Comcast 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast 2006 Annual Report 76

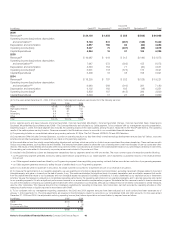

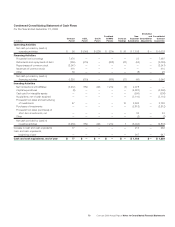

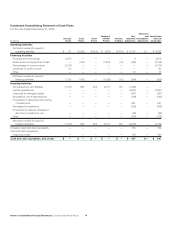

Reconciliation of 2006 Operating Income to

Operating Cash Flow

(in millions)

Operating Income $ 4,619

Depreciation and Amortization 4,823

Operating Cash Flow(a) $ 9,442

(a) Operating Cash Flow (as presented above) is defined as operating income before

depreciation and amortization, excluding impairment charges related to fixed and

intangible assets and gains or losses on sale of assets, if any.

Calculation of 2006 Free Cash Flow

(in millions)

Net Cash Provided by Operating Activities $ 6,618

Capital Expenditures (4,395)

Cash Paid For Intangible Assets (306)

Nonoperating Items, Net of Tax 706

Free Cash Flow(a) $ 2,623

(a) Free Cash Flow (as presented above) is defined as “Net Cash Provided by Operating

Activities” (as stated in our Consolidated Statement of Cash Flows) reduced by capital

expenditures and cash paid for intangible assets; and increased by any payments

related to certain nonoperating items, net of estimated tax benefits (such as income

taxes on investment sales, and nonrecurring payments related to income tax and

litigation contingencies of acquired companies).

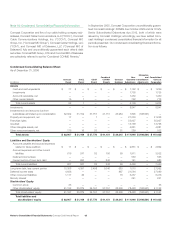

Reconciliation of Non-GAAP Measures

Reconciliation of Cable Segment Pro Forma, “As Adjusted” Financial Data

Pro Forma Cable Pro Forma

(in millions) Cable Adjustments(a) Pro Forma % Growth % Growth

2006

Revenue $ 24,100 $ 2,239 $ 26,339 12% 21%

Operating Expenses (excluding depreciation

and amortization) 14,396 1,432 15,828

Operating Cash Flow $ 9,704 $ 807 $ 10,511 15% 22%

Depreciation and Amortization 4,657 608 5,265

Operating Income $ 5,047 $ 199 $ 5,246

2005

Revenue $ 19,987 $ 3,569 $ 23,556

Operating Expenses (excluding depreciation

and amortization) 11,924 2,384 14,308

Stock option adjustment(b) 116 — 116

Operating Cash Flow $ 7,947 $ 1,185 $ 9,132

Depreciation and Amortization 4,346 1,134 5,480

Operating Income $ 3,601 $ 51 $ 3,652

(a) Pro forma results adjust only for certain acquisitions and dispositions, including Susquehanna Communications (April 2006), the Adelphia and Time Warner transactions

(July 2006) and the dissolution of the Texas and Kansas City cable partnership (effective January 1, 2007). Cable segment results are presented as if the transactions noted above

were effective on January 1, 2005.

(b) To be consistent with our management reporting, the 2005 Cable segment amounts have been adjusted as if stock options had been expensed as of January 1, 2005.