Comcast 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

Under the terms of our 2002 acquisition of AT&T Corp.’s cable

business, we are contractually liable for 50% of any liabilities of

AT&T in the actions described in items (i) and (ii) above (in which

we are also a defendant).

We deny any wrongdoing in connection with the claims that have

been made directly against us, our subsidiaries and Brian L. Roberts,

and are defending all of these claims vigorously. The final disposi-

tion of these claims is not expected to have a material adverse

effect on our consolidated financial position, but could possibly

be material to our consolidated results of operations of any one

period. Further, no assurance can be given that any adverse out-

come would not be material to our consolidated financial position.

AT&T — TCI Cases

In June 1998, class action lawsuits were filed by then-shareholders

of Tele-Communications, Inc. (“TCI”) Series A TCI Group Common

Stock (“Common A”) against AT&T and the directors of TCI relating

to the acquisition of TCI by AT&T, alleging that former members of

the TCI board of directors breached their fiduciary duties to Com-

mon A shareholders by agreeing to transaction terms whereby

holders of the Series B TCI Group Common Stock received a 10%

premium over what Common A shareholders received.

In connection with the TCI acquisition (completed in early 1999),

AT&T agreed under certain circumstances to indemnify TCI’s former

directors for certain liabilities, potentially including those incurred in

connection with this action. Under the terms of our acquisition of

AT&T Corp.’s cable business, (i) we agreed to indemnify AT&T for

certain liabilities, potentially including those incurred by AT&T in

connection with this action, and (ii) we assumed certain obligations

of TCI to indemnify its former directors, potentially including those

incurred in connection with this action.

In October 2006 these lawsuits were settled. We agreed to contrib-

ute approximately $44 million to the settlement. This amount was

paid in November 2006 and did not have a material impact on our

results of operations for the year ended December 31, 2006. The

settlement was approved in February 2007.

Patent Litigation

We are a defendant in several unrelated lawsuits claiming

infringement of various patents relating to various aspects of our

businesses. In certain of these cases other industry participants

are also defendants, and also in certain of these cases we expect

that any potential liability would be in part or in whole the responsi-

bility of our equipment vendors pursuant to applicable contractual

indemnification provisions. To the extent that the allegations in

these lawsuits can be analyzed by us at this stage of their pro-

ceedings, we believe the claims are without merit and intend to

defend the actions vigorously. The final disposition of these claims

is not expected to have a material adverse effect on our con-

solidated financial position, but could possibly be material to our

consolidated results of operations of any one period. Further, no

assurance can be given that any adverse outcome would not be

material to our consolidated financial position.

Antitrust Cases

We are defendants in two purported class actions originally filed in

the United States District Courts for the District of Massachusetts

and the Eastern District of Pennsylvania, respectively. The poten-

tial class in the Massachusetts case is our subscriber base in the

“Boston Cluster” area, and the potential class in the Pennsylvania

case is our subscriber base in the “Philadelphia and Chicago clus-

ters,” as those terms are defined in the complaints. In each case,

the plaintiffs allege that certain subscriber exchange transactions

with other cable providers resulted in unlawful “horizontal market

restraints” in those areas and seek damages pursuant to antitrust

statutes, including treble damages.

As a result of recent events in both cases relating to the proce-

dural issue of whether the plaintiffs’ claims could proceed in court

or, alternatively, whether the plaintiffs should be compelled to

arbitrate their claims pursuant to arbitration clauses in their sub-

scriber agreements, it has become more likely that these cases

will proceed in court. Our motion to dismiss the Pennsylvania case

on the pleadings was denied, and the plaintiffs have moved to

certify a class action. We are opposing the plaintiffs’ motion and

are proceeding with class discovery. We have moved to dismiss

the Massachusetts case. The Massachusetts case was recently

transferred to the Eastern District of Pennsylvania and plaintiffs are

seeking to consolidate it with the Pennsylvania case.

We believe the claims in these actions are without merit and are

defending the actions vigorously. The final disposition of these

claims is not expected to have a material adverse effect on our

consolidated financial position, but could possibly be material to

our consolidated results of operations of any one period. Further,

no assurance can be given that any adverse outcome would not

be material to our consolidated financial position.

Other

We are subject to other legal proceedings and claims that arise in

the ordinary course of our business. The amount of ultimate liability

with respect to such actions is not expected to materially affect our

financial position, results of operations or liquidity.

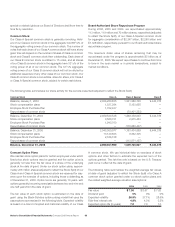

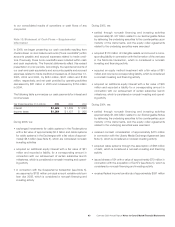

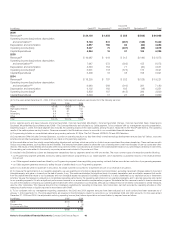

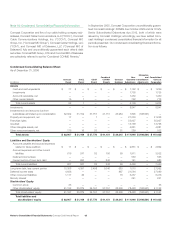

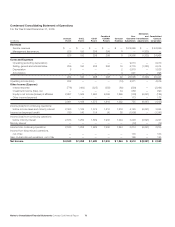

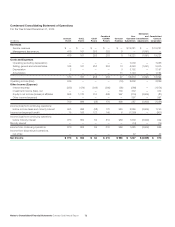

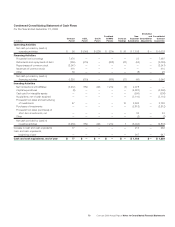

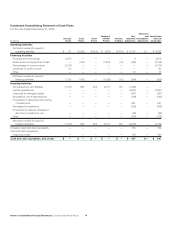

Note 14: Financial Data by Business Segment

Our reportable segments consist of our Cable and Programming

businesses. In evaluating the profitability of our segments, the

components of net income (loss) below operating income (loss)

before depreciation and amortization are not separately evaluated

by our management. Assets are not allocated to segments for

management reporting. Our financial data by business segment

is as follows: