Comcast 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMCAST CORP

FORM 10-K

(Annual Report)

Filed 02/27/15 for the Period Ending 12/31/14

CIK 0001166691

Symbol CMCSA

SIC Code 4841 - Cable and Other Pay Television Services

Industry Broadcasting & Cable TV

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2015, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

... 10-K (Annual Report) Filed 02/27/15 for the Period Ending 12/31/14 CIK Symbol SIC Code Industry Sector Fiscal Year 0001166691 CMCSA 4841 - Cable and Other Pay Television Services Broadcasting & Cable TV Services 12/31 http://www.edgar-online.com © Copyright 2015, EDGAR Online, Inc. All Rights... -

Page 2

... is a shell company (as defined in Rule 12b-2 of the Act). Comcast Corporation Yes 3 No  NBCUniversal Media, LLC Yes 3 No  As of June 30, 2014, the aggregate market value of the Comcast Corporation Class A common stock and Class A Special common stock held by non-affiliates of the registrant... -

Page 3

... Media, LLC meets the conditions set forth in General Instruction I(1)(a), (b) and (d) of Form 10-K and is therefore filing this form with the reduced disclosure format. DOCUMENTS INCORPORATED BY REFERENCE Comcast Corporation - Part III - The registrant's definitive Proxy Statement for its annual... -

Page 4

... Officers and Corporate Governance Item 11 Executive Compensation Item 12 Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13 Certain Relationships and Related Transactions, and Director Independence Item 14 Principal Accountant Fees and Services... -

Page 5

..., 2014. This Annual Report on Form 10-K modifies and supersedes documents filed before it. The Securities and Exchange Commission ("SEC") allows us to "incorporate by reference" information that we file with it, which means that we can disclose important information to you by referring you directly... -

Page 6

... of Comcast Cable, which is the nation's largest provider of video, high-speed Internet and voice services ("cable services") to residential customers under the XFINITY brand; we also provide similar and other services to small and medium-sized businesses and sell advertising. • Cable Networks... -

Page 7

...'s Discussion and Analysis of Financial Condition and Results of Operations. Available Information and Websites Comcast's phone number is (215) 286-1700, and its principal executive offices are located at One Comcast Center, Philadelphia, PA 19103-2838. NBCUniversal's phone number is (212) 664-4444... -

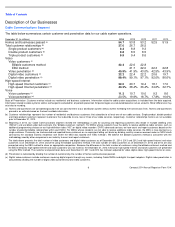

Page 8

... and report customers. The table above presents the total number of video customers and digital video customers as of December 31, 2014, 2013 and 2012 and high-speed Internet and voice customers as of December 31, 2014 and 2013 using the billable customers method. The total number of video customers... -

Page 9

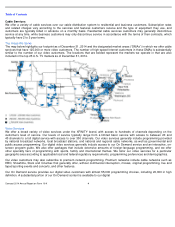

... Cable Services We offer a variety of cable services over our cable distribution system to residential and business customers. Subscription rates and related charges vary according to the services and features customers receive and the type of equipment they use, and customers are typically billed... -

Page 10

... as online security features. In addition, we are actively deploying wireless gateways, which combine a customer's wireless router, cable modem and voice adapter, to improve the performance of multiple Internet-enabled devices used at the same time within the home, provide faster Internet speeds and... -

Page 11

...home security and automation services provide our customers with home monitoring services and the ability to manage other functions within the home, such as lighting and climate control, through our XFINITY online portal or our mobile apps. We also receive revenue related to our digital media center... -

Page 12

... to our cable distribution system. Sales and Marketing We offer our services directly to residential and business customers through our customer service call centers, customer service centers, door-to-door selling, direct mail advertising, television advertising, Internet advertising, local media... -

Page 13

... Children's entertainment Horror and suspense Global financial news General entertainment HD programming Crime, mystery and suspense (a) Subscriber data is based on The Nielsen Company's January 2015 report, which is derived from information available during the period December 22, 2014... -

Page 14

..., sports, news, long-form and short-form programming, and locally produced programming from around the world. In addition, the NBC network owns various digital media properties, which primarily include brand-aligned websites. The NBC network produces its own programs or acquires the rights to... -

Page 15

... currently hold the Spanish-language U.S. broadcast rights to FIFA World Cup soccer from 2015 through 2022 and the Spanish-language U.S. broadcast rights for the NFL games that the NBC network will broadcast through the 2022-23 season as part of our agreement with the NFL. Comcast 2014 Annual Report... -

Page 16

... DMA served is defined by Nielsen Media Research as a geographic market for the sale of national spot and local advertising time. (b) Hispanic market rank is based on the relative size of the DMA among approximately 14.5 million U.S. Hispanic households as of December 31, 2014. (c) Based on Nielsen... -

Page 17

... areas and are continuing to expand their fiber-based networks. Our high-speed Internet services primarily compete with phone companies with fiber-based networks, which overlap approximately 60% of our service areas and also are continuing to expand their Comcast 2014 Annual Report on Form 10-K 12 -

Page 18

...services, and our voice services are facing increased competition as customers replace landline phones with mobile phones and Internet-based phone services such as Skype. Video Services We compete with a number of different sources that provide news, sports, information and entertainment programming... -

Page 19

...video service package offerings. Some content providers also are beginning to offer programming directly to customers over the Internet for a nominal fee. Additionally, we may compete with consumer electronic companies that sell Internet-connected TVs or gaming consoles that provide a user interface... -

Page 20

...broadcast and premium networks, local broadcast television stations, home entertainment, pay-per-view and video on demand services, online activities, such as social networking and viewing user-generated content, video games, and other forms of entertainment, news and information. Our cable networks... -

Page 21

...as DVRs and video on demand services, which give consumers greater flexibility to watch programming on a time-delayed or on-demand basis or to fast-forward or skip advertisements within programming, and from subscription video on demand services. Seasonality and Cyclicality Each of our businesses is... -

Page 22

... Communications Segment Video Services Program Carriage The Communications Act and FCC regulations prohibit cable operators and other multichannel video providers from requiring a financial interest in, or exclusive distribution rights for, any video programming network as a condition of carriage... -

Page 23

... of our video services customers are not subject to rate regulation. From time to time, Congress and the FCC consider imposing new pricing or packaging regulations. Cable Equipment The Communications Act includes provisions aimed at promoting the retail sale of set-top boxes and other equipment that... -

Page 24

..., such as rate regulation, tariffs, and unbundling requirements. The FCC also announced that the order adopts rules that bar ISPs from blocking access to lawful content, applications, services or non-harmful devices; prohibits ISPs from impairing or degrading lawful Internet traffic on the basis of... -

Page 25

...remainder of the term of those orders. These regulations require that we disclose information regarding network management, performance and commercial terms of the service (the "transparency rule"); bar us from blocking access to lawful content, applications, services or non-harmful devices; and bar... -

Page 26

...nontraditional voice services such as ours, including regulations relating to customer proprietary network information, local number portability duties and benefits, disability access, E911, law enforcement assistance (CALEA), outage reporting, rural call completion reporting, Universal Service Fund... -

Page 27

... imposing taxes on Internet access charges. Additionally, the FCC may impose Title II regulation on Internet access service, which may cause, directly or indirectly, some states and localities to impose additional taxes and fees on our high-speed Internet business. Comcast 2014 Annual Report on Form... -

Page 28

...agreements. Lawmakers also have proposed legislation that would provide certain program access rights and protections to online video distributors. We currently offer our cable networks both on a bundled and, when requested, on a stand-alone basis. It is uncertain whether any of these proposals will... -

Page 29

... households. Our owned television station reach does not exceed this limit. In 2013, the FCC launched a rulemaking that considers eliminating a rule that currently affords UHF stations (channels 14 and above) a 50% discount in calculating the extent of an individual station owner's holdings... -

Page 30

...rules protecting local television stations' exclusive rights to transmit network and syndicated programming in their local markets. Congress also is considering legislation that would eliminate or modify the must-carry and retransmission consent regime. We cannot predict what new laws or regulations... -

