Comcast 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 58

special or related rights as our Board of Directors shall from time to

time fix by resolution.

Common Stock

Our Class A Special common stock is generally nonvoting. Hold-

ers of our Class A common stock in the aggregate hold 66

2⁄3% of

the aggregate voting power of our common stock. The number of

votes that each share of our Class A common stock will have at any

given time will depend on the number of shares of Class A common

stock and Class B common stock then outstanding. Each share of

our Class B common stock is entitled to 15 votes, and all shares

of our Class B common stock in the aggregate have 33

1⁄3% of the

voting power of all of our common stock. The 33

1⁄3% aggregate

voting power of our Class B common stock will not be diluted by

additional issuances of any other class of our common stock. Our

Class B common stock is convertible, share for share, into Class A

or Class A Special common stock, subject to certain restrictions.

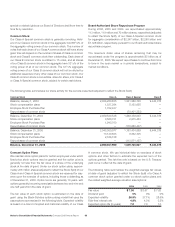

Board-Authorized Share Repurchase Program

During 2006, 2005 and 2004, we repurchased approximately

113 million, 119 million and 70 million shares, respectively (adjusted

to reflect the Stock Split), of our Class A Special common stock

for aggregate consideration of $2.347 billion, $2.290 billion and

$1.328 billion, respectively, pursuant to our Board-authorized share

repurchase program.

The maximum dollar value of shares remaining that may be

repurchased under the program is approximately $3 billion as of

December 31, 2006. We expect repurchases to continue from time

to time in the open market or in private transactions, subject to

market conditions.

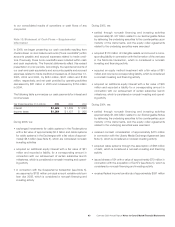

Comcast Option Plans

We maintain stock option plans for certain employees under which

fixed-price stock options may be granted and the option price is

generally not less than the fair value of a share of the underlying

stock at the date of grant. Under our stock option plans, approxi-

mately 236 million shares (adjusted to reflect the Stock Split) of our

Class A and Class A Special common stock are reserved for issu-

ance upon the exercise of options, including those outstanding as

of December 31, 2006. Option terms are generally 10 years, with

options generally becoming exercisable between two and nine and

one half years from the date of grant.

The fair value of each stock option is estimated on the date of

grant using the Black-Scholes option pricing model that uses the

assumptions summarized in the following table. Expected volatility

is based on a blend of implied and historical volatility of our Class

A common stock. We use historical data on exercises of stock

options and other factors to estimate the expected term of the

options granted. The risk-free rate is based on the U.S. Treasury

yield curve in effect at the date of grant.

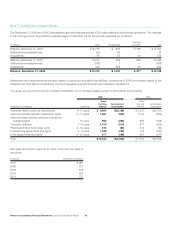

The following table summarizes the weighted-average fair values

at date of grant (adjusted to reflect the Stock Split) of a Class A

common stock option granted under our stock option plans and

the related weighted-average valuation assumptions:

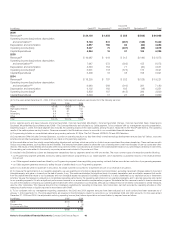

2006 2005 2004

Fair value $ 7.30 $ 8.67 $ 7.63

Dividend yield 0% 0% 0%

Expected volatility 26.9% 27.1% 28.6%

Risk-free interest rate 4.8% 4.3% 3.5%

Expected option life (in years) 7.0 7.0 7.0

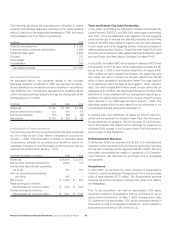

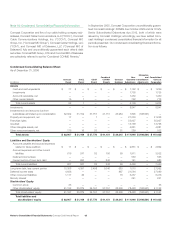

The following table summarizes our share activity for the periods presented (adjusted to reflect the Stock Split):

Common Stock Class A Class A Special Class B

Balance, January 1, 2004 2,036,280,835 1,331,386,738 9,444,375

Stock compensation plans 1,537,284 8,153,658 —

Employee Stock Purchase Plan 1,702,427 — —

Repurchases of common stock — (70,401,353) —

Balance, December 31, 2004 2,039,520,546 1,269,139,043 9,444,375

Stock compensation plans 3,586,731 2,975,453 —

Employee Stock Purchase Plan 1,943,700 — —

Repurchases of common stock — (118,680,437) —

Balance, December 31, 2005 2,045,050,977 1,153,434,059 9,444,375

Stock compensation plans 13,140,825 9,362,105 —

Employee Stock Purchase Plan 2,166,158 — —

Repurchases of common stock — (113,071,157) —

Balance, December 31, 2006 2,060,357,960 1,049,725,007 9,444,375