Cricket Wireless 2010 Annual Report Download - page 101

Download and view the complete annual report

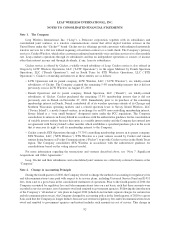

Please find page 101 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cost of Equipment. Cost of equipment primarily includes the cost of devices and accessories purchased from

third-party vendors and resold to the Company’s customers in connection with its services, as well as the lower of

cost or market write-downs associated with excess or damaged devices and accessories.

Selling and Marketing. Selling and marketing expenses primarily include advertising expenses, promotional

and public relations costs associated with acquiring new customers, store operating costs (such as retail associates’

salaries and rent), and salary and overhead charges associated with selling and marketing functions.

General and Administrative. General and administrative expenses primarily include call center and other

customer care program costs and salary, overhead and outside consulting costs associated with the Company’s

customer care, billing, information technology, finance, human resources, accounting, legal and executive

functions.

Cash and Cash Equivalents

The Company considers all highly liquid investments with a maturity at the time of purchase of three months or

less to be cash equivalents. The Company invests its cash with major financial institutions in money market funds,

short-term U.S. Treasury securities and other securities such as prime-rated short-term commercial paper. The

Company has not experienced any significant losses on its cash and cash equivalents.

Short-Term Investments

Short-term investments generally consist of highly liquid, fixed-income investments with an original maturity

at the time of purchase of greater than three months. Such investments consist of commercial paper, asset-backed

commercial paper and obligations of the U.S. government and government agencies.

Investments are classified as available-for-sale and stated at fair value. The net unrealized gains or losses on

available-for-sale securities are reported as a component of comprehensive income (loss). The specific

identification method is used to compute the realized gains and losses on investments. Investments are

periodically reviewed for impairment. If the carrying value of an investment exceeds its fair value and the

decline in value is determined to be other-than-temporary, an impairment loss is recognized for the difference.

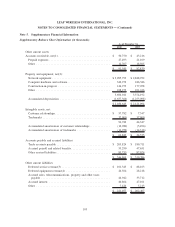

Restricted Cash, Cash Equivalents and Short-Term Investments

Restricted cash, cash equivalents and short-term investments consist primarily of amounts that the Company

has set aside to satisfy certain contractual obligations. Restricted cash, cash equivalents and short-term investments

are included in either short-term or long-term other assets, depending on the contractual obligation. As of

December 31, 2010 the Company had approximately $3.6 million and $7.8 million of restricted cash, cash

equivalents and short-term investments, included as other current and other long-term assets, respectively. As of

December 31, 2009 the Company had approximately $3.9 million and $8.3 million of restricted cash, cash

equivalents and short-term investments, included as other current and other long-term assets, respectively.

Fair Value of Financial Instruments

The authoritative guidance for fair value measurements defines fair value for accounting purposes, establishes a

framework for measuring fair value and provides disclosure requirements regarding fair value measurements. The

guidance defines fair value as an exit price, which is the price that would be received upon the sale of an asset or paid

upon transfer of a liability in an orderly transaction between market participants at the measurement date. The degree

of judgment utilized in measuring the fair value of assets and liabilities generally correlates to the level of pricing

observability. Assets and liabilities with readily available, actively quoted prices or for which fair value can be

measured from actively quoted prices in active markets generally have more pricing observability and require less

judgment in measuring fair value. Conversely, assets and liabilities that are rarely traded or not quoted have less

pricing observability and are generally measured at fair value using valuation models that require more judgment.

These valuation techniques involve some level of management estimation and judgment, the degree of which is

95

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)