Page 31

... help protect our intellectual property rights. In particular, piracy of programming and films through unauthorized distribution of counterfeit DVDs, peer-to-peer file sharing and other platforms presents challenges for our cable networks, broadcast television and filmed entertainment businesses... -

Page 32

... information. In 2013, FTC regulations implementing the Children's Online Privacy Protection Act ("COPPA") went into effect. COPPA imposes requirements on website operators and online services that are directed to children under 13 years of age, or that knowingly collect or post personal information... -

Page 33

... government agencies when certain information has been disclosed because of a security breach. The FCC has adopted security breach rules for voice services. In October 2014, the FCC proposed to impose fines totaling $10 million on two companies for failing to protect customer data from unauthorized... -

Page 34

... actively regulates other aspects of our businesses, including the mandatory blackout of syndicated and network programming, customer service standards, inside wiring, leased access, loudness of commercial advertisements, political advertising, Emergency Alert System requirements, equal employment... -

Page 35

... social conditions; consumer response to new and existing products and services; technological developments; and, particularly in view of new technologies, the ability to develop and protect intellectual property rights. Our actual results could differ materially from our forward-looking statements... -

Page 36

...networks directly to customers over the Internet at price points lower than our traditional video service package offerings, which could adversely affect demand for our video services or cause us to offer more customized programming packages that may be less profitable. 31 Comcast 2014 Annual Report... -

Page 37

... Wi-Fi networks, and devices such as wireless data cards, tablets and smartphones, and mobile wireless routers that connect to such devices, may compete with our high-speed Internet services. Our voice services continue to face increased competition from wireless and Internet-based phone services as... -

Page 38

... state and local authorities relating to our acquisition of cable systems from Time Warner Cable and Charter and cannot predict what conditions might be applied to any such approvals or how such conditions might affect our businesses. Failure to comply with the laws and regulations applicable to our... -

Page 39

... to our video services or distribute existing programming to more of our customers or through additional delivery platforms, such as On Demand or mobile apps. Additionally, in the past few years, we have begun paying certain local broadcast television stations in exchange for their required consent... -

Page 40

... may disrupt our businesses. Network and information systems and other technologies, including those related to our network management, customer service operations and programming delivery, are critical to our business activities. Network and information systems-related events, including those... -

Page 41

... video on demand services, or substitute services for our high-speed Internet and phone services, such as mobile phones, smartphones and Wi-Fi networks. Weak economic conditions also may have a negative impact on our advertising revenue, the performance of our films and home entertainment releases... -

Page 42

... as from the sale of advertising in connection with our content, and increases our costs due to our active enforcement of our intellectual property rights. For example, NBCUniversal has brought a suit against a multichannel video provider to challenge the commercial-skipping functionality in its DVR... -

Page 43

..., currency exchange rate fluctuations and inflationary pressures, the requirements of local laws and customs relating to the publication and distribution of content and the display and sale of advertising, import or export restrictions and changes in trade regulations, difficulties in developing... -

Page 44

... condition as of December 31, 2014. Our corporate headquarters and Cable Communications segment headquarters are located in Philadelphia, Pennsylvania at One Comcast Center. We own an 80% interest in the entity whose primary asset is One Comcast Center. We also lease locations for numerous business... -

Page 45

..., multipurpose arena in Philadelphia, Pennsylvania that we own, was the principal physical operating asset of our other businesses as of December 31, 2014. Item 3: Legal Proceedings Refer to Note 17 to Comcast Corporation's consolidated financial statements included in this Annual Report on Form... -

Page 46

... established public trading market for Comcast's Class B common stock. The Class B common stock can be converted, on a share for share basis, into Class A or Class A Special common stock. Dividends Declared 2014 Month Declared: Dividend Per Share Month Declared: 2013 Dividend Per Share January May... -

Page 47

... close of the Time Warner Cable merger, subject to market conditions. The total number of shares purchased during the first quarter of 2014 includes 126,302 shares received in the administration of employee share-based compensation plans. In February 2015, our Board of Directors increased our share... -

Page 48

... Common Stock Sales Price Table The following table sets forth, for the indicated periods, the high and low sales prices of Comcast's Class A and Class A Special common stock. Class A High Low Class A Special High Low 2014 First Quarter Second Quarter Third Quarter Fourth Quarter 2013 First Quarter... -

Page 49

... in the cable, communications and media industries. This peer group consists of us (Class A and Class A Special common stock), as well as Cablevision Systems Corporation (Class A), DISH Network Corporation (Class A), DirecTV Inc. and Time Warner Cable Inc. (the "cable subgroup"), and Time Warner Inc... -

Page 50

... Financial Data Comcast Year ended December 31 (in millions, except per share data) 2014 2013 2012 2011 (b) 2010 Statement of Income Data Revenue Operating income Net income attributable to Comcast Corporation (a) Basic earnings per common share attributable to Comcast Corporation shareholders... -

Page 51

...HD") and digital video recorder ("DVR") advanced services. Our video customers have the ability to use our XFINITY online portal or our mobile apps to view certain live television programming and On Demand content, browse program listings, and schedule, manage and watch DVR recordings. Comcast 2014... -

Page 52

... as online security features. In addition, we are actively deploying wireless gateways, which combine a customer's wireless router, cable modem and voice adapter, to improve the performance of multiple Internet-enabled devices used at the same time within the home, provide faster Internet speeds and... -

Page 53

... sale of advertising on our broadcast networks, owned local broadcast television stations and related digital media properties, from the licensing of our owned programming through various distribution platforms, including to cable and broadcast networks and to subscription video on demand services... -

Page 54

...speed Internet customers and 5.6 million voice customers. As a result of the Time Warner Cable merger, Time Warner Cable stockholders will receive, in exchange for each share of Time Warner Cable common stock owned immediately prior to the Time Warner Cable merger, 2.875 shares of our Class A common... -

Page 55

... and entertainment, news and information content to consumers. Competition for our bundled cable services that include video, high-speed Internet and/or voices services consists primarily of direct broadcast satellite ("DBS") providers, which have a national footprint and compete Comcast 2014 Annual... -

Page 56

... A number of companies have announced plans to launch online video services that will reportedly involve both linear and on-demand programming, and one traditional provider of cable services has begun to offer smaller packages of programming networks directly to customers over the Internet at prices... -

Page 57

... the seasonal nature of vacation travel, local entertainment offerings and seasonal weather variations. Our theme parks generally experience peak attendance during the summer months when schools are closed and during early winter and spring holiday periods. Comcast 2014 Annual Report on Form 10-K 52 -

Page 58

... of Contents Consolidated Operating Results % Change 2013 to 2014 % Change 2012 to 2013 Year ended December 31 (in millions) 2014 2013 2012 Revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation Amortization... -

Page 59

... in the NBCUniversal segments. Revenue for our segments is discussed separately below under the heading "Segment Operating Results." Revenue for our other businesses is discussed separately under the heading "Corporate and Other Results of Operations." Comcast 2014 Annual Report on Form 10-K 54 -

Page 60

... Results of Operations." Consolidated depreciation and amortization increased slightly in 2014 primarily due to increases in capital spending in our Cable Communications and NBCUniversal segments, as well as increases related to our acquisitions in 2013 of our corporate headquarters and real estate... -

Page 61

... to Comcast Corporation or NBCUniversal, net cash provided by operating activities, or other measures of performance or liquidity we have reported in accordance with GAAP. Beginning in 2014, Fandango, our movie ticketing and entertainment business that was previously presented in our Cable Networks... -

Page 62

... to 2014 % Change from 2012 to 2013 Revenue Residential: Video High-speed Internet Voice Business services Advertising Other Total revenue Operating costs and expenses Programming Technical and product support Customer service Franchise and other regulatory fees Advertising, marketing and promotion... -

Page 63

.... While the growth rate of residential customer additions slowed in 2014, the increase in the number of residential customers receiving our voice services through our discounted bundled offerings accounted for increases in revenue of 5.1% and 6.0% in Comcast 2014 Annual Report on Form 10-K 58 -

