Cricket Wireless 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.likely sale or disposal of all or a significant portion of an asset group. Based upon this evaluation, we concluded that

no triggering events or changes in circumstances had occurred.

Goodwill

We record the excess of the purchase price over the fair value of net assets acquired in a business combination

as goodwill. However, as of December 31, 2009, goodwill primarily represented the excess of our reorganization

value over the fair value of identified tangible and intangible assets recorded in connection with fresh-start reporting

as of July 31, 2004. Goodwill is tested for impairment annually as well as when an event or change in circumstance

indicates an impairment may have occurred. As further discussed in the notes to the consolidated financial

statements, goodwill is tested for impairment by comparing the fair value of our single reporting unit to our carrying

amount to determine if there is a potential goodwill impairment. If the fair value of the reporting unit is less than its

carrying value, an impairment loss is recorded to the extent that the implied fair value of the goodwill of the

reporting unit is less than its carrying value.

During the third quarter of each year, we assess our goodwill for impairment at the reporting unit level by

applying a fair value test. This fair value test involves a two-step process. The first step is to compare the carrying

value of our net assets to our fair value. If the fair value is determined to be less than the carrying value, a second step

is performed to measure the amount of the impairment, if any.

In connection with the annual impairment test in 2010, significant judgments were required in order to

estimate our fair value. We based our determination of fair value primarily upon our average market capitalization

for the month of August, plus a control premium. Average market capitalization is calculated based upon the

average number of shares of Leap common stock outstanding during such month and the average closing price of

Leap common stock during such month. We considered the month of August to be an appropriate period over which

to measure average market capitalization in 2010 because trading prices during that period reflected market reaction

to our most recently announced financial and operating results, announced early in the month of August.

In conducting the annual impairment test during the third quarter of 2010, we applied a control premium of

30% to our average market capitalization. We believe that consideration of a control premium is customary in

determining fair value, and is contemplated by the applicable accounting guidance. We believe that our

consideration of a control premium was appropriate because we believe that our market capitalization does not

fully capture the fair value of our business as a whole or the additional amount an assumed purchaser would pay to

obtain a controlling interest in our company. We determined the amount of the control premium as part of our third

quarter 2010 impairment testing based upon our relevant transactional experience, a review of recent comparable

telecommunications transactions and an assessment of market, economic and other factors. Depending on the

circumstances, the actual amount of any control premium realized in any transaction involving our company could

be higher or lower than the control premium that we applied.

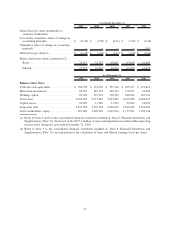

The carrying value of our goodwill was $430.1 million as of August 31, 2010. As of August 31, 2010, the

carrying value of our net assets exceeded the fair value of our company, determined based upon our average market

capitalization during the month of August 2010 and applying an assumed control premium of 30%. As a result, we

performed the second step of the assessment to measure the amount of any impairment. Under step two of the

assessment, we performed a hypothetical purchase price allocation as if our company was being acquired in a

business combination and estimated the fair value of our identifiable assets and liabilities. This determination

required us to make significant estimates and assumptions regarding the fair value of both our recorded and

unrecorded assets and liabilities such as customer relationships, wireless licenses and property and equipment. This

step of the assessment indicated that the implied fair value of our goodwill was zero, as the fair value of our

identifiable assets (net of liabilities) as of August 31, 2010 exceeded the fair value of our company. As a result, we

recorded a non-cash impairment charge of $430.1 million in the third quarter of 2010, reducing the carrying amount

of our goodwill to zero.

On October 1, 2010, we and Pocket contributed substantially all of our respective wireless spectrum and

operating assets in the South Texas region to a new joint venture, STX Wireless, which is controlled and managed

by Cricket. The excess purchase price over the fair value of the net assets acquired by STX Wireless

was$31.1 million and was allocated to goodwill on our consolidated balance sheet at December 31, 2010.

56