Comcast 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 52

Fair Value Method

We hold unrestricted equity investments in publicly traded com-

panies that we account for as AFS or trading securities. The net

unrealized pretax gains on investments accounted for as AFS

securities as of December 31, 2006 and 2005, of $254 million and

$56 million, respectively, have been reported in our consolidated

balance sheet principally as a component of accumulated other

comprehensive income (loss), net of related deferred income taxes

of $89 million and $19 million, respectively.

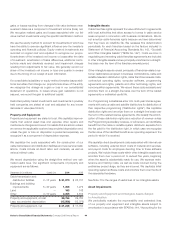

The cost, fair value and unrealized gains and losses related to our

AFS securities are as follows:

Year Ended December 31 (in millions) 2006 2005

Cost $ 936 $ 1,104

Unrealized gains 254 62

Unrealized losses — (6)

Fair value $ 1,190 $ 1,160

Proceeds from the sales of AFS securities for the years ended

December 31, 2006, 2005 and 2004 were $209 million, $490 mil-

lion and $67 million, respectively. Gross realized gains on these

sales for the years ended December 31, 2006, 2005 and 2004

were $59 million, $18 million and $10 million, respectively. Sales of

AFS securities for the years ended December 31, 2006 and 2005

consisted principally of sales of Time Warner common stock.

As of December 31, 2006 and 2005, approximately $1.879 billion

and $1.496 billion, respectively, of our fair value method securities

support our obligations under our exchangeable notes or prepaid

forward contracts.

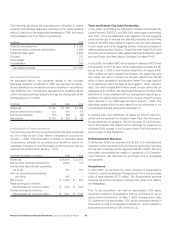

Cablevision Systems Corporation

In June 2005, we, through a majority-owned partnership, entered

into a prepaid forward sale that terminates in 2013 of approxi-

mately 5.1 million shares of Cablevision Systems Corporation

(“Cablevision”) Class A common stock for cash proceeds of $114

million. We have designated the derivative component of the pre-

paid forward as a fair value hedge of the related Cablevision shares.

Accordingly, the mark to market adjustment on 2.9 million of the

Cablevision shares held by us and classified as AFS securities will

be recorded to investment income (loss), net over the term of the

prepaid forward.

Discovery Holding Company

In July 2005, we received 10 million shares of Discovery Hold-

ing Company (“Discovery”) Series A common stock in connection

with the spin-off by Liberty Media of Discovery. All of these shares

collateralize a portion of our Liberty Media prepaid forward sales

obligation that terminates in 2014.

Embarq Corporation

In May 2006, we received approximately 1.3 million shares of

Embarq Corporation (“Embarq”) common stock in connection with

the spin-off by Sprint Nextel of Embarq, its local communications

business. In the spin-off, each share of Sprint Nextel Corporation

common stock received 0.05 shares of the new Embarq common

stock. Of these shares, 100,000 shares collateralize our Sprint

Nextel prepaid forward sales obligation that terminates in 2011.

Liberty Capital and Liberty Interactive

In May 2006, we received 25 million shares of Liberty Media Inter-

active (“Liberty Interactive”) Series A common stock and 5 million

shares of Liberty Media Capital (“Liberty Capital”) Series A com-

mon stock in connection with Liberty Media’s restructuring. In the

restructuring, each share of Liberty Media Series A common stock

received 0.25 shares of the new Liberty Interactive Series A com-

mon stock and 0.05 shares of Liberty Capital Series A common

stock in exchange for each share of Liberty Media Series A com-

mon stock. All of these shares collateralize a portion of our Liberty

Media prepaid forward sales obligation that terminates in 2014.

Liberty Global

In June 2004, we received approximately 11 million shares of Liberty

Global, Inc. (“Liberty Global”) Series A common stock in connec-

tion with its spin-off by Liberty Media. In the spin-off, each share

of Liberty Media Series A common stock received 0.05 shares of

the new Liberty Global Series A common stock. Approximately 5

million of these shares collateralize a portion of our Liberty Media

prepaid forward sales obligation that terminates in 2014.

In December 2004, we sold 3 million shares of Liberty Global Series

A common stock to Liberty Media in a private transaction for cash

proceeds of $128 million.

In February 2005, we entered into a prepaid forward sale that

terminates in 2015 of approximately 2.7 million shares of Liberty

Global Series A common stock for cash proceeds of $99 million.

In September 2005, we received approximately 7.7 million shares

of Liberty Global Series C common stock in connection with Liberty

Global’s special stock dividend. All of these shares collateralize a

portion of our Liberty Media prepaid forward sales obligation that

terminates in 2014 and a portion of our Liberty Global prepaid for-

ward sales obligation that terminates in 2015.

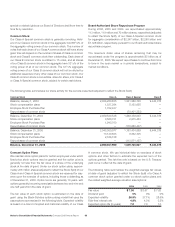

Sprint Nextel

In March 2006, we received cash proceeds of $62 million in con-

nection with Sprint Nextel’s redemption of all of its outstanding

Seventh Series B Convertible Preferred Stock (“Sprint Preferred

Stock”), including all 61,726 shares of Sprint Preferred Stock held

by us. In connection with the redemption transaction, we recog-

nized investment income of $8 million.