Comcast 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements Comcast 2006 Annual Report 46

Cable Programming Expenses

Cable programming expenses are the fees we pay to program-

ming networks to license the programming we package, offer and

distribute to our cable subscribers. Programming is acquired for

distribution to our cable subscribers, generally pursuant to multiyear

distribution agreements, with rates typically based on the number

of subscribers that receive the programming. From time to time

these contracts expire and programming continues to be provided

based on interim arrangements while the parties negotiate new

contractual terms, sometimes with effective dates that affect prior

periods. While payments are typically made under the prior con-

tract terms, the amount of our programming expenses recorded

during these interim arrangements is based on our estimates of the

ultimate contractual terms expected to be negotiated.

Our cable subsidiaries have received or may receive incentives from

programming networks for the licensing of their programming. We

classify the deferred portion of these fees within noncurrent liabilities

and recognize the fees as a reduction of programming expenses

(included in operating expenses) over the term of the contract.

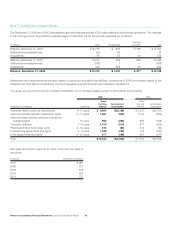

Share-Based Compensation

Prior to January 1, 2006, we accounted for our share-based com-

pensation plans in accordance with the provisions of Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for Stock

Issued to Employees” (“APB No. 25”), as permitted by SFAS

No. 123, “Accounting for Stock-Based Compensation” (“SFAS No.

123”), and accordingly did not recognize compensation expense

for stock options with an exercise price equal to or greater than the

market price of the underlying stock at the date of grant.

Effective January 1, 2006, we adopted SFAS No. 123R, “Share-

Based Payment” (“SFAS No. 123R”), using the Modified Prospective

Approach. Under the Modified Prospective Approach, the amount

of compensation cost recognized includes: (i) compensation cost

for all share-based payments granted prior to but not yet vested as

of January 1, 2006, based on the grant date fair value estimated

in accordance with the provisions of SFAS No. 123 and (ii) com-

pensation cost for all share-based payments granted or modified

subsequent to January 1, 2006, based on the estimated fair value

at the date of grant or subsequent modification date in accordance

with the provisions of SFAS No. 123R.

SFAS No. 123R also required us to change the classification, in

our consolidated statement of cash flows, of any income tax ben-

efits realized upon the exercise of stock options or issuance of

restricted share unit awards in excess of that which is associated

with the expense recognized for financial reporting purposes. These

amounts are presented as a financing cash inflow rather than as

a reduction of income taxes paid in our consolidated statement of

cash flows. See Note 10 for further details regarding the adoption

of SFAS No. 123R.

Postretirement and Postemployment Benefits

We charge to operations the estimated costs of retiree benefits and

benefits for former or inactive employees, after employment but

before retirement, during the years the employees provide services

(see Note 9).

Income Taxes

We recognize deferred tax assets and liabilities for temporary dif-

ferences between the financial reporting basis and the tax basis

of our assets and liabilities and the expected benefits of utilizing

net operating loss carryforwards. The impact on deferred taxes of

changes in tax rates and laws, if any, applied to the years during

which temporary differences are expected to be settled, is reflected

in the consolidated financial statements in the period of enactment

(see Note 11).

We account for income tax uncertainties that arise in connection

with business combinations and those that are associated with enti-

ties acquired in business combinations in accordance with Emerging

Issues Task Force (“EITF”) Issue No. 93-7, “Uncertainties Related to

Income Taxes in a Purchase Business Combination.” Deferred tax

assets and liabilities are recorded as of the date of a business com-

bination and are based on our estimate of the ultimate tax basis

that will be accepted by the various taxing authorities. Liabilities for

contingencies associated with prior tax returns filed by the acquired

entity are recorded based on our estimate of the ultimate settlement

that will be accepted by the various taxing authorities. Estimated

interest expense on these liabilities subsequent to the acquisition is

reflected in our consolidated income tax provision. We adjust these

deferred tax accounts and liabilities periodically to reflect revised

estimated tax bases and any estimated settlements with the vari-

ous taxing authorities. The effect of these adjustments is generally

applied to goodwill except for post-acquisition interest expense,

which is recognized as an adjustment of income tax expense.

Derivative Financial Instruments

We use derivative financial instruments for a number of purposes.

We manage our exposure to fluctuations in interest rates by enter-

ing into instruments, which may include interest rate exchange

agreements (“swaps”), interest rate lock agreements (“rate locks”),

interest rate cap agreements (“caps”) and interest rate collar agree-

ments (“collars”). We manage our exposure to fluctuations in the

value of some of our investments by entering into equity collar

agreements (“equity collars”) and equity put option agreements

(“equity put options”). We are also a party to equity warrant agree-

ments (“equity warrants”). We have issued indexed debt instruments

(“Exchangeable Notes” and “ZONES”) and have entered into pre-

paid forward sale agreements (“prepaid forward sales”) whose

value, in part, is derived from the market value of certain publicly

traded common stock. We have also sold call options on some of

our investments in equity securities. We use equity hedges to man-

age exposure to changes in equity prices associated with stock

appreciation rights of acquired companies. These equity hedges

are recorded at fair value based on market quotes.