Comcast 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27 Comcast 2006 Annual Report MD&A

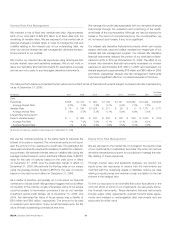

Consolidated Revenues

Our Cable and Programming segments accounted for substan-

tially all of the increases in consolidated revenues for 2006 and

2005. Cable segment and Programming segment revenues are

discussed separately below. The remaining changes relate to our

other business activities, primarily Comcast Spectacor, whose rev-

enues were negatively affected in 2005 by the National Hockey

League (“NHL”) lockout.

Consolidated Operating, Selling, General and

Administrative Expenses

Our Cable and Programming segments accounted for substan-

tially all of the increases in consolidated operating, selling, general

and administrative expenses for 2006 and 2005. Cable segment

and Programming segment expenses are discussed separately

below. The remaining changes relate to our other business activi-

ties, primarily Comcast Spectacor, and the impact of adopting

Statement of Financial Accounting Standards (“SFAS”) No. 123R,

“Share-Based Payment” (“SFAS No. 123R”).

Effective January 1, 2006, we adopted SFAS No. 123R using the

Modified Prospective Approach. SFAS No. 123R revises SFAS

No. 123, “Accounting for Stock-Based Compensation” (“SFAS

No. 123”) and supersedes Accounting Principles Board (“APB”)

Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB

No. 25”). SFAS No. 123R requires the cost of all share-based pay-

ments to employees, including grants of employee stock options,

to be recognized in the financial statements based on their fair

values at grant date, or the date of later modification, over the

requisite service period. In addition, SFAS No. 123R requires unrec-

ognized cost (based on the amounts previously disclosed in our

pro forma footnote disclosure) related to options vesting after the

date of initial adoption to be recognized in the financial statements

over the remaining requisite service period.

The incremental pretax share-based compensation expense rec-

ognized because of the adoption of SFAS No. 123R for the year

ended December 31, 2006, was $126 million. Total share-based

compensation expense recognized under SFAS No. 123R, includ-

ing the incremental pretax share-based compensation expense,

was $190 million for the year ended December 31, 2006. Share-

based compensation expense is reflected in the operating results

of each of our business segments. Refer to Note 10 and Note 14

to our consolidated financial statements for further details on our

adoption of SFAS No. 123R.

Consolidated Depreciation and Amortization

The increases in depreciation expense for 2006 and 2005 are pri-

marily a result of capital expenditures in our Cable segment and,

in 2006, the depreciation associated with acquisitions of cable

systems.

The decreases in amortization expense for 2006 and 2005 are

primarily a result of decreases in the amortization of our franchise-

related customer relationship intangible assets, partially offset by

increased amortization expense related to software-related intan-

gibles acquired in various transactions, and in 2006, the customer

relationship intangible assets recorded in connection with the

acquisitions of cable systems.

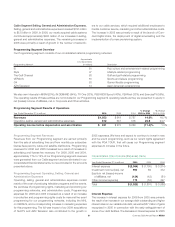

Segment Operating Results

Certain adjustments have been made in our segment presenta-

tion to be consistent with our management reporting presentation.

These adjustments primarily relate to the adoption of SFAS No.

123R and are further discussed in Note 14 to our consolidated

financial statements.

To measure the performance of our operating segments, we use

operating income before depreciation and amortization, exclud-

ing impairment charges related to fixed and intangible assets,

and gains or losses from the sale of assets, if any. This measure

eliminates the significant level of noncash depreciation and amor-

tization expense that results from the capital-intensive nature of

our businesses and from intangible assets recognized in busi-

ness combinations. It is also unaffected by our capital structure

or investment activities. We use this measure to evaluate our con-

solidated operating performance, the operating performance of our

operating segments, and to allocate resources and capital to our

operating segments. It is also a significant performance measure in

our annual incentive compensation programs. We believe that this

measure is useful to investors because it is one of the bases for

comparing our operating performance with other companies in our

industries, although our measure may not be directly comparable

to similar measures used by other companies. Because we use

this metric to measure our segment profit or loss, we reconcile it to

operating income, the most directly comparable financial measure

calculated and presented in accordance with generally accepted

accounting principles in the United States (“GAAP”) in the business

segment footnote to our consolidated financial statements. You

should not consider this measure a substitute for operating income

(loss), net income (loss), net cash provided by operating activities,

or other measures of performance or liquidity we have reported in

accordance with GAAP.

Cable Segment Overview

Our cable systems simultaneously deliver video, high-speed Internet

and phone services to our subscribers. The majority of our Cable

segment revenue is earned from subscriptions to these cable ser-

vices. Subscribers typically pay us monthly, based on their chosen

level of service, number of services and the type of equipment

they use, and generally may discontinue service at any time. We

measure our success in selling subscription-based services to cus-

tomers by a metric referred to as a revenue generating unit (“RGU”).

Each individual cable service (basic cable, digital cable, high-speed

Internet or phone service) that a subscriber receives represents

one RGU. As of December 31, 2006, we had approximately