Page 64

... allocated to voice revenue in the bundled rate decreased in 2014 and 2013 because video and high-speed Internet rates increased, while voice rates remained relatively flat. As of December 31, 2014, 20.5% of the homes and businesses in the areas we serve subscribed to our voice services, compared to... -

Page 65

...in customer service activity. The increases in customer service activity were primarily due to sales and related support activities associated with the continued deployment of enhanced devices and services, which include our X1 platform, Cloud DVR technology, wireless gateways, and home security and... -

Page 66

... Segments Operating Results Year ended December 31 (in millions) 2014 2013 2012 % Change 2013 to 2014 % Change 2012 to 2013 Revenue Cable Networks Broadcast Television Filmed Entertainment Theme Parks Headquarters, other and eliminations Total revenue Operating Income Before Depreciation and... -

Page 67

... and digital platforms, continues to increase and as the use of DVRs and video on demand services that give viewers more control over when they view content continues to increase. Advertising revenue decreased slightly in 2014 primarily due to continued declines in audience ratings at our networks... -

Page 68

... media properties. Advertising, marketing and promotion expenses remained relatively flat in 2014. Advertising, marketing and promotion expenses increased in 2013 primarily due to increased spending on marketing related to the launch of new programming on our cable networks. 63 Comcast 2014 Annual... -

Page 69

... 2013 to 2014 % Change 2012 to 2013 Year ended December 31 (in millions) 2014 2013 2012 Revenue Advertising Content licensing Other Total revenue Operating costs and expenses Programming and production Other operating and administrative Advertising, marketing and promotion Total operating costs... -

Page 70

... programming, as well as the marketing of DVDs and costs associated with our related digital media properties. Advertising, marketing and promotion expenses increased in 2014 and 2013 primarily due to increased spending on marketing associated with our primetime lineup. 65 Comcast 2014 Annual Report... -

Page 71

... 2013 to 2014 % Change 2012 to 2013 Year ended December 31 (in millions) 2014 2013 2012 Revenue Theatrical Content licensing Home entertainment Other Total revenue Operating costs and expenses Programming and production Other operating and administrative Advertising, marketing and promotion... -

Page 72

... films have generally increased in recent years and may continue to increase in the future. Advertising, marketing and promotion expenses decreased in 2014 and 2013 primarily due to fewer significant theatrical releases compared to their respective prior years. 67 Comcast 2014 Annual Report on Form... -

Page 73

... Headquarters and Other operating costs and expenses incurred by our NBCUniversal businesses include overhead, personnel costs and costs associated with corporate initiatives. Operating costs and expenses increased in 2014 and 2013 primarily due to higher employee-related costs, including... -

Page 74

... plan that provided benefits to former employees of a company we acquired as part of the AT&T Broadband transaction in 2002, as well as an increase in labor costs in our Comcast-Spectacor business. Consolidated Other Income (Expense) Items, Net Year ended December 31 (in millions) 2014 2013 2012... -

Page 75

... with the redemption of Liberty Media Series A common stock in October 2013. Our income tax expense in the future may continue to be impacted by adjustments to uncertain tax positions and related interest, and changes in tax laws. We expect our 2015 annual effective tax rate to be in the range... -

Page 76

.... Our commercial paper programs provide a lower-cost source of borrowing to fund our short-term working capital requirements. These commercial paper programs are fully and unconditionally guaranteed by us and our 100% owned cable holding company subsidiaries, Comcast Cable Communications, LLC ("CCCL... -

Page 77

...Net cash used in investing activities in 2012 consisted primarily of cash paid for capital expenditures, intangible assets and purchases of investments, which was substantially offset by proceeds from the sale of investments and return of capital from investees. Comcast 2014 Annual Report on Form 10... -

Page 78

... to Universal Studios Hollywood in University City, California, and our purchase of an 80% interest in a business whose primary asset is our corporate headquarters located in Philadelphia, Pennsylvania. Proceeds from Sales of Businesses and Investments In 2014, proceeds from sales of businesses and... -

Page 79

... billion of shares through the close of the Time Warner Cable merger in early 2015, subject to market conditions. As of December 31, 2014, we had $3.25 billion remaining under the Board's authorization. In February 2015, our Board of Directors increased our share repurchase program authorization to... -

Page 80

... terms, including fixed or minimum quantities to be purchased and price provisions. Our purchase obligations related to our Cable Communications segment include programming contracts with cable networks and local broadcast television stations, contracts with customer premise equipment manufacturers... -

Page 81

... benefits we receive from the right to solicit new customers and to market new services, such as advanced video services and highspeed Internet and voice services, in a particular service area. The amounts we record for cable franchise rights are primarily a result of cable system acquisitions... -

Page 82

... the discounted cash flow models, we also consider multiples of operating income before depreciation and amortization generated by the underlying assets, current market transactions and profitability information. In 2014, we performed a quantitative assessment of our cable franchise rights. Based... -

Page 83

... discounted cash flows, which are supported by our internal forecasts. Adjustments to capitalized film and stage play production costs of $26 million, $167 million and $161 million were recorded in 2014, 2013 and 2012, respectively. Income Taxes We base our provision for income taxes on our current... -

Page 84

... interest rates on variable rate debt and swaps using the average implied forward London Interbank Offered Rate through the year of maturity based on the yield curve in effect on December 31, 2014, plus the applicable borrowing margin on December 31, 2014. 79 Comcast 2014 Annual Report on Form... -

Page 85

...' credit ratings. As of December 31, 2014 and 2013, Comcast was not required to post collateral under the terms of these agreements. As of December 31, 2014, the collateral that Comcast held from certain of its counterparties under the terms of these agreements was not material. Comcast 2014 Annual... -

Page 86

... Consolidated Statement of Cash Flows Consolidated Statement of Changes in Equity Notes to Consolidated Financial Statements NBCUniversal Media, LLC See Index to NBCUniversal Media, LLC Financial Statements and Supplemental Data on page 148. 81 82 83 84 85 86 87 88 89 Comcast 2014 Annual Report... -

Page 87

...access and report directly to the Audit Committee. The Audit Committee recommended, and the Board of Directors approved, that the Comcast audited consolidated financial statements be included in this Form 10-K. Brian L. Roberts Chairman and Chief Executive Officer Comcast 2014 Annual Report on Form... -

Page 88

... Accounting Firm To the Board of Directors and Stockholders of Comcast Corporation Philadelphia, Pennsylvania We have audited the accompanying consolidated balance sheets of Comcast Corporation and subsidiaries (the "Company") as of December 31, 2014 and 2013, and the related consolidated statements... -

Page 89

...of Contents Comcast Corporation Consolidated Balance Sheet December 31 (in millions, except share data) 2014 2013 Assets Current Assets: Cash and cash equivalents Investments Receivables, net Programming rights Other current assets Total current assets Film and television costs Investments Property... -

Page 90

Table of Contents Comcast Corporation Consolidated Statement of Income Year ended December 31 (in millions, except per share data) 2014 2013 2012 Revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation Amortization ... -

Page 91

Table of Contents Comcast Corporation Consolidated Statement of Comprehensive Income Year ended December 31 (in millions) 2014 2013 2012 Net income Unrealized gains (losses) on marketable securities, net of deferred taxes of $(19), $(110) and $(95) Deferred gains (losses) on cash flow hedges, net ... -

Page 92

...: Current and noncurrent receivables, net Film and television costs, net Accounts payable and accrued expenses related to trade creditors Other operating assets and liabilities Net cash provided by operating activities Investing Activities Capital expenditures Cash paid for intangible assets... -

Page 93

... 31, 2012 16,998 Stock compensation plans Repurchases and retirements of common stock Employee stock purchase plans Dividends declared Other comprehensive income (9) (loss) Purchase of NBCUniversal noncontrolling common equity interest (17,006) Redeemable subsidiary 725 preferred stock Contributions... -

Page 94

... property licenses and other services. Our other business interests consist primarily of Comcast-Spectacor, which owns the Philadelphia Flyers and the Wells Fargo Center arena in Philadelphia, Pennsylvania and operates arena management-related businesses. 89 Comcast 2014 Annual Report on Form 10-K -

Page 95

... billed in advance on a monthly basis based on the services and features they receive and the type of equipment they use. We manage credit risk by screening applicants through the use of internal customer information, identification verification tools and credit bureau data. If a customer's account... -

Page 96

... sale of advertising on our broadcast networks, owned local broadcast television stations and related digital media properties, from the licensing of our owned programming through various distribution platforms, including to cable and broadcast networks and to subscription video on demand services... -

Page 97

...basis over the annual period following the initial activation date. Cable Communications Programming Expenses Cable Communications programming expenses are the fees we pay to license the programming we distribute to our video customers. Programming is acquired for distribution to our video customers... -

Page 98

... common shares related to our stock options in periods in which the combination of the option exercise price and the associated unrecognized compensation expense is greater than the average market price of our Class A common stock or our Class A Special common stock, as applicable. 93 Comcast 2014... -

Page 99

... Class A common stock will continue to fluctuate, the number of shares of Class A common stock to be issued and the total value of the consideration exchanged will not be determinable until the closing date. The Time Warner Cable merger was approved by both Comcast shareholders and Time Warner Cable... -

Page 100

... the related tax impacts, were recorded to additional paid-in capital. The NBCUniversal Enterprise preferred stock pays dividends at a fixed rate of 5.25% per annum. The holders have the right to cause NBCUniversal Enterprise to redeem their shares at a price equal to the liquidation preference plus... -

Page 101

...Contents Comcast Corporation Note 6: Film and Television Costs December 31 (in millions) 2014 2013 Film Costs: Released, less amortization Completed, not released In production and in development Television Costs: Released, less amortization In production and in development Programming rights, less... -

Page 102

... is no plan to broadcast certain programming, we recognize an impairment charge to programming and production expense. Note 7: Investments December 31 (in millions) 2014 2013 Fair Value Method Equity Method: The Weather Channel Hulu Other Cost Method: AirTouch Other Total investments Less: Current... -

Page 103

... investments were equity securities that we account for as trading securities and were held as collateral related to our obligations under prepaid forward sale agreements. Prepaid Forward Sale Agreements December 31 (in millions) 2014 2013 Assets: Fair value equity securities held as collateral... -

Page 104

... recognize our proportionate share of Hulu's accumulated losses from the date of the NBCUniversal transaction through July 2013. Cost Method We use the cost method to account for investments not accounted for under the fair value method or the equity method. 99 Comcast 2014 Annual Report on Form 10... -

Page 105

...the AirTouch preferred stock and redeemable subsidiary preferred shares are based on Level 2 inputs that use pricing models whose inputs are derived primarily from or corroborated by observable market data through correlation or other means for substantially the full term of the financial instrument... -

Page 106

...deploying new customer premise equipment, and costs associated with installation of our services in accordance with accounting guidance related to cable television companies. Costs capitalized include all direct labor and materials, as well as various indirect costs. All costs incurred in connection... -

Page 107

... Amount 2014 Accumulated Amortization 2013 Gross Accumulated Carrying Amount Amortization December 31 (in millions) Indefinite-Lived Intangible Assets: Franchise rights Trade names FCC licenses Finite-Lived Intangible Assets: Customer relationships Software Cable franchise renewal costs and... -

Page 108

... external direct costs of material and services and payroll costs for employees devoting time to these software projects. We also capitalize costs associated with the purchase of software licenses. We include these costs in other intangible assets and amortize them on a straight-line basis over... -

Page 109

Table of Contents Comcast Corporation Note 10: Long-Term Debt Long-Term Debt Outstanding December 31 (in millions) Weighted-Average Interest Rate as of December 31, 2014 2014 2013 Commercial paper Revolving bank credit facilities Senior notes with maturities of 5 years or less Senior notes with ... -

Page 110

...credit facility. Commercial Paper Programs Our commercial paper programs provide a lower-cost source of borrowing to fund our short-term working capital requirements. The Comcast commercial paper program is supported by the Comcast and Comcast Cable Communications, LLC $6.25 billion revolving credit... -

Page 111

... Comcast Corporation • Level 2: Consists of financial instruments that are valued using models or other valuation methodologies. These models use inputs that are observable either directly or indirectly. Level 2 inputs include (1) quoted prices for similar assets or liabilities in active markets... -

Page 112

... prices for identical financial instruments in an active market. (b) We did not recognize service costs related to our pension plans in 2014 and 2013 as the plans were frozen. The 2012 amount included service costs related to our pension benefits of $139 million. 107 Comcast 2014 Annual Report... -

Page 113

...certain members of management and nonemployee directors (each, a "participant"). The amount of compensation deferred by each participant is based on participant elections. Participant accounts, except for those in the NBCUniversal plan, are credited with income primarily based on a fixed annual rate... -

Page 114

... vested benefits, which is known as a withdrawal liability. In addition, actions taken by other participating employers may lead to adverse changes in the financial condition of one of these plans, which could result in an increase in our withdrawal liability. 109 Comcast 2014 Annual Report on... -

Page 115

... Class A Special common stock, subject to certain restrictions. Shares of Common Stock Outstanding (in millions) A A Special B Balance, December 31, 2011 Stock compensation plans Repurchases and retirements of common stock Employee stock purchase plans Balance, December 31, 2012 Stock compensation... -

Page 116

... and in the case of stock options, have a 10 year term. Additionally, through our employee stock purchase plans, employees are able to purchase shares of Comcast Class A common stock at a discount through payroll deductions. The cost associated with our share-based compensation is based on an award... -

Page 117

...RSUs and Class A common stock options awarded under our various plans and the related weighted-average valuation assumptions. Year ended December 31 2014 2013 2012 RSUs fair value Stock options fair value Stock Option Valuation Assumptions: Dividend yield Expected volatility Risk-free interest rate... -

Page 118

... to reverse. We record the change in our consolidated financial statements in the period of enactment. Income tax consequences that arise in connection with a business combination include identifying the tax basis of assets and liabilities acquired and any contingencies associated with uncertain tax... -

Page 119

... due to an increase in our financial reporting basis in the consolidated net assets of NBCUniversal Holdings in excess of the tax basis. Net deferred tax assets included in other current assets are primarily related to our current investments and current liabilities. As of December 31, 2014, we had... -

Page 120

... but unpaid • we recorded a liability of $572 million for a quarterly cash dividend of $0.225 per common share paid in January 2015 • we used $3.2 billion of equity securities to settle a portion of our obligations under prepaid forward sale agreements 115 Comcast 2014 Annual Report on Form 10-K -

Page 121

... 7 for additional information) During 2012: • we acquired $757 million of property and equipment and intangible assets that were accrued but unpaid • we recorded a liability of $430 million for a quarterly cash dividend of $0.1625 per common share paid in January 2013 • NBCUniversal entered... -

Page 122

... potential class in the Pennsylvania case is our customer base in the "Philadelphia and Chicago Clusters," as those terms are defined in the complaints. In each case, the plaintiffs allege that certain customer exchange transactions with other cable providers resulted in unlawful horizontal market... -

Page 123

...tie" the rental of set-top boxes to the provision of premium cable services in violation of Section 1 of the Sherman Antitrust Act, various state antitrust laws and unfair/deceptive trade practices acts in California, Illinois and Alabama. The plaintiffs also allege a claim for unjust enrichment and... -

Page 124

...Operating Income (Loss) Capital Expenditures Assets 2013 Cable Communications (a) NBCUniversal Cable Networks (b) Broadcast Television Filmed Entertainment (b) Theme Parks Headquarters and Other (d) Eliminations (e) NBCUniversal Corporate and Other Eliminations (e) Comcast Consolidated $ 41,836... -

