Comcast 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

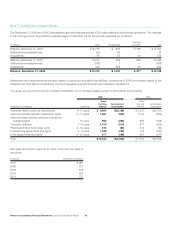

Prior to January 1, 2006, we accounted for our share-based com-

pensation plans in accordance with the provisions of APB No. 25,

as permitted by SFAS No. 123, and accordingly did not recog-

nize compensation expense for stock options with an exercise

price equal to or greater than the market price of the underlying

stock at the date of grant. Had the fair-value-based method as

prescribed by SFAS No. 123 been applied, additional pretax com-

pensation expense of $166 million and $283 million would have

been recognized for the years ended December 31, 2005 and

2004, respectively. The pretax compensation expense includes the

expense related to discontinued operations, which for each of the

years ended December 31, 2005 and 2004, was $4 million. Had

the fair-value-based method as prescribed by SFAS No. 123 been

applied, the effect on net income and earnings per share would

have been as follows (adjusted to reflect the Stock Split):

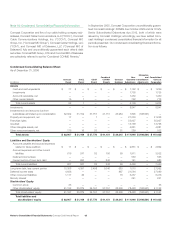

(in millions, except per share data) 2005 2004

Net income, as reported $ 928 $ 970

Add: Share-based compensation

expense included in net income,

as reported above, net of related

tax effects 42 27

Less: Share-based compensation

expense determined under fair

value-based method for all awards,

net of related tax effects (150) (206)

Pro forma, net income $ 820 $ 791

Basic earnings for common

stockholders per common share:

As reported $ 0.28 $ 0.29

Pro forma $ 0.25 $ 0.24

Diluted earnings for common

stockholders per common share:

As reported $ 0.28 $ 0.29

Pro forma $ 0.25 $ 0.23

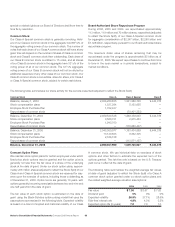

On December 23, 2004, the Compensation Committee of our

Board of Directors approved the acceleration of vesting of all

unvested options granted prior to January 1, 2003, to purchase

shares of our Class A Special common stock having an exercise

price of $22.67 (adjusted to reflect the Stock Split) or greater and

held by current employees. Options with respect to approximately

23.3 million shares (adjusted to reflect the Stock Split) of our Class

A Special common stock were subject to this acceleration. This

acceleration was effective as of December 31, 2004, except for

those holders of incentive stock options (“ISOs”), who were given

the opportunity to decline the acceleration of an option if such

acceleration would have the effect of changing the status of the

option for federal income tax purposes from an ISO to a nonquali-

fied stock option. Because these options had exercise prices in

excess of current market values (were “underwater”) and were

not fully achieving their original objectives of incentive compen-

sation and employee retention, the acceleration may have had a

positive effect on employee morale, retention and perception of

option value. The acceleration also took into account the fact that

in December 2004, we completed the repurchase of stock options

held by certain nonemployees for cash (including underwater

options) under a stock option liquidity program (see above), and

that no such offer (nor any other “solution” for underwater options)

was made to current employees. The acceleration had no effect

on reported net income, an immaterial impact on pro forma net

income in 2005 and an approximate $39 million, net of tax, impact

on pro forma net income in 2004. The impacts of the acceleration

are reflected in the pro forma amounts above. This acceleration

eliminated the future compensation expense we would have oth-

erwise recognized in our statement of operations with respect to

these options subsequent to the adoption of SFAS No. 123R.

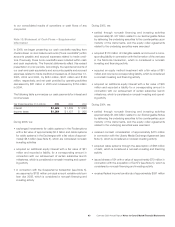

Note 11: Income Taxes

We join with our 80% or more owned subsidiaries in filing consoli-

dated federal income tax returns. E! Entertainment filed separate

consolidated federal income tax returns for periods prior to our

obtaining 100% ownership, which occurred in November 2006

(see Note 5). Income tax (expense) benefit consists of the following

components:

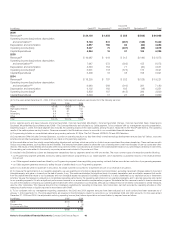

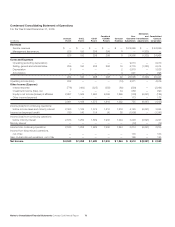

Year Ended December 31 (in millions) 2006 2005 2004

Current (expense) benefit

Federal $ (887) $ (590) $ (120)

State (77) (123) (208)

(964) (713) (328)

Deferred (expense) benefit

Federal (301) (66) (536)

State (82) (94) 63

(383) (160) (473)

Income tax (expense) benefit $ (1,347) $ (873) $ (801)