Cricket Wireless 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

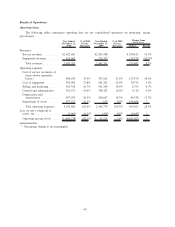

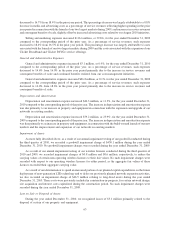

Depreciation and Amortization

Depreciation of property and equipment is applied using the straight-line method over the estimated useful

lives of our assets once the assets are placed in service. The following table summarizes the depreciable lives (in

years):

Depreciable

Life

Network equipment:

Switches .......................................................... 10

Switch power equipment .............................................. 15

Cell site equipment and site improvements ................................. 7

Towers ........................................................... 15

Antennae.......................................................... 5

Computer hardware and software .......................................... 3-5

Furniture, fixtures, retail and office equipment ................................ 3-7

Impairment of Long-Lived Assets

We assess potential impairments to our long-lived assets, including property and equipment and certain

intangible assets, when there is evidence that events or changes in circumstances indicate that the carrying value

may not be recoverable. An impairment loss may be required to be recognized when the undiscounted cash flows

expected to be generated by a long-lived asset (or group of such assets) is less than its carrying value. Any required

impairment loss would be measured as the amount by which the asset’s carrying value exceeds its fair value and

would be recorded as a reduction in the carrying value of the related asset and charged to results of operations.

As a result of the sustained decrease in our market capitalization, and in conjunction with the annual

assessment of our goodwill, we tested our long-lived assets for potential impairment during the third quarter of

2010. Since our long-lived assets do not have identifiable cash flows that are largely independent of other asset

groupings, we completed this assessment at the enterprise level. As required by the authoritative guidance for

impairment testing, we compared our total estimated undiscounted future cash flows to the carrying value of our

long-lived and indefinite-lived assets at September 30. Under this analysis, our total estimated undiscounted future

cash flows were determined to have exceeded the total carrying value of our long-lived and indefinite-lived assets. If

our total estimated undiscounted future cash flows calculated in this analysis were 10% less than those determined,

they would continue to exceed the total carrying value of our long-lived and indefinite-lived assets. We estimated

our future cash flows based on projections regarding our future operating performance, including projected

customer growth, customer churn, average monthly revenue per customer and costs per gross additional customer. If

our actual results were to materially differ from those projected, that difference could have a significant adverse

effect on our estimated undiscounted future cash flows and could ultimately result in an impairment to our long-

lived assets.

We believe that it is appropriate to evaluate the recoverability of our property and equipment and other long-

lived assets based on the cash flows and carrying value of the assets of the entire company because we are unable to

accurately attribute cash flows to lower level asset groupings which generate cash flows independently from other

asset groupings, such as individual markets. Had lower level asset groupings and related cash flows been available

for use in this evaluation, it is possible that the undiscounted cash flow test results may have been significantly

different.

In connection with the analysis described above, we evaluated certain network design, site acquisition and

capitalized interest costs relating to the expansion of our network which had been accumulated in

construction-in-progress. In August 2010, we entered into a wholesale agreement which permits us to offer

Cricket wireless services outside our current network. We believe that this agreement will allow us to strengthen and

expand our distribution and provides us with greater flexibility with respect to our network expansion plans. As a

result, we have determined to spend an increased portion of our planned capital expenditures on the future

deployment of next-generation LTE technology and to defer our previously planned network expansion activities.

53