Comcast 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MD&A Comcast 2006 Annual Report 30

Advertising. As part of our programming license agreements with

programming networks, we receive an allocation of scheduled

advertising time that we may sell to local, regional and national

advertisers. We also coordinate the advertising sales efforts of other

cable operators in some markets, and in other markets we have

formed and operate advertising interconnects, which establish a

physical, direct link between multiple cable systems and provide

for the sale of regional and national advertising across larger geo-

graphic areas than could be provided by a single cable operator.

Advertising revenues increased in 2006 as a result of the strong

growth in political advertising and the addition of our newly acquired

cable systems. We expect slower growth in our advertising revenues

in 2007, primarily as a result of lower levels of political advertising.

Other. We also generate revenues from our regional sports and

news networks, video installation services, commissions from

third-party electronic retailing, and fees for other services, such as

providing businesses with data connectivity and networked appli-

cations. Our regional sports and news networks include Comcast

SportsNet (Philadelphia), Comcast SportsNet Mid-Atlantic (Balti-

more/Washington), Cable Sports Southeast, CN8 — The Comcast

Network, Comcast SportsNet Chicago, Comcast SportsNet West

(Sacramento) and MountainWest Sports Network. These networks

earn revenue through the sale of advertising time and receive pro-

gramming license fees paid by cable and satellite distributors.

Franchise Fees. Our franchise fee revenues represent the pass-

through to our subscribers of the fees required to be paid to state

and local franchising authorities. Under the terms of our franchise

agreements, we are generally required to pay up to 5% of our gross

video revenues to the local franchising authority. The increases in

franchise fees are primarily a result of the increases in our revenues

upon which the fees apply.

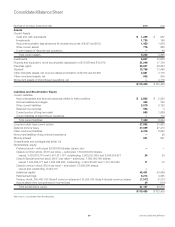

Total Cable Segment Revenue. As a result of the growth in

revenues from our products and services, we have been able to

increase our total average monthly revenue per video subscriber

(including all revenue sources) from approximately $77 in 2004 to

approximately $95 in 2006.

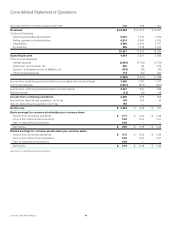

AVERAGE MONTHLY TOTAL REVENUE

PER VIDEO SUBSCRIBER

$77

$84

$95

200620052004

Cable Segment Expenses

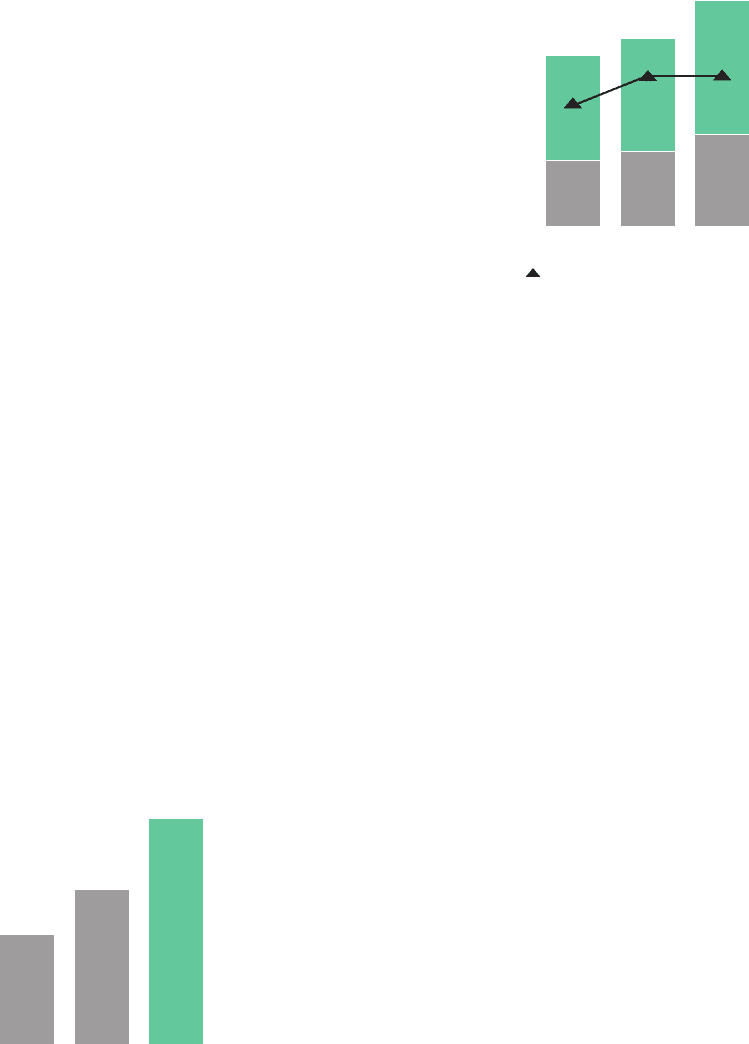

We continue to focus on controlling the growth of expenses. Our

operating margins (operating income before depreciation and

amortization as a percentage of revenue) were 40.2%, 39.8% and

38.1% for the years ended December 31, 2006, 2005 and 2004,

respectively.

OPERATING MARGINS

(in billions)

$6.9 $7.9

$9.7

200620052004

$18.2

$20.0

$24.1

30

45

38%

40% 40%

Operating Margins

Revenue

Operating Income Before

Depreciation and Amortization

Cable Segment Operating Expenses. Cable programming

expenses, our largest expense, are the fees we pay to program-

ming networks to license the programming we package, offer and

distribute to our cable subscribers. These expenses are affected

by changes in the rates charged by programming networks, the

number of subscribers and the programming options we offer to

subscribers. Cable programming expenses increased to $4.9 bil-

lion in 2006 as a result of increases in rates and the newly acquired

cable systems, from $4.1 billion in 2005 and $3.9 billion in 2004.

We anticipate our cable programming expenses will increase in the

future, as the fees charged by programming networks increase and

as we provide additional channels and ON DEMAND programming

options to our subscribers. We anticipate that these increases may

be mitigated to some extent by volume discounts.

Other operating expenses increased to $3.7 billion in 2006 from

$2.9 billion in 2005 and $2.8 billion in 2004. In 2006, our newly

acquired cable systems contributed approximately $650 million of

our increases in other operating expenses. The remaining increases

in 2006 were primarily a result of growth in the number of sub-

scribers to our cable services, which required additional personnel

to handle service calls and provide customer support, and costs

associated with the delivery of these services. The increase in 2005

was primarily a result of increases in our technical services group

due to the launch of Comcast Digital Voice, the deployment of digi-

tal simulcasting, the implementation of a new provisioning system

and, to a lesser degree, the repair of our cable systems as a result

of weather-related damage.

■

■