Page 125

...: Video High-speed Internet Voice Business services Advertising Other Total 47.1% 25.6% 8.3% 9.0% 5.5% 4.5% 100% 2013 49.1% 24.7% 8.7% 7.7% 5.2% 4.6% 100% 2012 50.4% 24.1% 9.0% 6.5% 5.8% 4.2% 100% Subscription revenue received from customers who purchase bundled services at a discounted rate is... -

Page 126

...Quarterly Financial Information (Unaudited) First Quarter Second Quarter Third Quarter Fourth Quarter Total Year (in millions, except per share data) 2014 Revenue Operating income Net income attributable to Comcast Corporation (a) Basic earnings per common share attributable to Comcast Corporation... -

Page 127

... and the Comcast commercial paper program are also fully and unconditionally guaranteed by NBCUniversal. The Comcast commercial paper program is supported by the Comcast and Comcast Cable Communications, LLC revolving credit facility. Comcast MO Group, CCH and Comcast MO of Delaware are collectively... -

Page 128

... Elimination Nonand Media Guarantor Consolidation Parent Subsidiaries Adjustments Consolidated Comcast Corporation Assets Cash and cash equivalents $ - Investments - Receivables, net - Programming rights - Other current assets 267 Total current assets 267 Film and television costs - Investments 36... -

Page 129

... CCHMO Parents Media Parent NonGuarantor Subsidiaries Elimination and Consolidation Adjustments Consolidated Comcast Corporation Assets Cash and cash equivalents $ - Investments - Receivables, net - Programming rights - Other current assets 237 Total current assets 237 Film and television costs... -

Page 130

... Media Parent NonGuarantor Subsidiaries Elimination and Consolidation Adjustments Consolidated Comcast Corporation Revenue: Service revenue Management fee revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation... -

Page 131

... Media Parent NonGuarantor Subsidiaries Elimination and Consolidation Adjustments Consolidated Comcast Corporation Revenue: Service revenue Management fee revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation... -

Page 132

... Media Parent NonGuarantor Subsidiaries Elimination and Consolidation Adjustments Consolidated Comcast Corporation Revenue: Service revenue Management fee revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation... -

Page 133

... for redeemable subsidiary preferred stock - Other 238 Net cash provided by (used in) financing (4,402) activities Increase (decrease) in cash and cash - equivalents Cash and cash equivalents, beginning of year - Cash and cash equivalents, end of year $ - $ Comcast 2014 Annual Report on Form... -

Page 134

... Parents Media Parent NonGuarantor Subsidiaries Elimination and Consolidated Consolidation Comcast Adjustments Corporation Net cash provided by (used in) operating activities $ (600) $ Investing Activities: Net transactions with affiliates 66 Capital expenditures (7) Cash paid for intangible assets... -

Page 135

...dividends for redeemable subsidiary preferred stock - Other 99 Net cash provided by (used in) financing activities (3,467) Increase (decrease) in cash and cash - equivalents Cash and cash equivalents, beginning of year - Cash and cash equivalents, end of year $ - $ Comcast 2014 Annual Report on Form... -

Page 136

... in connection with the evaluation required by paragraph (d) of Exchange Act Rules 13a-15 or 15d-15 that occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect, Comcast's internal control over financial reporting. NBCUniversal Media, LLC... -

Page 137

... required by paragraph (d) of Exchange Act Rules 13a-15 or 15d-15 that occurred during our last fiscal quarter that have materially affected, or are reasonably likely to materially affect, NBCUniversal's internal control over financial reporting. Item 9B: Other Information None. Comcast 2014 Annual... -

Page 138

... J. Angelakis has served as the Chief Financial Officer of Comcast Corporation for more than five years. Mr. Angelakis currently serves on the board of directors of the Federal Reserve Bank of Philadelphia. Stephen B. Burke has served as an Executive Vice President for more than five years. On... -

Page 139

...Vice President For the year ended December 31, 2014, NBCUniversal reimbursed Comcast approximately $35 million for direct services provided by our executive officers. Item 11: Executive Compensation Comcast incorporates the information required by this item by reference to its 2015 Proxy Statement... -

Page 140

... its annual financial statements, reviews of its quarterly financial statements and audit services provided in connection with other statutory or regulatory filings. Audit-related fees in 2014 and 2013 consisted primarily of fees paid or accrued for audits associated with employee benefit plans and... -

Page 141

...the quarter ended June 30, 2009). Amended and Restated By-Laws of Comcast Corporation (incorporated by reference to Exhibit 3.1 to Comcast's Current Report on Form 8-K filed on November 23, 2011). Specimen Class A Common Stock Certificate (incorporated by reference to Exhibit 4.1 to Comcast's Annual... -

Page 142

... subsidiaries on a consolidated basis), are omitted pursuant to Item 601(b)(4)(iii)(A) of Regulation S-K. We agree to furnish copies of any such instruments to the SEC upon request. Credit Agreement dated as of June 6, 2012 among Comcast Corporation, Comcast Cable Communications, LLC, the Financial... -

Page 143

..., 2014. Comcast-NBCUniversal 2011 Employee Stock Purchase Plan, as amended and restated effective October 21, 2014. Comcast Corporation Supplemental Executive Retirement Plan, as amended and restated effective January 1, 2005 (incorporated by reference to Exhibit 10.15 to Comcast's Annual Report on... -

Page 144

...Exhibit 10.25 to Comcast's Annual Report on Form 10-K for the year ended December 31, 2010). Amendment No. 5 to Employment Agreement between Comcast Corporation and Brian L. Roberts, dated as of June 30, 2011 (incorporated by reference to Exhibit 99.1 to Comcast's Current Report on Form 8-K filed on... -

Page 145

... by reference to Exhibit 99.1 to Comcast's Current Report on Form 8-K filed on February 25, 2011). Employment Agreement between Comcast Corporation and Neil Smit, dated as of November 21, 2011 (incorporated by reference to Exhibit 10.37 to Comcast's Annual Report on Form 10-K for the year... -

Page 146

...reference to Exhibit 99.1 to Comcast's Current Report on Form 8-K filed on January 29, 2015). Statement of Earnings to Fixed Charges and Earnings to Combined Fixed Charges and Preferred Dividends. List of subsidiaries. Consent of Deloitte & Touche LLP. 141 Comcast 2014 Annual Report on Form 10-K 10... -

Page 147

... of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. The following financial statements from Comcast Corporation's Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission on... -

Page 148

... not applicable, or because the information required is included in the consolidated financial statements and notes thereto. (b) Exhibits required to be filed by Item 601 of Regulation S-K: 2.1 Transaction Agreement, dated February 12, 2013, by and among Comcast Corporation, General Electric Company... -

Page 149

...Report on Form 10-Q of Comcast Corporation for the quarter ended March 31, 2013). Credit Agreement, dated as of June 6, 2012, among Comcast Corporation, Comcast Cable Communications, LLC, the Financial Institutions party thereto and JP Morgan Chase Bank, N.A., as Administrative Agent and the Issuing... -

Page 150

.... The following financial statements from NBCUniversal Media, LLC's Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission on February 27, 2015, formatted in XBRL (eXtensible Business Reporting Language): (1) the Consolidated Balance Sheet... -

Page 151

... Rodin Comcast 2014 Annual Report on Form 10-K Chairman and CEO; Director (Principal Executive Officer) Founder; Chairman Emeritus of the Board Vice Chairman and CFO (Principal Financial Officer) Senior Vice President, Chief Accounting Officer and Controller (Principal Accounting Officer) Director... -

Page 152

... 27, 2015. NBCUNIVERSAL MEDIA, LLC By: NBCUNIVERSAL, LLC, its sole member By: / S / S TEPHEN B. B URKE Name: Stephen B. Burke Title: Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 153

... Registered Public Accounting Firm Consolidated Balance Sheet Consolidated Statement of Income Consolidated Statement of Comprehensive Income Consolidated Statement of Cash Flows Consolidated Statement of Changes in Equity Notes to Consolidated Financial Statements Comcast 2014 Annual Report on Form... -

