Comcast 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386

|

|

Table of Contents

In addition, our cable networks and broadcast television networks have programming rights agreements of varying scope and

duration with various sports organizations to broadcast and produce sporting events, including certain NFL, NHL, NBA and MLB

games. Labor disputes in these and other sports organizations could have an adverse effect on our businesses.

The loss of key management personnel or popular on-

air and creative talent could have an adverse effect on our

businesses.

We rely on certain key management personnel in the operation of our businesses. While we maintain long-

term and emergency

transition plans for key management personnel and believe we could either identify internal candidates or attract outside candidates

to fill any vacancy created by the loss of any key management personnel, the loss of one or more of our key management

personnel could have a negative impact on our businesses. In addition, our cable networks, broadcast television and filmed

entertainment businesses depend on the abilities and expertise of our on-air and creative talent. If we fail to retain our on-

air or

creative talent, if the costs to retain such talent increase materially, if we need to make significant termination payments, or if these

individuals lose their current appeal, our businesses could be adversely affected.

We face risks relating to doing business internationally that could adversely affect our businesses.

We, primarily through NBCUniversal, operate our businesses worldwide. There are risks inherent in doing business internationally,

including global financial market turmoil, economic volatility and the global economic slowdown, currency exchange rate

fluctuations and inflationary pressures, the requirements of local laws and customs relating to the publication and distribution of

content and the display and sale of advertising, import or export restrictions and changes in trade regulations, difficulties in

developing, staffing and managing foreign operations, issues related to occupational safety and adherence to diverse local labor

laws and regulations, and potentially adverse tax developments. In addition, doing business internationally is subject to risks

relating to political or social unrest, corruption and government regulation, including U.S. laws such as the Foreign Corrupt

Practices Act that impose stringent requirements on how we conduct our foreign operations. If any of these events occur, our

businesses may be adversely affected.

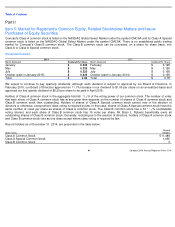

Our Class B common stock has substantial voting rights and separate approval rights over several potentially material

transactions, and our Chairman and CEO has considerable influence over our company through his beneficial ownership

of our Class B common stock.

Our Class B common stock has a nondilutable 33 /

% of the combined voting power of our Class A and Class B common stock.

This nondilutable voting power is subject to proportional decrease to the extent the number of shares of Class B common stock is

reduced below 9,444,375, which was the number of shares of Class B common stock outstanding on the date of our 2002

acquisition of AT&T Corp.’

s cable business, subject to adjustment in specified situations. Stock dividends payable on the Class B

common stock in the form of Class B or Class A Special common stock do not decrease the nondilutable voting power of the Class

B common stock. The Class B common stock also has separate approval rights over several potentially material transactions, even

if they are approved by our Board of Directors or by our other shareholders and even if they might be in the best interests of our

other shareholders. These potentially material transactions include mergers or consolidations involving Comcast

Corporation, transactions (such as a sale of all or substantially all of our assets) or issuances of securities that require shareholder

approval, transactions that result in any person or group owning shares representing more than 10% of the combined voting power

of the resulting or surviving corporation, issuances of Class B common stock or securities exercisable or convertible into Class B

common stock, and amendments to our articles of incorporation or by-

laws that would limit the rights of holders of our Class B

common stock. Brian L. Roberts, our chairman and CEO, beneficially owns all of the outstanding shares of our Class B common

stock and, accordingly, has considerable influence over our company and the potential ability to transfer effective control by selling

the Class B common stock, which could be at a premium.

Comcast 2014 Annual Report on Form 10

-

K

38

1 3