Comcast 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

25 Comcast 2006 Annual Report

Introduction and Overview

We are the largest cable operator in the United States and offer a

variety of consumer entertainment and communication products and

services. As of December 31, 2006, our cable systems served approx-

imately 23.4 million video subscribers, 11 million high-speed Internet

subscribers and 2.4 million phone subscribers and passed approxi-

mately 45.7 million homes in 39 states and the District of Columbia.

We classify our operations in two reportable segments: Cable and

Programming. Our Cable segment, which generates approximately

95% of our consolidated revenues, manages and operates our

cable systems. Our Programming segment consists of our six

national programming networks. During 2006, our operations gen-

erated consolidated revenues of approximately $25 billion.

Our Cable segment earns revenues primarily through subscrip-

tions to our video, high-speed Internet and phone services (“cable

services”). Our video revenues continue to increase as a result of

digital subscriber growth and demand for our other digital cable

services, including video on demand, which we refer to as ON

DEMAND, Digital Video Recorder (“DVR”) and High Definition Tele-

vision (“HDTV”), as well as higher pricing on our basic video service.

As of December 31, 2006, approximately 51% of the homes in the

areas we serve subscribed to our video service and approximately

52% of those video subscribers subscribed to at least one of our

digital cable services. Our high-speed Internet service with Internet

access at downstream speeds from 6Mbps to 16Mbps, depending

on the level of service selected, has been one of our fastest

growing services over the past several years. As of December 31,

2006, approximately 25% of the homes in the areas we serve sub-

scribed to our high-speed Internet service. Comcast Digital Voice,

our phone service that provides unlimited local and domestic

long-distance calling and other features, is our most recent cable

service offering. As of December 31, 2006, approximately 6% of

the homes in the areas we serve subscribed to Comcast Digital

Voice. In 2006, we began offering our video, high-speed Internet

and Comcast Digital Voice services in a package that we refer to

as the “triple play.” In addition to cable services, other Cable seg-

ment revenue sources include advertising and the operation of our

regional sports and news networks.

Our Programming segment consists of our consolidated national

programming networks: E!, Style, The Golf Channel, VERSUS (for-

merly known as OLN), G4 and AZN Television. Revenue from our

Programming segment is earned primarily from advertising rev-

enues and from monthly per subscriber license fees paid by cable

and satellite distributors.

Our other business interests include Comcast Spectacor, which owns

the Philadelphia Flyers, the Philadelphia 76ers and two large multipur-

pose arenas in Philadelphia, and manages other facilities for sporting

events, concerts and other events. Comcast Spectacor and all other

consolidated businesses not included in our Cable or Programming

segments are included in “Corporate and Other” activities.

On January 31, 2007, our Board of Directors approved a three-

for-two stock split in the form of a 50% stock dividend (the “Stock

Split”) payable on February 21, 2007, to shareholders of record on

February 14, 2007. The number of shares outstanding and related

amounts have been adjusted to reflect the Stock Split for all peri-

ods presented.

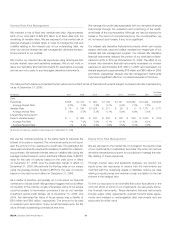

2006 Financial and Operational Highlights

• consolidated revenue growth of 18.5% and consolidated operat-

ing income growth of 31.2%, both driven by results in our Cable

segment

• Cable segment revenue growth of 20.6% and growth in oper-

ating income before depreciation and amortization of 22.1%,

both driven by revenue generating units (“RGUs”) growth and

the success of our triple play offering, as well as growth from

acquisitions

2006 Business Developments

• completed transactions with Adelphia and Time Warner that

resulted in a net increase of 1.7 million video subscribers, a net

cash payment by us of approximately $1.5 billion and the dis-

position of our ownership interest in Time Warner Cable Inc.

(“TWC”) and Time Warner Entertainment Company, L.P. (“TWE”),

the assets of two cable system partnerships and the transfer of

our previously owned cable systems in Los Angeles, Cleveland

and Dallas. We collectively refer to these transactions as the

“Adelphia and Time Warner transactions.”

• initiated the dissolution of the Texas and Kansas City Cable

Partnership (“TKCCP”) that resulted in our acquisition of cable

systems serving Houston, Texas (approximately 700,000 video

subscribers) in January 2007

• acquired the cable systems of Susquehanna Communications

serving approximately 200,000 video subscribers for approxi-

mately $775 million

• acquired the 39.5% interest in E! Entertainment Television (which

operates the E! and Style programming networks) that we did

not already own for approximately $1.2 billion

• participated in a consortium of investors (“SpectrumCo”) that

acquired wireless spectrum licenses covering approximately

91% of the population in the United States for approximately

$2.4 billion (our portion was $1.3 billion)

• repurchased approximately 113 million shares (adjusted to reflect

the Stock Split) of our Class A Special common stock pursuant

to our Board-authorized share repurchase program for approxi-

mately $2.3 billion

Refer to Note 5 to our consolidated financial statements for infor-

mation about acquisitions and other significant events.