Cricket Wireless 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and a $15.0 million increase to redeemable non-controlling interests (formerly referred to as minority interests) as

of December 31, 2008. The Company has retrospectively applied the guidance for non-controlling interests to all

prior periods presented.

Prior to the acquisition by the Company of all of the remaining membership interests in LCW Wireless and

Denali on August 25, 2010 and December 27, 2010, respectively, the Company consolidated its interests in these

ventures (along with their wholly-owned subsidiaries), in accordance with the authoritative guidance for

consolidation of variable interest entities.

As described in Note 3, the Company consolidates its non-controlling membership interest in Savary Island in

accordance with the authoritative guidance for the consolidation of variable interest entities because Savary Island

is a variable interest entity and the Company has entered into an agreement with Savary Island’s other member

which establishes a specified purchase price in the event that exercises its right to sell its membership interest to the

Company. Also, as described in Note 3, the Company consolidates its controlling membership interest in STX

Wireless in accordance with the authoritative guidance for consolidations based on the voting interest model. All

intercompany accounts and transactions are eliminated in the consolidated financial statements.

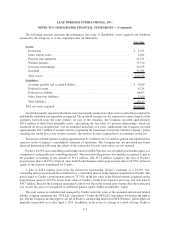

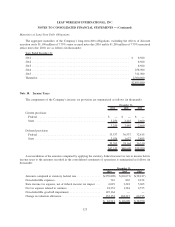

The aggregate carrying amount and classification of the significant assets and liabilities of the Company’s

variable interest entities, excluding intercompany accounts and transactions, as of December 31, 2010 (with respect

to Savary Island) and December 31, 2009 (with respect to LCW Wireless and Denali), are presented in the following

table below (in thousands):

2010 2009

Year Ended

December 31,

Assets

Cash and cash equivalents .................................... $ 5,250 $ 14,099

Short-term investments ...................................... — 2,731

Inventories ............................................... — 5,029

Property and equipment, net................................... — 267,194

Wireless licenses ........................................... 156,055 333,910

Liabilities

Accounts payable and accrued liabilities .......................... $ — $ 6,850

Current maturities of long-term debt............................. — 8,000

Other current liabilities ...................................... — 18,803

Long-term debt ............................................ — 10,096

Other long-term liabilities ...................................... — 9,463

116

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)