time and to compare our non-selling cash costs to those of other wireless communications providers.

Other companies may calculate this measure differently.

Churn, which measures customer turnover, is calculated as the net number of customers that disconnect from

our service divided by the weighted-average number of customers divided by the number of months during the

period being measured. Customers who do not pay their monthly bill for their second month of service are deducted

from our gross customer additions in the month in which they are disconnected; as a result, these customers are not

included in churn. Customers of our Cricket Wireless and Cricket Broadband service are generally disconnected

from service approximately 30 days after failing to pay a monthly bill, and pay-in-advance customers who ask to

terminate their service are disconnected when their paid service period ends. Customers of our Cricket PAYGo

service are generally disconnected from service if they have not replenished or “topped up” their account within

60 days after the end of their most recent term of service. Management uses churn to measure our retention of

customers, to measure changes in customer retention over time, and to help evaluate how changes in our business

affect customer retention. In addition, churn provides management with a useful measure to compare our customer

turnover activity to that of other wireless communications providers. We believe investors use churn primarily as a

tool to track changes in our customer retention over time and to compare our customer retention to that of other

wireless communications providers. Other companies may calculate this measure differently.

Adjusted OIBDA is a non-GAAP financial measure defined as operating income (loss) before depreciation and

amortization, adjusted to exclude the effects of: gain/(loss) on sale/disposal of assets; impairment of assets; and

share-based compensation expense . Adjusted OIBDA should not be construed as an alternative to operating income

(loss) or net income as determined in accordance with GAAP, or as an alternative to cash flows from operating

activities as determined in accordance with GAAP or as a measure of liquidity.

In a capital-intensive industry such as wireless telecommunications, management believes that adjusted

OIBDA, and the associated percentage margin calculations, are meaningful measures of our operating performance.

We use adjusted OIBDA as a supplemental performance measure because management believes it facilitates

comparisons of our operating performance from period to period and comparisons of our operating performance to

that of other companies by backing out potential differences caused by the age and book depreciation of fixed assets

(affecting relative depreciation expenses) as well as the items described above for which additional adjustments

were made. While depreciation and amortization are considered operating costs under generally accepted

accounting principles, these expenses primarily represent the non-cash current period allocation of costs

associated with long-lived assets acquired or constructed in prior periods. Because adjusted OIBDA facilitates

70