Comcast 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

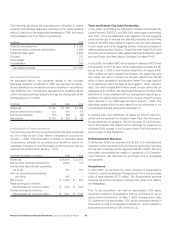

Note 8: Long-Term Debt

Weighted Average

Interest Rate as of

December 31 (in millions) December 31, 2006 2006 2005

Commercial paper 5.42% $ 199 $ 549

Term loan, due 2008 5.85% 185 —

Senior notes,

due 2006 – 2097 6.93% 26,942 20,993

Senior subordinated notes,

due 2006 – 2012 10.63% 202 349

ZONES due 2029 2.00% 747 752

Debt supporting Trust

Preferred Securities,

due 2027 9.65% 283 284

Exchangeable notes,

due 2007 5.77% 49 46

Other, including capital

lease obligations — 368 398

Total debt 28,975 23,371

Less: current portion 983 1,689

Long-term debt $ 27,992 $ 21,682

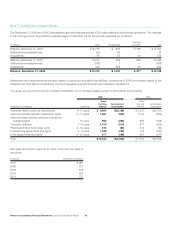

As of December 31, 2006, maturities of long-term debt outstand-

ing were as follows:

(in millions) Maturities

2007 $ 983

2008 1,668

2009 2,249

2010 1,320

2011 1,767

Thereafter 20,988

Guarantee Structures

Comcast Corporation (our parent corporation) and a number of our

wholly owned subsidiaries that hold substantially all of our cable

assets have unconditionally guaranteed each other’s debt secu-

rities and indebtedness for borrowed money, including amounts

outstanding under our $5.0 billion revolving bank credit facility. As

of December 31, 2006, $27.141 billion of our debt was included in

this cross-guarantee structure.

Comcast Holdings Corporation (“Comcast Holdings”), our wholly

owned subsidiary, is not part of the cross-guarantee structure.

However, Comcast Corporation has unconditionally guaranteed

Comcast Holdings’ ZONES due October 2029 and its 10

5⁄8%

Senior Subordinated Debentures due 2012, which totaled $683

million as of December 31, 2006. The Comcast Holdings guaran-

tee is subordinate to the guarantees under the cross-guarantee

structure.

Debt Borrowings

During 2006, we issued $7.485 billion aggregate principal amount

of senior notes as follows:

(in millions) Principal

Floating-rate notes (LIBOR + 0.3%), due 2009 $ 1,250

5.90% Senior notes, due 2016 1,000

6.50% Senior notes, due 2017 1,000

5.875% Senior notes, due 2018 900

6.45% Senior notes, due 2037 1,865

7.00% Senior notes, due 2055 1,470

$ 7,485

We used the net proceeds of these offerings for working capi-

tal and general corporate purposes, including the repayment of

commercial paper obligations (see below), the Adelphia and Time

Warner transactions, the refinancing of debt associated with the

Houston Asset Pool, and the acquisition of the remaining portion

of E! Entertainment Television that we did not already own (see

Note 5).

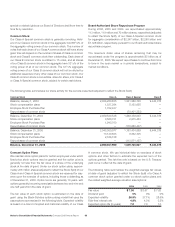

Debt Repayments

During 2006, we repaid $1.607 billion aggregate principal amount

of senior notes and senior subordinated notes at their scheduled

maturity dates as follows:

(in millions) Principal

6.375% Senior notes $ 500

6.875% Senior notes 388

8.3% Senior notes 600

10.5% Senior subordinated notes 119

$ 1,607

During 2006, we also repaid $350 million outstanding under our

commercial paper program and $82 million of other debt.

Commercial Paper

Our commercial paper program provides a lower cost borrowing

source of liquidity to fund our short-term working capital require-

ments. The program allows for a maximum of $2.25 billion of

commercial paper to be issued at any one time. Our revolving bank

credit facility supports this program. Amounts outstanding under

the program are classified as long-term in our consolidated bal-

ance sheet because we have both the ability and the intent to

refinance these obligations, if necessary, on a long-term basis with

amounts available under our revolving bank credit facility.

Revolving Bank Credit Facility

We have a $5.0 billion revolving bank credit facility due Octo-

ber 2010 (the “credit facility”) with a syndicate of banks. The base

rate, chosen at our option, is either London Interbank Offered Rate

(“LIBOR”) or the greater of the prime rate or the Federal Funds rate

plus 0.5%. The borrowing margin is based on our senior unse-

cured debt ratings. As of December 31, 2006, the interest rate for