Cricket Wireless 2010 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2010 Cricket Wireless annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

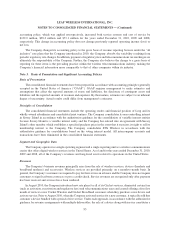

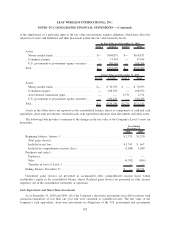

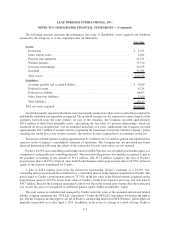

of the significance of a particular input to the fair value measurement requires judgment, which may affect the

valuation of assets and liabilities and their placement within the fair value hierarchy levels.

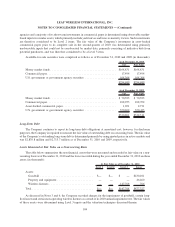

Level 1 Level 2 Level 3 Total

At Fair Value as of December 31, 2010

Assets:

Money market funds.......................... $— $168,831 $— $168,831

Commercial paper ........................... — 17,494 — 17,494

U.S. government or government agency securities .... — 108,364 — 108,364

Total....................................... $— $294,689 $— $294,689

Level 1 Level 2 Level 3 Total

At Fair Value as of December 31, 2009

Assets:

Money market funds ......................... $— $ 70,393 $ — $ 70,393

Commercial paper ........................... — 108,952 — 108,952

Asset-backed commercial paper ................. — — 2,731 2,731

U.S. government or government agency securities.... — 350,435 — 350,435

Total....................................... $— $529,780 $2,731 $532,511

Assets in the tables above are reported on the consolidated balance sheets as components of cash and cash

equivalents, short-term investments, restricted cash, cash equivalents and short-term investments and other assets.

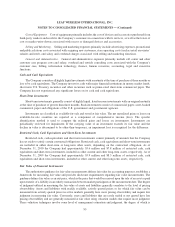

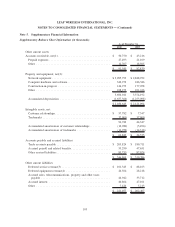

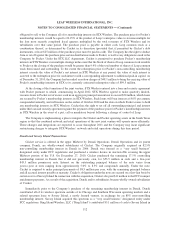

The following table provides a summary of the changes in the fair value of the Company’s Level 3 assets (in

thousands).

2010 2009

Year Ended

December 31,

Beginning balance, January 1 ...................................... $2,731 $1,250

Total gains (losses):

Included in net loss ............................................ $3,341 $ 667

Included in comprehensive income (loss) ............................ (1,680) 1,680

Purchases and (sales):

Purchases ................................................... — —

Sales....................................................... (4,392) (866)

Transfers in (out) of Level 3 ..................................... — —

Ending balance, December 31 ...................................... $ — $2,731

Unrealized gains (losses) are presented in accumulated other comprehensive income (loss) within

stockholder’s equity in the consolidated balance sheets. Realized gains (losses) are presented in other income

(expense), net in the consolidated statements of operations.

Cash Equivalents and Short-Term Investments

As of December 31, 2010 and 2009, all of the Company’s short-term investments were debt securities with

contractual maturities of less than one year and were classified as available-for-sale. The fair value of the

Company’s cash equivalents, short-term investments in obligations of the U.S. government and government

103

LEAP WIRELESS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)