Cricket Wireless 2010 Annual Report Download - page 114

Download and view the complete annual report

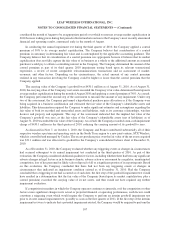

Please find page 114 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.second step of the goodwill impairment test, which would require management to determine the fair value of its net

assets and could require the Company to recognize a material non-cash impairment charge that could reduce all or a

portion of the carrying value of its goodwill of $31.1 million.

Wireless Licenses

The Company operates networks under PCS and AWS wireless licenses granted by the FCC that are specific to

a particular geographic area on spectrum that has been allocated by the FCC for such services. Wireless licenses are

initially recorded at cost and are not amortized. Although FCC licenses are issued with a stated term (ten years in the

case of PCS licenses and fifteen years in the case of AWS licenses), wireless licenses are considered to be indefinite-

lived intangible assets because the Company expects to provide wireless service using the relevant licenses for the

foreseeable future, PCS and AWS licenses are routinely renewed for either no or a nominal fee and management has

determined that no legal, regulatory, contractual, competitive, economic or other factors currently exist that limit

the useful lives of the Company’s and Savary Island’s PCS and AWS licenses. On a quarterly basis, the Company

evaluates the remaining useful lives of its indefinite-lived wireless licenses to determine whether events and

circumstances, such as legal, regulatory, contractual, competitive, economic or other factors, continue to support an

indefinite useful life. If a wireless license is subsequently determined to have a finite useful life, the Company would

first test the wireless license for impairment and the wireless license would then be amortized prospectively over its

estimated remaining useful life. In addition, on a quarterly basis, the Company evaluates the triggering event criteria

outlined in the authoritative guidance for the impairment or disposal of long-lived assets to determine whether

events or changes in circumstances indicate that an impairment condition may exist. In addition to these quarterly

evaluations, the Company also tests its wireless licenses for impairment on an annual basis in accordance with the

authoritative guidance for goodwill and other intangible assets. As of December 31, 2010 and 2009, the carrying

value of the Company’s and Savary Island’s wireless licenses was $2.0 billion and $1.9 billion, respectively.

Wireless licenses to be disposed of by sale are carried at the lower of their carrying value or fair value less costs to

sell. As of December 31 2009, wireless licenses with a carrying value of $2.4 million were classified as assets held

for sale, respectively, as more fully described in Note 7.

Portions of the AWS spectrum that the Company was awarded in Auction #66 were subject to use by U.S.

federal government and/or incumbent commercial licensees. FCC rules require winning bidders to avoid interfering

with these existing users or to clear the incumbent users from the spectrum through specified relocation procedures.

In connection with the launch of new markets over the past two years, the Company worked with several incumbent

government and commercial licensees to clear AWS spectrum. The Company’s spectrum clearing costs have been

capitalized to wireless licenses as incurred. During the years ended December 31, 2010 and 2009, the Company

incurred approximately $3.8 million and $8.2 million, respectively, in spectrum clearing costs.

For purposes of testing impairment, the Company’s wireless licenses in its operating markets are combined

into a single unit of account because management believes that utilizing these wireless licenses as a group

represents the highest and best use of the assets, and the value of the wireless licenses would not be significantly

impacted by a sale of one or a portion of the wireless licenses, among other factors. The Company’s and Savary

Island’s non-operating licenses are tested for impairment on an individual basis because these licenses are not

functioning as part of a group with licenses in the Company’s operating markets. As of December 31, 2010, the

carrying values of the Company’s and Savary Island’s operating and non-operating wireless licenses were

$1,804.0 million and $164.1 million, respectively. An impairment loss would be recognized on the Company’s

and Savary Island’s operating wireless licenses when the aggregate fair value of the wireless licenses is less than

their aggregate carrying value and is measured as the amount by which the licenses’ aggregate carrying value

exceeds their aggregate fair value. An impairment loss would be recognized on the Company’s and Savary Island’s

non-operating wireless licenses when the fair value of a wireless license is less than its carrying value and is

measured as the amount by which the license’s carrying value exceeds its fair value. Any required impairment loss

would be recorded as a reduction in the carrying value of the relevant wireless license and charged to results of

operations. As a result of the annual impairment test of wireless licenses, the Company recorded an impairment

108

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)