Cricket Wireless 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

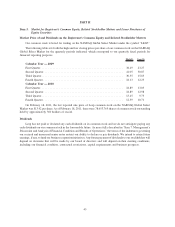

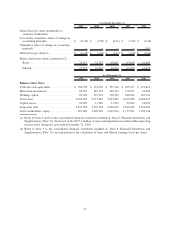

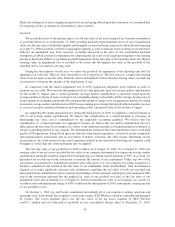

Item 6. Selected Financial Data (in thousands, except per share data)

The following selected financial data were derived from our audited consolidated financial statements (as

adjusted for the change in accounting principle as discussed in Note 2 to the consolidated financial statements

included in “Item 8. Financial Statements and Supplementary Data”). These tables should be read in conjunction

with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

“Item 8. Financial Statements and Supplementary Data” included elsewhere in this report.

During the fourth quarter of 2010, we elected to change the method of accounting for regulatory fees and

telecommunications taxes paid with respect to our service plans, including Universal Service Fund and E-911 fees,

from a net to a gross basis in the consolidated statements of operations. Prior to the fourth quarter of 2010, we

accounted for regulatory fees and telecommunications taxes on a net basis, such that regulatory fees and

telecommunications taxes were recorded as service revenue, net of amounts owed and remitted to government

agencies. Following the introduction of our “all-inclusive” rate plans in August 2010 (which do not include separate

charges for certain fees and telecommunications taxes), we changed our accounting policy in the fourth quarter of

2010 to a gross basis such that we no longer deduct from service revenues regulatory fees and telecommunications

taxes owed and remitted to government agencies and instead include such amounts in cost of service. This change in

accounting policy, which has been applied retrospectively, increased both service revenues and cost of service by

$139.9 million, $98.2 million, $73.1 million, $71.4 million and $64.6 million for the years ended December 31,

2010, 2009, 2008, 2007 and 2006, respectively. This change in accounting policy does not change previously

reported operating income (loss) or net loss.

2010 2009 2008 2007 2006

Year Ended December 31,

Statement of Operations Data:

Revenues .......................... $2,697,203 $2,481,321 $2,031,924 $1,702,167 $1,231,778

Operating income (loss)(1) ............. (450,738) 31,124 46,700 60,262 23,725

Loss before income taxes and cumulative

effect of change in accounting

principle......................... (742,542) (197,354) (104,411) (40,521) (17,635)

Income tax expense .................. (42,513) (40,609) (38,970) (35,924) (8,469)

Loss before cumulative effect of change in

accounting principle ................ (785,055) (237,963) (143,381) (76,445) (26,104)

Cumulative effect of change in accounting

principle......................... — — — — 623

Netloss......................... (785,055) (237,963) (143,381) (76,445) (25,481)

Accretion of redeemable non-controlling

interests, net of tax ................. (86,898) (1,529) (6,820) (3,854) (1,321)

Net loss attributable to common

stockholders .................... $ (871,953) $ (239,492) $ (150,201) $ (80,299) $ (26,802)

Basic loss per share attributable to common

stockholders:

Loss before cumulative effect of change in

accounting principle ................ $ (11.49) $ (3.30) $ (2.21) $ (1.20) $ (0.44)

Cumulative effect of change in accounting

principle......................... — — — — 0.01

Basic loss per share(2) ................ $ (11.49) $ (3.30) $ (2.21) $ (1.20) $ (0.43)

46