Cricket Wireless 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

agencies and a majority of its short-term investments in commercial paper is determined using observable market-

based inputs for similar assets, which primarily include yield curves and time-to-maturity factors. Such investments

are therefore considered to be Level 2 items. The fair value of the Company’s investment in asset-backed

commercial paper prior to its complete sale in the second quarter of 2010 was determined using primarily

unobservable inputs that could not be corroborated by market data, primarily consisting of indicative bids from

potential purchasers, and was therefore considered to be a Level 3 item.

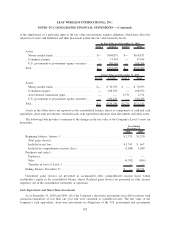

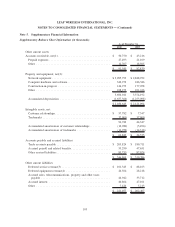

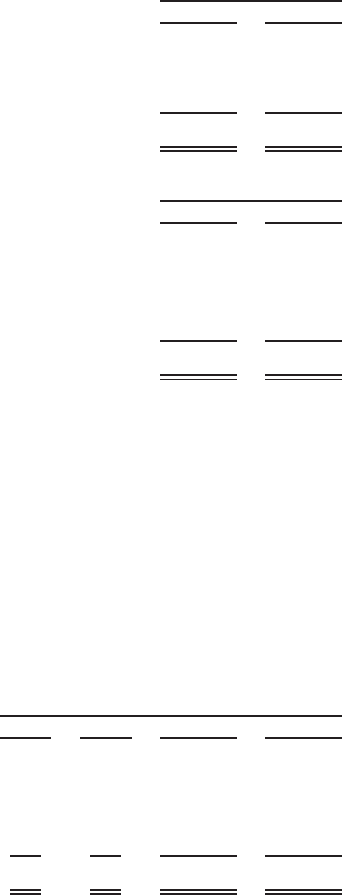

Available-for-sale securities were comprised as follows as of December 31, 2010 and 2009 (in thousands):

Cost Fair Value

As of December 31, 2010

Money market funds .......................................... $168,831 $168,831

Commercial paper ............................................ 17,494 17,494

U.S. government or government agency securities .................... 108,364 108,364

$294,689 $294,689

Cost Fair Value

As of December 31, 2009

Money market funds .......................................... $ 70,393 $ 70,393

Commercial paper ............................................ 108,955 108,952

Asset-backed commercial paper .................................. 1,051 2,731

U.S. government or government agency securities .................... 350,402 350,435

$530,801 $532,511

Long-Term Debt

The Company continues to report its long-term debt obligations at amortized cost; however, for disclosure

purposes, the Company is required to measure the fair value of outstanding debt on a recurring basis. The fair value

of the Company’s outstanding long-term debt is determined primarily by using quoted prices in active markets and

was $2,876.8 million and $2,715.7 million as of December 31, 2010 and 2009, respectively.

Assets Measured at Fair Value on a Nonrecurring Basis

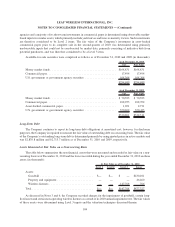

The table below summarizes the non-financial assets that were measured and recorded at fair value on a non-

recurring basis as of December 31, 2010 and the losses recorded during the year ended December 31, 2010 on those

assets (in thousands):

Level 1 Level 2 Level 3 Losses

At Fair Value as of December 31, 2010

Assets:

Goodwill .................................. $— $— $ — $430,101

Property and equipment ....................... — — — 46,460

Wireless licenses ............................ — — 147,768 766

Total....................................... $— $— $147,768 $477,327

As discussed in Notes 3 and 6, the Company recorded charges for the impairment of goodwill, certain long-

lived assets and certain non-operating wireless licenses as a result of its 2010 annual impairment test. The fair values

of these assets were determined using Level 3 inputs and the valuation techniques discussed therein.

104

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)