Cricket Wireless 2010 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

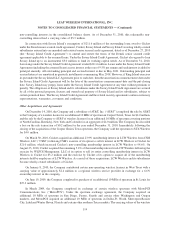

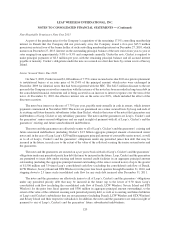

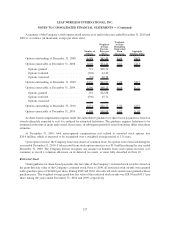

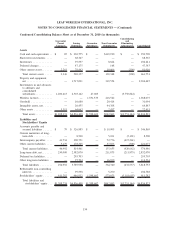

The components of the Company’s deferred tax assets (liabilities) are summarized as follows (in thousands):

2010 2009

As of December 31,

Deferred tax assets:

Net operating loss carryforwards .............................. $794,601 $ 559,912

Wireless licenses .......................................... 26,750 33,780

Capital loss carryforwards ................................... 3,045 1,510

Reserves and allowances . ................................... 12,329 16,006

Share-based compensation ................................... 38,086 31,053

Deferred charges .......................................... 46,329 39,583

Investments and deferred tax on unrealized losses ................. — 9,669

Intangible Assets .......................................... 10,982 —

Goodwill ............................................... 43,792 —

Other .................................................. 5,317 7,630

Gross deferred tax assets . . . ................................... 981,231 699,143

Deferred tax liabilities:

Intangible assets .......................................... — (12,903)

Property and equipment . . ................................... (265,737) (151,868)

Other .................................................. (5,032) (513)

Net deferred tax assets ....................................... 710,462 533,859

Valuation allowance ......................................... (708,479) (531,826)

Other deferred tax liabilities:

Wireless licenses .......................................... (279,327) (236,409)

Goodwill ............................................... — (13,540)

Investment in joint ventures .................................. (10,608) (6,398)

Net deferred tax liabilities . . ................................... $(287,952) $(254,314)

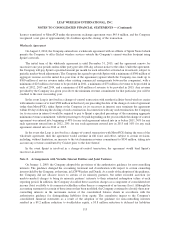

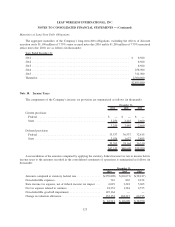

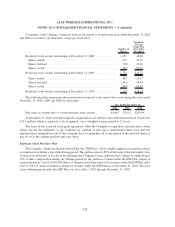

Deferred tax assets (liabilities) are reflected in the accompanying consolidated balance sheets as follows (in

thousands):

2010 2009

As of December 31,

Current deferred tax assets (included in other current assets) ........... $ 7,751 $ 5,198

Long-term deferred tax liabilities................................ (295,703) (259,512)

$(287,952) $(254,314)

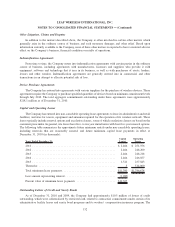

Except with respect to the $2.0 million TMT credit outstanding as of December 31, 2010 and 2009, the

Company established a full valuation allowance against its net deferred tax assets due to the uncertainty surrounding

the realization of such assets. The valuation allowance is based on available evidence, including the Company’s

historical operating losses. Deferred tax liabilities associated with wireless licenses and investments in certain joint

ventures cannot be considered a source of taxable income to support the realization of deferred tax assets because

these deferred tax liabilities will not reverse until some indefinite future period. Since it has recorded a valuation

allowance against the majority of its deferred tax assets, the Company carries a net deferred tax liability on its

balance sheet. During the year ended December 31, 2010, the Company recorded a $176.7 million increase to its

valuation allowance, which primarily consisted of $152.2 million and $13.3 million related to the impact of 2010

124

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)