Page 154

...Report of Independent Registered Public Accounting Firm To the Member of NBCUniversal Media, LLC New York, New York We have audited the accompanying consolidated balance sheets of NBCUniversal Media, LLC and subsidiaries (the "Company") as of December 31, 2014 and 2013, and the related consolidated... -

Page 155

... Media, LLC Consolidated Balance Sheet December 31 (in millions) 2014 2013 Assets Current Assets: Cash and cash equivalents Receivables, net Programming rights Other current assets Total current assets Film and television costs Investments Property and equipment, net Goodwill Intangible assets... -

Page 156

...Media, LLC Consolidated Statement of Income Year ended December 31 (in millions) 2014 2013 2012 Revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion...to consolidated financial statements....Comcast 2014 Annual Report on Form 10-K -

Page 157

Table of Contents NBCUniversal Media, LLC Consolidated Statement of Comprehensive Income Year ended December 31 (in millions) 2014 2013 2012 Net income Deferred gains (losses) on cash flow hedges, net Employee benefit obligations, net Currency translation adjustments, net Comprehensive income Net (... -

Page 158

...: Current and noncurrent receivables, net Film and television costs, net Accounts payable and accrued expenses related to trade creditors Other operating assets and liabilities Net cash provided by operating activities Investing Activities Capital expenditures Cash paid for intangible assets... -

Page 159

..., LLC Consolidated Statements of Changes in Equity Accumulated Other Comprehensive Member's Capital Income (Loss) Redeemable Noncontrolling (in millions) Interests Noncontrolling Interests Total Equity Balance, December 31, 2011 Compensation plans Dividends declared Purchase of subsidiary shares... -

Page 160

... media and entertainment companies that develops, produces and distributes entertainment, news and information, sports, and other content for global audiences. In 2013, Comcast acquired General Electric Company's ("GE") 49% common equity interest in our parent, NBCUniversal, LLC ("NBCUniversal... -

Page 161

... sale of advertising on our broadcast networks, owned local broadcast television stations and related digital media properties, from the licensing of our owned programming through various distribution platforms, including to cable and broadcast networks and to subscription video on demand services... -

Page 162

... discontinued operations. The updated accounting guidance also provides guidance on the financial statement presentations and disclosures of discontinued operations. The updated accounting guidance will be effective prospectively for us on January 1, 2015. 157 Comcast 2014 Annual Report on Form 10-K -

Page 163

... Media, LLC Revenue Recognition In May 2014, the FASB and the International Accounting Standards Board updated the accounting guidance related to revenue recognition. The updated accounting guidance provides a single, contract-based revenue recognition model to help improve financial reporting... -

Page 164

... in our consolidated financial statements. Consolidated Balance Sheet December 31 (in millions) 2014 2013 Transactions with Comcast and Consolidated Subsidiaries Receivables, net Accounts payable and accrued expenses related to trade creditors Accrued expenses and other current liabilities Note... -

Page 165

...) 2014 2013 Film Costs: Released, less amortization Completed, not released In production and in development Television Costs: Released, less amortization In production and in development Programming rights, less amortization Less: Current portion of programming rights Film and television costs... -

Page 166

... programming rights using the ratio of the current period revenue to the estimated total remaining revenue or under the terms of the contract. Acquired programming costs are recorded at the lower of unamortized cost or net realizable value on a program by program, package, channel or daypart basis... -

Page 167

... fair value, as applicable, and establish a new cost basis for the investment. For our available-for-sale securities and cost method investments, we record the impairment to investment income (loss), net. For our equity method investments, we record the impairComcast 2014 Annual Report on Form 10... -

Page 168

... our Universal theme park in Hollywood, California. These purchases resulted in increases in 2013 of $1.7 billion in property and equipment, which are included, as applicable, within the captions "buildings and leasehold improvements" and "land" in the table above. 163 Comcast 2014 Annual Report on... -

Page 169

... NBCUniversal Media, LLC Note 9: Goodwill and Intangible Assets Goodwill (in millions) Cable Networks Broadcast Television Filmed Entertainment Theme Parks Total Balance, December 31, 2012 Acquisitions Adjustments Balance, December 31, 2013 Acquisitions Adjustments (a) Balance, December 31, 2014... -

Page 170

...of customer relationships acquired in business combinations, intellectual property rights and software. Our finite-lived intangible assets are amortized primarily on a straight-line basis over their estimated useful life or the term of the associated agreement. We capitalize direct development costs... -

Page 171

... Enterprise with respect to its $4 billion aggregate principal amount of senior notes, $1.35 billion revolving credit facility and associated commercial paper program, or $725 million liquidation preference of Series A cumulative preferred stock. Comcast 2014 Annual Report on Form 10-K 166 -

Page 172

...of a production is based on Level 3 inputs that primarily use an analysis of future expected cash flows. Adjustments to capitalized film and stage play production costs of $26 million, $167 million and $161 million were recorded in 2014, 2013 and 2012, respectively. 167 Comcast 2014 Annual Report on... -

Page 173

... market prices for identical financial instruments in an active market. (b) We did not recognize service costs related to our pension plans in 2014 and 2013 as the plans were frozen. The 2012 amount included service costs related to our pension benefits of $134 million. Postretirement Benefit Plans... -

Page 174

... participate in other multiemployer benefit plans that provide health and welfare and retirement savings benefits to active and retired participants. We make periodic contributions to these plans in accordance with the terms of applicable collective bargaining agreements and laws but do not sponsor... -

Page 175

... in any of these plans, applicable law would require us to fund our allocable share of the unfunded vested benefits, which is known as a withdrawal liability. In addition, actions taken by other participating employers may lead to adverse changes in the financial condition of one of these... -

Page 176

... on the date of grant of RSUs and Class A common stock options awarded under Comcast's various plans to employees of NBCUniversal and the related weighted-average valuation assumptions. Year ended December 31 2014 2013 2012 RSUs fair value Stock options fair value Stock Option Valuation Assumptions... -

Page 177

...unpaid During 2013: • we acquired $306 million of property and equipment and intangible assets that were accrued but unpaid During 2012: • we entered into a capital lease transaction that resulted in an increase in property and equipment and debt of $85 million Comcast 2014 Annual Report on Form... -

Page 178

...89 73 402 2014 2013 2012 Rent expense Note 17: Financial Data by Business Segment $ 222 $ 250 $ 317 We present our operations in four reportable business segments: Cable Networks, Broadcast Television, Filmed Entertainment and Theme Parks. Our financial data by reportable business segment is... -

Page 179

...our Cable Networks segment. (e) No single customer accounted for a significant amount of revenue in any period. (f) We use operating income (loss) before depreciation and amortization, excluding impairment charges related to fixed and intangible assets and gains or losses from the sale of assets, if... -

Page 180

... Report of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of Comcast Corporation Philadelphia, Pennsylvania We have audited the consolidated financial statements of Comcast Corporation and subsidiaries (the "Company") as of December 31, 2014 and 2013... -

Page 181

Table of Contents Report of Independent Registered Public Accounting Firm To the Member of NBCUniversal Media, LLC New York, New York We have audited the consolidated financial statements of NBCUniversal Media, LLC and subsidiaries (the "Company") as of December 31, 2014 and 2013, and for each of ... -

Page 182

...375 221 375 405 198 307 355 $ $ NBCUniversal Media, LLC Schedule II - Valuation and Qualifying Accounts Year ended December 31, 2014, 2013 and 2012 Additions Charged to Balance at Beginning Year Ended December 31 (in millions) of Year Costs and Expenses (a) Deductions from Reserves (a) Balance at... -

Page 183

... benefits and increased financial security available on a tax-favored basis to those individuals, the Board of Directors of Comcast Corporation, a Pennsylvania corporation (the "Board"), hereby amends and restates the Comcast Corporation 2005 Deferred Compensation Plan (the "Plan"). The Plan... -

Page 184

... the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise. 2.5. " Annual Rate of Pay " means, as of any date, an employee's annualized base pay rate. An employee's Annual Rate of Pay shall not include sales commissions... -

