Comcast 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 50

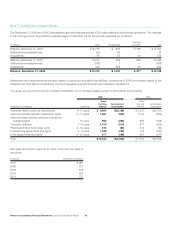

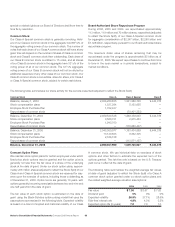

The following represents the purchase price allocation to assets

acquired and liabilities assumed, exclusive of the cable systems

held by Century and Parnassos and transferred to TWC, as a result

of the Adelphia and Time Warner transactions:

(in millions) 2006

Property and equipment $ 2,692

Franchise-related customer relationships 1,648

Cable franchise rights 6,842

Goodwill 271

Other assets 111

Total liabilities (397)

Net assets acquired $ 11,167

Discontinued Operations

As discussed above, the operating results of the Comcast

Exchange Systems transferred to TWC are reported as discon-

tinued operations for all periods and are presented in accordance

with SFAS No. 144. The following represents the operating results

of the Comcast Exchange Systems through the closing date of the

Exchanges (July 31, 2006):

(in millions) 2006 2005 2004

Revenues $ 734 $ 1,180 $ 1,086

Income before income taxes 121 159 67

Income tax expense (18) (59) (25)

Net income $ 103 $ 100 $ 42

Unaudited Pro Forma Information

The following unaudited pro forma information has been presented

as if the Adelphia and Time Warner transactions occurred on

January 1, 2005. This information is based on historical results

of operations, adjusted for purchase price allocations and is not

necessarily indicative of what the results would have been had we

operated the entities since January 1, 2005.

Year Ended December 31 (in millions) 2006 2005

Revenues $ 26,616 $ 23,672

Income from continuing operations 2,284 770

Income from discontinued operations,

net of tax 103 100

Gain on discontinued operations,

net of tax 195 —

Net Income $ 2,582 $ 870

Basic earnings for common

stockholders per common share $ 0.82 $ 0.26

Diluted earnings for common

stockholders per common share $ 0.81 $ 0.26

Texas and Kansas City Cable Partnership

In July 2006, we initiated the dissolution of Texas and Kansas City

Cable Partners (“TKCCP”), our 50%-50% cable system partnership

with TWC. Once the dissolution was triggered, the non-triggering

party had the right to choose and take full ownership of one of two

pools of TKCCP’s cable systems together with any debt allocated

to such asset pool by the triggering partner. One pool consisted of

cable systems serving Houston, Texas (“Houston Asset Pool”) and

the other pool consisted of cable systems serving Kansas City, south

and west Texas, and New Mexico (“Kansas City Asset Pool”).

In July 2006, we notified TWC of our election to dissolve TKCCP and

the allocation of all of its debt, which totaled approximately $2 bil-

lion as of July 1, 2006, to the Houston Asset Pool. In August 2006,

TWC notified us that it selected the Kansas City Asset Pool and

as a result, we were to receive the Houston Asset Pool. The $2

billion of debt allocated to the Houston Asset Pool was required

to be refinanced within 60 days of the August 1, 2006, selection

date. This debt included $600 million owed to each partner (for an

aggregate of $1.2 billion). We refinanced this debt in October 2006

(see Note 8). To be consistent with our management reporting pre-

sentation, the results of operations of the Houston Asset Pool have

been reported in our Cable segment since August 1, 2006. The

operating results of the Houston Asset Pool are eliminated in our

consolidated financial statements (see Note 14).

In January 2007, the distribution of assets by TKCCP was com-

pleted and we received the Houston Asset Pool. We will account

for the distribution of assets by TKCCP as a sale of our 50% inter-

est in the Kansas City Asset Pool in exchange for acquiring an

additional 50% interest in the Houston Asset Pool and expect to

record a gain on this transaction.

E! Entertainment Television

In November 2006, we acquired the 39.5% of E! Entertainment

Television (which operates the E! and Style programming networks)

that we did not already own for approximately $1.2 billion. We have

historically consolidated the results of operations of E! Entertain-

ment Television. We allocated the purchase price to intangibles

and goodwill.

Susquehanna

In April 2006, we acquired the cable systems of Susquehanna

Cable Co. and its subsidiaries (“Susquehanna”) for a total purchase

price of approximately $775 million. The Susquehanna systems

acquired are located primarily in Pennsylvania, New York, Maine,

and Mississippi.

Prior to the acquisition, we held an approximate 30% equity

ownership interest in Susquehanna that we accounted for as an

equity method investment. On May 1, 2006, Susquehanna Cable

Co. redeemed the approximate 70% equity ownership interest in

Susquehanna held by Susquehanna Media Co., which resulted in

Susquehanna becoming 100% owned by us.