Cricket Wireless 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.continues to grow. We believe that our existing unrestricted cash, cash equivalents and short-term investments,

together with cash generated from operations, provide us with sufficient liquidity to meet the future operating and

capital requirements for our current business operations, as well as our current business expansion efforts. From

time to time, we may generate additional liquidity by selling certain non-core assets or through future capital market

transactions.

Our current business expansion efforts include activities to enhance our network capacity in our existing

markets, thereby allowing us to offer our customers an even higher-quality service area. In addition, we plan to

begin deployment of next-generation LTE network technology, with a commercial trial market scheduled to be

launched in late 2011. We also plan to continue to strengthen and expand our distribution, including through the

wholesale agreement we have entered into, which permits us to offer Cricket services outside of our current network

footprint.

We currently plan to deploy LTE network technology over the next few years, and we may pursue other

activities to build our business. Future business expansion efforts could also include the launch of additional new

product and service offerings, the acquisition of additional spectrum through private transactions or FCC auctions,

the build-out and launch of new markets, entering into partnerships with others or the acquisition of other wireless

communications companies or complementary businesses. We do not intend to pursue any of these other business

expansion activities at a significant level unless we believe we have sufficient liquidity to support the operating and

capital requirements for our current business operations, our current business expansion efforts and any such other

activities.

We determine our future capital and operating requirements and liquidity based, in large part, upon our

projected financial and operating performance, and we regularly review and update these projections due to changes

in general economic conditions, our current and projected financial and operating results, the competitive landscape

and other factors. In evaluating our liquidity and managing our financial resources, we plan to maintain what we

consider to be a reasonable surplus of unrestricted cash, cash equivalents and short-term investments to be available,

if necessary, to address unanticipated variations or changes in working capital, operating and capital requirements,

and our financial and operating performance. If cash generated from operations were to be adversely impacted by

substantial changes in our projected financial and operating performance (for example, as a result of changes in

general economic conditions, increased competition in our markets, slower-than-anticipated growth or customer

acceptance of our products or services, increased churn or other factors), we believe that we could manage our

expenditures, including capital expenditures, and the pace and timing of our business expansion efforts to the extent

we deemed necessary, to match our available liquidity. Our projections regarding future capital and operating

requirements and liquidity are based upon current operating, financial and competitive information and projections

regarding our business and its financial performance. There are a number of risks and uncertainties (including the

risks to our business described above and others set forth in this report in Part I — Item 1A. under the heading

entitled “Risk Factors”) that could cause our financial and operating results and capital requirements to differ

materially from our projections and that could cause our liquidity to differ materially from the assessment set forth

above.

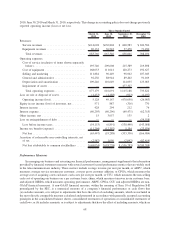

As of December 31, 2010, we had $2,841 million in senior indebtedness outstanding, which comprised

$250 million in aggregate principal amount of 4.5% convertible senior notes due 2014, $300 million in aggregate

principal amount of 10.0% unsecured senior notes due 2015, $45.5 million in principal amount of a non-negotiable

promissory note maturing in 2015, $1,100 million in aggregate principal amount of 7.75% senior secured notes due

2016 and $1,200 million in aggregate principal amount of 7.75% unsecured senior notes due 2020, as more fully

described below. The indentures governing Cricket’s secured and unsecured senior notes contain covenants that

restrict the ability of Leap, Cricket and their restricted subsidiaries to take certain actions, including incurring

additional indebtedness beyond specified thresholds.

Although our significant outstanding indebtedness results in certain risks to our business that could materially

affect our financial condition and performance, we believe that these risks are manageable and that we are taking

appropriate actions to monitor and address them. For example, in connection with our financial planning process

and capital raising activities, we seek to maintain an appropriate balance between our debt and equity capitalization

and we review our business plans and forecasts to monitor our ability to service our debt and to assess our capacity

74