Page 185

... term "Applicable Interest Rate" for such Participant's Account to mean the lesser of (i) the rate in effect under Section 2.6(a) or (ii) the Prime Rate plus one percent. A Participant's re-employment by a Participating Company following an employment termination date shall not affect the Applicable... -

Page 186

... to amounts credited to the Company Stock Fund pursuant to deferral elections by Outside Directors or Directors Emeriti made pursuant to Section 3.1(a), Comcast Corporation Class A Common Stock, par value $0.01, including a fractional share, and such other securities issued by Comcast Corporation as... -

Page 187

... replacement benefits for a period of not less than three months under an accident or health plan covering employees of the individual's employer. 2.23. " Disabled Participant " means: (a) A Participant whose employment or, in the case of a Participant who is an Outside Director or Director Emeritus... -

Page 188

... has an Annual Rate of Pay of $200,000 or more as of both (iii) the date on which an Initial Election is filed with the Administrator for the 2013 Plan Year and (iv) January 1, 2013. (c) For Plan Years beginning on and after January 1, 2014, (i) each employee of a Participating Company other than... -

Page 189

...to be an Eligible Employee following the transfer of employment directly from the Company to NBCUniversal; (v) Has an Annual Rate of Pay of $200,000 or more as of both (iii) the date on which an Initial Election is filed with the Administrator for the 2013 Plan Year and (iv) January 1, 2013; and (vi... -

Page 190

... last reported sale price of a share on the principal exchange on which shares are listed on the date of determination, or if such date is not a trading day, the next trading date. (b) If shares of Company Stock are not so listed, but trades of shares are reported on the Nasdaq National Market, Fair... -

Page 191

... who was an employee of an entity that was a Participating Company in the Prior Plan as of June 30, 2002 and who had an Annual Rate of Pay of $125,000 as of each of (i) June 30, 2002; (ii) the date on which an Initial Election was filed with the Administrator and (iii) the first day of each... -

Page 192

...the Prior Plan; plus (iii) Such Eligible Comcast Employee's Account in the Restricted Stock Plan to the extent such Account is credited to the "Income Fund." (b) With respect to amounts credited pursuant to an Eligible Comcast Employee's Initial Elections on account of Compensation earned after 2014... -

Page 193

... which the Initial Election relates. (c) 2013 Plan Year For Eligible NBCU Employees, and Plan Years Beginning After December 31, 2013 . With respect to: (w) Eligible NBCU employees for Compensation earned after December 31, 2012; (x) Eligible Comcast Employees for Compensation earned after December... -

Page 194

...2.37(e), each employee of a Participating Company other than NBCUniversal and Comcast Spectacor: (i) who becomes an employee of a Participating Company and has an Annual Rate of Pay of $200,000 or more as of his employment commencement date, or (ii) who has an Annual Rate of Pay that is increased to... -

Page 195

... amount credited to an Account under the Plan, including an Active Participant, a Deceased Participant and an Inactive Participant. 2.41. " Participating Company " means the Company, Comcast Spectacor and each other Affiliate of the Company in which the Company owns, directly or indirectly... -

Page 196

... " means the Comcast Corporation 2005 Deferred Compensation Plan, as set forth herein, and as amended from time to time. 2.46. " Plan Year " means the calendar year. 2.47. " Prime Rate " means, for any calendar year, the interest rate that, when compounded daily pursuant to rules established by the... -

Page 197

... Person, together with such Person's Affiliates, provided that the term "Third Party" shall not include the Company or an Affiliate of the Company. 2.57. " Total Compensation " means: (a) For Plan Years beginning before 2015, the sum of an Eligible Employee's Annual Rate of Pay, plus Company Credits... -

Page 198

... For Plan Years beginning after 2014, the sum of an Eligible Employee's Annual Rate of Pay, plus Company Credits described in Section 3.8, plus any target bonus amount under a cash bonus award that is includible as "Compensation" under Section 2.16, plus the grant date value of any annual long-term... -

Page 199

... an Eligible Employee other than a New Key Employee unless (i) such Signing Bonus is forfeitable if the Participant fails to continue in service to a specified date (other than as the result of the Participant's termination of employment because of death, Disability or Company-initiated termination... -

Page 200

...applicable Performance Period. (b) Initial Election of Distribution Date . Each Outside Director, Director Emeritus or Eligible Employee shall, contemporaneously with an Initial Election, also elect the time of payment of the amount of the deferred Compensation to which such Initial Election relates... -

Page 201

... in connection with a Change of Control, and for the 12-month period following a Change of Control, the Committee may exercise its discretion to terminate the Plan and, notwithstanding any other provision of the Plan or the terms of any Initial Election or Subsequent Election, distribute the Account... -

Page 202

...of this Plan to the contrary, including but not limited to ...terms of Section 3.7(b) to the Decedent's Account unless the Decedent affirmatively has elected, in writing, filed with the Administrator, to waive the application...may pay such amounts directly to any taxing authority as payment on account of... -

Page 203

... with respect to such Company Credits (and income, gains and losses credited with respect to Company Credits) on the same basis as all other amounts credited to such Participant's Account. 3.9. Separation from Service . (a) Required Suspension of Payment of Benefits . To the extent compliance... -

Page 204

... under the Company Stock Fund and Income Fund, as applicable, through the date immediately preceding the date on which the distribution request is transmitted to the recordkeeper. 4.3. Plan-to-Plan Transfers; Change in Time and Form of Election Pursuant to Special Section 409A Transition Rules . The... -

Page 205

... amounts credited to the Company Stock Fund with respect to Outside Directors' Accounts shall be distributable in the form of Company Stock, rounded to the nearest whole share. (d) Timing of Credits . Compensation deferred pursuant to the Plan shall be deemed invested in the Income Fund on the date... -

Page 206

... Stock Fund shall be based on hypothetical purchases and sales of Company Stock at Fair Market Value as of the effective date of an investment election. 5.3. Status of Deferred Amounts . Regardless of whether or not the Company is a Participant's employer, all Compensation deferred under this Plan... -

Page 207

... section 1.409A-3(j)(4)(iii) (or any successor provision of law). (c) To pay employment taxes to the extent permitted by Treasury Regulation section 1.409A-3(j)(4)(vi) (or any successor provision of law). (d) In connection with the recognition of income as the result of a failure to comply with... -

Page 208

...be taken in order to submit a claim for review. Written notice of a denial of a claim shall be provided within 90 days of the receipt of the claim, provided that if special circumstances require an extension of time for processing the claim, the Administrator may notify the Applicant in writing that... -

Page 209

... with the claims procedure regulations of the Department of Labor set forth in 29 CFR § 2560.503-1. Claims for benefits under the Plan must be filed with the Administrator at the following address: Comcast Corporation One Comcast Center 1701 John F. Kennedy Boulevard Philadelphia, PA 19103... -

Page 210

... , as the context may require. 12.4. Law Governing Construction . The construction and administration of the Plan and all questions pertaining thereto, shall be governed by the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), and other applicable federal law and, to the extent... -

Page 211

IN WITNESS WHEREOF, COMCAST CORPORATION has caused this Plan to be executed by its officers thereunto duly authorized, and its corporate seal to be affixed hereto, on the 21st day of October, 2014. COMCAST CORPORATION BY: /s/ David L. Cohen ATTEST: /s/ Arthur R. Block -29- -

Page 212

... Corporation 2002 Restricted Stock Plan (the "Plan"). The purpose of the Plan is to promote the ability of Comcast Corporation to recruit and retain employees and enhance the growth and profitability of Comcast Corporation by providing the incentive of long-term awards for continued employment... -

Page 213

... the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise. (e) " Annual Rate of Pay " means, as of any date, an employee's annualized base pay rate. An employee's Annual Rate of Pay shall not include sales commissions... -

Page 214

... Elections and Special Diversification Elections made on or after January 1, 2014, the "Applicable Interest Rate" shall be the Applicable Interest Rate that applies to "Protected Benefits" under the Comcast Corporation 2005 Deferred Compensation Plan (the "2005 Deferred Compensation Plan") if, as... -

