Comcast 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 62

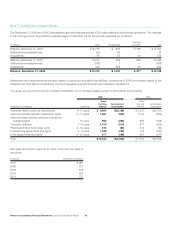

Our effective income tax (expense) benefit differs from the federal

statutory amount because of the effect of the following items:

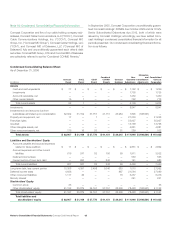

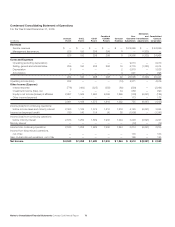

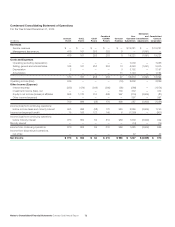

Year Ended December 31 (in millions) 2006 2005 2004

Federal tax at statutory rate $ (1,258) $ (602) $ (610)

State income taxes, net of

federal benefit (132) (105) (20)

Nondeductible losses from

joint ventures and equity

in net (losses) income of

affiliates, net 18 (24) (9)

Adjustments to prior year

income tax accrual and

related interest 97 (105) (157)

Other (72) (37) (5)

Income tax (expense) benefit $ (1,347) $ (873) $ (801)

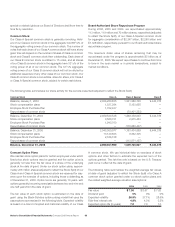

Our net deferred tax liability consists of the following components:

December 31 (in millions) 2006 2005

Deferred tax assets:

Net operating loss carryforwards $ 309 $ 331

Differences between book and tax basis

of long-term debt 177 191

Nondeductible accruals and other 742 904

1,228 1,426

Deferred tax liabilities:

Differences between book and tax basis

of property and equipment and

intangible assets $ 25,527 $ 23,712

Differences between book and tax basis

of investments 2,633 4,442

Differences between book and tax basis

of indexed debt securities 720 644

28,880 28,798

Net deferred tax liability $ 27,652 $ 27,372

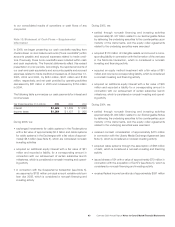

We recorded $(27) million and $319 million of deferred income

tax liabilities (assets) in 2006 through income from discontinued

operations and gain on discontinued operations, respectively. We

decreased net deferred income tax liabilities by $474 million in 2006,

principally in connection with the Adelphia and Time Warner trans-

actions, the acquisition of the interest in E! Entertainment Television

that we did not already own and Susquehanna (see Note 5).

We recorded an increase (decrease) of $79 million, $2 million and

$(12) million to net deferred income tax liabilities in 2006, 2005 and

2004, respectively, in connection with unrealized gains (losses) on

marketable securities, cash flow hedges and other amounts that

are included in accumulated other comprehensive income (loss).

Net deferred tax liabilities included in current liabilities are related

primarily to our current investments. We have federal net operating

loss carryforwards of $178 million and various state carryforwards

that expire in periods through 2026. The determination of the state

net operating loss carryforwards is dependent upon the subsidiar-

ies’ taxable income or loss, apportionment percentages and other

respective state laws that can change from year to year and impact

the amount of such carryforward.

In 2006, 2005 and 2004, income tax benefits attributable to share-

based compensation of approximately $60 million, $35 million and

$80 million, respectively, were allocated to stockholders’ equity.

In the ordinary course of business, our tax returns, including those

of acquired subsidiaries, are subject to examination by various tax-

ing authorities.

In December 2004, the Internal Revenue Service concluded an

examination of the tax returns of MediaOne Group, Inc., a sub-

sidiary acquired in our 2002 acquisition of AT&T Corp.’s cable

business, for the period of 1996 through 2000. We received a

notice of adjustment disallowing certain deductions, principally a

$1.5 billion breakup fee paid by MediaOne in 1999. The National

Office of the IRS has issued a Technical Advice Memorandum that

is adverse to us. We do not agree with the adjustment. We have

received a final assessment and are in the process of preparing an

appeal. In November 2005, we made a payment of $557 million

to reduce the accruing of interest on the pending assessment. If

we are successful in part or full, all or some of the funds would be

refundable. If the IRS prevails, there would be no material effect on

our consolidated results of operations for any period.

During 2005, the IRS proposed the disallowance of noncash inter-

est deductions taken on the ZONES (see Note 8). The National

Office of the IRS has issued a Technical Advice Memorandum

that is adverse to us. We have recognized a cumulative federal

tax benefit of $523 million through December 31, 2006, which will

reverse and become payable upon the maturity or retirement of the

ZONES; we have recorded this amount as a deferred tax liability. If

the IRS’s position is sustained, the income tax benefits previously

recognized would be disallowed, and interest would be assessed

on amounts disallowed. Accordingly, the amounts recorded as

deferred taxes would become payable. We do not agree with the

IRS’s position and have appealed. The ultimate resolution of this

issue is not expected to have a material effect on our consolidated

results of operations for any period.

Other examinations of our tax returns may result in future tax

and interest assessments by the taxing authorities, and we have

accrued a liability when we believe that it is probable that we

will be assessed. Differences between the estimated and actual

amounts determined upon ultimate resolution, individually or in the

aggregate, are not expected to have a material adverse effect on

our consolidated financial position but could possibly be material