Cricket Wireless 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

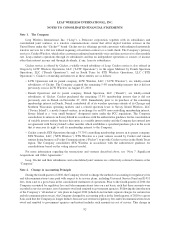

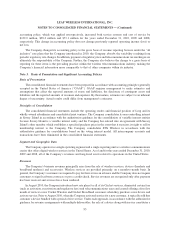

dependent on the price transparency of the asset, liability or market and the nature of the asset or liability. The

Company has categorized its assets and liabilities measured at fair value into a three-level hierarchy in accordance

with this guidance. See Note 4 for further discussion regarding the Company’s measurement of assets and liabilities at

fair value.

Inventories

Inventories consist of devices and accessories not yet placed into service and units designated for the

replacement of damaged customer devices, and are stated at the lower of cost or market using the average cost

method.

Property and Equipment

Property and equipment are initially recorded at cost. Additions and improvements are capitalized, while

expenditures that do not enhance the asset or extend its useful life are charged to operating expenses as incurred.

Depreciation is applied using the straight-line method over the estimated useful lives of the assets once the assets are

placed in service.

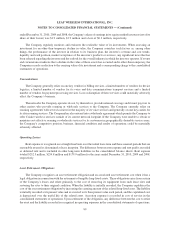

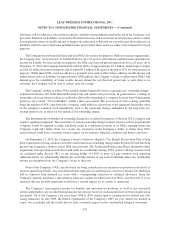

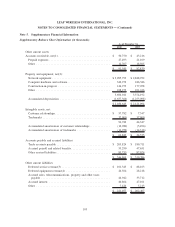

The following table summarizes the depreciable lives for property and equipment (in years):

Depreciable

Life

Network equipment:

Switches .......................................................... 10

Switch power equipment .............................................. 15

Cell site equipment and site improvements ................................. 7

Towers ........................................................... 15

Antennae.......................................................... 5

Computer hardware and software .......................................... 3-5

Furniture, fixtures, retail and office equipment ................................ 3-7

The Company’s network construction expenditures are recorded as construction-in-progress until the network

or other asset is placed in service, at which time the asset is transferred to the appropriate property or equipment

category and depreciation commences. The Company capitalizes salaries and related costs of engineering and

technical operations employees as components of construction-in-progress during the construction period to the

extent time and expense are attributed to the construction effort. The Company also capitalizes certain

telecommunications and other related costs as construction-in-progress during the construction period to the

extent they are incremental and directly related to the network under construction. In addition, interest is capitalized

on the carrying values of both wireless licenses and equipment during the construction period and is depreciated

over an estimated useful life of ten years. During the year ended December 31, 2010 and 2009 the Company

capitalized $0 and $20.8 million in interest, respectively, to property and equipment.

In accordance with the authoritative guidance for accounting for costs of computer software developed or

obtained for internal use, certain costs related to the development of internal use software are capitalized and

amortized over the estimated useful life of the software. During the years ended December 31, 2010 and 2009, the

Company capitalized internal use software costs of $114.5 million and $69.1 million, respectively, to property and

equipment, and amortized internal use software costs of $32.8 million and $21.3 million, respectively.

Property and equipment to be disposed of by sale is not depreciated and is carried at the lower of carrying value

or fair value less costs to sell. No property and equipment was classified as assets held for sale as of December 31,

2010 or 2009.

96

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)