Page 215

... stock option or other compensation plan, program or arrangement established or maintained by the Company or an Affiliate, including but not limited to this Plan, the Comcast Corporation 2003 Stock Option Plan, the Comcast Corporation 2002 Stock Option Plan, the Comcast Corporation 1996 Stock Option... -

Page 216

... Units, as applicable. The portion of a Grantee's Account deemed invested in the Company Stock Fund shall be treated as if such portion of the Account were invested in hypothetical shares of Common Stock or Special Common Stock otherwise deliverable as Shares upon the Vesting Date associated with... -

Page 217

..., LLC, a Delaware limited liability company, and its subsidiaries (collectively, "NBCUniversal") shall be a Deferral Eligible Employee with respect to any Award granted to such Grantee on or after January 29, 2011. (t) " Deferred Stock Units " means the number of hypothetical Shares subject... -

Page 218

...If Shares are listed on a stock exchange, Fair Market Value shall be determined based on the last reported sale price of a Share on the principal exchange on which Shares are listed on the date of determination, or if such date is not a trading day, the next trading date. If Shares are not so listed... -

Page 219

... and (C) as of the last day of any calendar quarter beginning after December 31, 2008 and before January 1, 2014, and (y) equals the sum of: (A) The amount credited to a Grantee's Account under Section 3.8 of the 2005 Deferred Compensation Plan after December 31, 2013 and on or before September 30... -

Page 220

... purposes of determining the time and form of payment of amounts credited to the Income Fund, the rules of the 2005 Deferred Compensation Plan shall apply on the same basis as if such amounts were credited to a participant's account under such 2005 Deferred Compensation Plan. (gg) " Initial Election... -

Page 221

...the exercise price for an option to purchase any securities of the Company or an Affiliate of the Company, under any Comcast Plan, but only to the extent of the number of Shares surrendered or attested to; plus (4) The number of such Shares owned by such Grantee or such Grantee's Family Member as to... -

Page 222

...Based Compensation. (oo) " Person " means an individual, a corporation, a partnership, an association, a trust or any other entity or organization. (pp) " Plan " means the Comcast Corporation 2002 Restricted Stock Plan, as set forth herein, and as amended from time to time. (qq) " Prime Rate " means... -

Page 223

... which a Vesting Date has not occurred, and for purposes of Paragraphs 2(kk) and 9(c), the term "Share" or "Shares" also means a share or shares of Special Common Stock. (xx) " Special Common Stock " means Class A Special Common Stock, par value $0.01, of the Company. (yy) " Special Diversification... -

Page 224

...be treated as references to either the Board or the Committee acting alone. (b) Grants . Subject to the express terms and conditions set forth in the Plan, the Committee shall have the power, from time to time, to: (i) select those Employees and Non-Employee Directors to whom Awards shall be granted... -

Page 225

... of the Plan, to determine the terms and conditions of each Award, including the restrictions applicable to such Shares and the conditions upon which a Vesting Date shall occur; and (ii) interpret the Plan's provisions, prescribe, amend and rescind rules and regulations for the Plan, and make... -

Page 226

... Non-Employee Directors, the rules of this Paragraph 7 shall apply so that either the Board or the Committee acting alone shall have all of the authority otherwise reserved in this Paragraph 7 to the Committee. The terms and conditions of Awards shall be set forth in writing as determined from time... -

Page 227

... the rules for performance-based compensation under section 162(m) of the Code. All references to Shares in Awards granted before the consummation of the AT&T Broadband Transaction as to which a Vesting Date has not occurred shall be deemed to be references to Special Common Stock. (f) Rights of... -

Page 228

...Committee on or before the 30 th day following the Date of Grant and 12 or more months in advance of the applicable Vesting Date. No Initial Election to defer the receipt of Shares issuable with respect to Restricted Stock Units that are Performance-Based Compensation shall be effective unless it is... -

Page 229

...before the close of business at least one year before the date on which the distribution would otherwise be made. Notwithstanding the foregoing, except as otherwise provided by the Committee, an Active Grantee who is re-employed by a Participating Company following an employment termination date may... -

Page 230

... a hypothetical share of Special Common Stock credited to the Account in lieu of delivery of the Shares to which the Election applies. To the extent an Account is deemed invested in the Income Fund, the Committee shall credit earnings with respect to such Account at the Applicable Interest Rate, as... -

Page 231

... another employer's obligation to pay benefits with respect to such Grantee which have not become payable under the deferred compensation plan, program or arrangement under which such future right to payment arose, to the Plan, or to assume a future payment obligation of the Company or an Affiliate... -

Page 232

... of amounts deemed invested in the Income Fund immediately following the effective date of a Diversification Election shall be based on hypothetical sales of Common Stock or Special Common Stock, as applicable, underlying the liquidated Deferred Stock Units at Fair Market Value as of the effective... -

Page 233

...the then-existing requirements of the 1933 Act and the 1934 Act, including Rule 16b-3. Such conditions may include the delivery by the Grantee of an investment representation to the Company in connection with a Vesting Date occurring with respect to Shares subject to an Award, or the execution of an... -

Page 234

... Date under any Award under the Plan that is not subject to an Initial Election, or the distribution of the portion of a Grantee's Account that is credited to the Company Stock Fund, shall be satisfied by the Company's withholding a portion of the Shares subject to such Award having a Fair Market... -

Page 235

minimum amount; and (B) to pay to the Company in cash all or a portion of the taxes to be withheld in connection with such grant, Vesting Date or Account distribution. In all cases, the Shares so withheld by the Company shall have a Fair Market Value that does not exceed the amount of taxes to be ... -

Page 236

... of a stock dividend, stock split, recapitalization or other change in the number or class of issued and outstanding equity securities of the Company resulting from a subdivision or consolidation of the Shares and/or other outstanding equity security or a recapitalization or other capital adjustment... -

Page 237

... with the claims procedure regulations of the Department of Labor set forth in 29 CFR § 2560.503-1. Claims for benefits under the Plan must be filed with the Committee at the following address: Comcast Corporation One Comcast Center, 52 nd Floor 1701 John F. Kennedy Boulevard Philadelphia, PA 19103... -

Page 238

...sooner terminated by the Board. 16. GOVERNING LAW The Plan and all determinations made and actions taken pursuant to the Plan shall be governed in accordance with Pennsylvania law. Executed on the 21 st day of October, 2014. COMCAST CORPORATION BY: /s/ David L. Cohen ATTEST: /s/ Arthur R. Block -27- -

Page 239

Exhibit 10.13 THE COMCAST CORPORATION RETIREMENT-INVESTMENT PLAN (Amended and Restated Effective October 21, 2014) -

Page 240

... After-Tax Contributions Change of Percentage Rate Discontinuance of Pre-Tax Contributions, Roth Contributions and After-Tax Contributions Matching Contributions Comcast Retirement Contributions Timing and Deductibility of Contributions Fund Limitation on Pre-Tax Contributions and Matching... -

Page 241

... Disability Benefits . Rules for Election of Optional Mode of Retirement or Disability Benefit Death Benefits Explanations to Participants Beneficiary Designation Recalculation of Life Expectancy Transfer of Account to Other Plan Section 401(a)(9) Nonforfeitable Amounts Vesting of Comcast Retirement... -

Page 242

... for Non-Key Employees Social Security No Employment Rights Governing Law Severability of Provisions No Interest in Fund Spendthrift Clause Incapacity Withholding Missing Persons/Uncashed Checks Notice Additional Service Credit Listed Employer Applicability Limitation General Eligibility and... -

Page 243

Page Section 16.3. Section 16.4. Eligibility to Participate Separate Testing 71 71 73 77 78 80 83 -iv- SCHEDULE A MINIMUM DISTRIBUTION REQUIREMENTS APPENDIX A APPENDIX B EXHIBIT A PARTICIPATING COMPANIES/LISTED EMPLOYERS EXHIBIT B NBCUNIVERSAL, LLC -

Page 244