Comcast 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

43 Comcast 2006 Annual Report

Note 1: Organization and Business

We are a Pennsylvania corporation and were incorporated in

December 2001. Through our predecessors, we have developed,

managed and operated cable systems since 1963. We classify our

operations in two reportable segments: Cable and Programming.

Our Cable segment is principally involved in the management and

operation of cable systems in the United States. As of December 31,

2006, we served approximately 23.4 million video subscribers,

11 million high-speed Internet subscribers and 2.4 million phone

subscribers. Our regional sports and news networks are included

in our Cable segment because they derive a substantial portion of

their revenues from our cable operations.

Our Programming segment operates our consolidated national

programming networks: E!, Style, The Golf Channel, VERSUS (for-

merly known as OLN), G4 and AZN Television.

Our other businesses consist principally of Comcast Spectacor,

which owns the Philadelphia Flyers, the Philadelphia 76ers and

two large multipurpose arenas in Philadelphia, and manages other

facilities for sporting events, concerts and other special events, and

our corporate activities. We also own equity method investments in

other programming networks.

Stock Split

On January 31, 2007, our Board of Directors approved a three-

for-two stock split in the form of a 50% stock dividend (the “Stock

Split”) payable on February 21, 2007, to shareholders of record on

February 14, 2007. The stock dividend was in the form of an addi-

tional 0.5 share for every share held and was payable in shares of

Class A common stock on the existing Class A common stock and

payable in shares of Class A Special common stock on the exist-

ing Class A Special common stock and Class B common stock

with cash being paid in lieu of fractional shares. Our stock began

trading ex-dividend on February 22, 2007. The number of shares

outstanding and related prices, per share amounts, share con-

versions and share-based data have been adjusted to reflect the

Stock Split for all periods presented.

Note 2: Summary of Significant Accounting Policies

Basis of Consolidation

The accompanying consolidated financial statements include (i) all

of our accounts, (ii) all entities in which we have a controlling vot-

ing interest (“subsidiaries”) and (iii) variable interest entities (“VIEs”)

required to be consolidated in accordance with generally accepted

accounting principles in the United States (“GAAP”). We have

eliminated all significant intercompany accounts and transactions

among consolidated entities.

Our Use of Estimates

We prepare our consolidated financial statements in conformity with

GAAP, which requires us to make estimates and assumptions that

affect the reported amounts and disclosures. Actual results could

differ from those estimates. Estimates are used when account-

ing for various items, such as allowances for doubtful accounts,

investments, derivative financial instruments, asset impairment,

nonmonetary transactions, certain acquisition-related liabilities,

programming-related liabilities, pensions and other postretire-

ment benefits, revenue recognition, depreciation and amortization,

income taxes and legal contingencies.

Fair Values

We have determined the estimated fair value amounts presented

in these consolidated financial statements using available market

information and appropriate methodologies. However, considerable

judgment is required in interpreting market data to develop the esti-

mates of fair value. The estimates presented in these consolidated

financial statements are not necessarily indicative of the amounts

that we could realize in a current market exchange. The use of dif-

ferent market assumptions and/or estimation methodologies may

have a material effect on the estimated fair value amounts. We

based these fair value estimates on pertinent information available

to us as of December 31, 2006 and 2005.

Cash Equivalents

The carrying amounts of our cash equivalents approximate their fair

value. Our cash equivalents principally consist of commercial paper,

money market funds, U.S. government obligations and certificates of

deposit with maturities of less than three months when purchased.

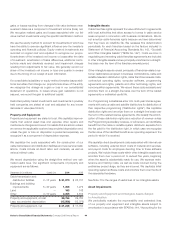

Investments

We review our investment portfolio each reporting period to deter-

mine whether a decline in the market value is considered to be

other than temporary. If an investment is deemed to have expe-

rienced an other than temporary decline below its cost basis, we

reduce the carrying amount of the investment to its fair market

value. We charge the impairment to earnings and establish a new

cost basis for the investment.

Purchases of or proceeds from the sale of trading securities are

classified as cash flows from operating activities, while cash flows

from all other investment securities are classified as cash flows

from investing activities.

We classify unrestricted publicly traded investments as available-

for-sale (“AFS”) or trading securities and record them at fair value.

For AFS securities, we record unrealized gains or losses resulting

from changes in fair value between measurement dates as a com-

ponent of other comprehensive income (loss), except when we

consider declines in value to be other than temporary. These other

than temporary declines are recognized as a component of invest-

ment income (loss), net. For trading securities, we record unrealized