Cricket Wireless 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

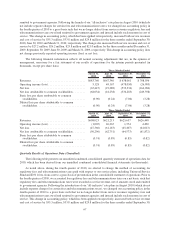

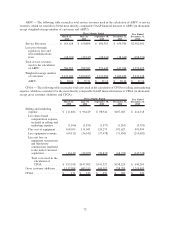

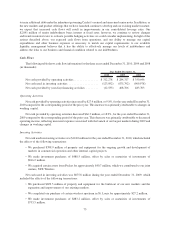

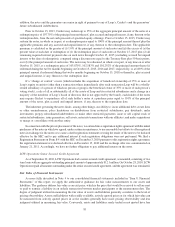

CCU — The following table reconciles total costs used in the calculation of CCU to cost of service, which we

consider to be the most directly comparable GAAP financial measure to CCU (in thousands, except weighted-

average number of customers and CCU):

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

Year Ended

December 31,

2010

Three Months Ended

Cost of service . ........... $ 195,740 $ 209,608 $ 215,389 $ 219,898 $ 840,635

Plus general and

administrative expense . . . 92,256 88,944 89,202 91,169 361,571

Less share-based

compensation expense

included in cost of service

and general and

administrative expense . . . (6,059) (8,885) (7,405) (8,479) (30,828)

Plus net loss on equipment

transactions and third-

party commissions

unrelated to the initial

customer acquisition . . . . 16,141 22,025 38,833 68,729 145,728

Less pass-through regulatory

fees and

telecommunications

taxes ............... (28,576) (32,217) (28,941) (18,642) (108,376)

Total costs used in the

calculation of CCU . . . $ 269,502 $ 279,475 $ 307,078 $ 352,675 $1,208,730

Weighted-average number of

customers . . . ........... 5,135,102 5,290,825 5,131,982 5,400,449 5,239,589

CCU................... $ 17.49 $ 17.61 $ 19.95 $ 21.77 $ 19.22

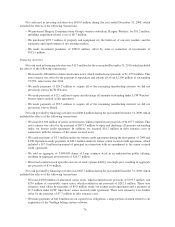

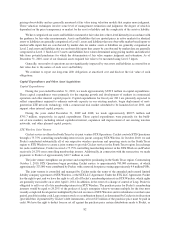

Adjusted OIBDA — The following table reconciles adjusted OIBDA to operating income (loss), which we

consider to be the most directly comparable GAAP financial measure to adjusted OIBDA (in thousands):

March 31,

2010

June 30,

2010

September 30,

2010

December 31,

2010

Year Ended

December 31,

2010

Three Months Ended

Operating income (loss) . . ...... $ 5,128 $ 49,167 $(478,050) $ (26,983) $(450,738)

Plus depreciation and

amortization . . ........... 109,246 110,649 114,055 123,085 457,035

OIBDA.................... $114,374 $159,816 $(363,995) $ 96,102 $ 6,297

Less loss on sale or disposal of

assets . . ................ 1,453 1,488 923 1,197 5,061

Plus impairment of assets ..... — — 477,327 — 477,327

Plus share-based compensation

expense ................ 7,165 10,716 8,982 9,746 36,609

Adjusted OIBDA . . ........... $122,992 $172,020 $ 123,237 $107,045 $ 525,294

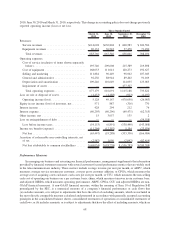

Liquidity and Capital Resources

Overview

Our principal sources of liquidity are our existing unrestricted cash, cash equivalents and short-term

investments and cash generated from operations. We had a total of $419.2 million in unrestricted cash, cash

equivalents and short-term investments as of December 31, 2010. We generated $312.3 million of net cash from

operating activities during the year ended December 31, 2010, and we expect that cash from operations will

continue to be a significant and increasing source of liquidity as our markets continue to mature and our business

73