Comcast 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements Comcast 2006 Annual Report 48

income taxes. We do not expect FIN 48 to have a material impact

on our consolidated financial statements.

EITF Issue No. 06-1

In June 2006, the EITF reached a consensus on EITF Issue No.

06-1, “Accounting for Consideration Given by a Service Provider

to Manufacturers or Resellers of Specialized Equipment Necessary

for an End-Customer to Receive Service from the Service Provider”

(“EITF 06-1”). EITF 06-1 provides guidance on the accounting for

consideration given by a vendor to a customer. The provisions of

EITF 06-1 will be effective for us as of December 31, 2007. We do

not expect EITF 06-1 to have a material impact on our consoli-

dated financial statements.

EITF Issue No. 06-3

In June 2006, the EITF reached a consensus on EITF Issue

No. 06-3, “How Taxes Collected from Customers and Remitted

to Governmental Authorities Should Be Presented in the Income

Statement (That Is, Gross versus Net Presentation)” (“EITF 06-3”).

EITF 06-3 provides that the presentation of taxes assessed by

a governmental authority that is directly imposed on a revenue-

producing transaction between a seller and a customer on either

a gross basis (included in revenues and costs) or on a net basis

(excluded from revenues) is an accounting policy decision that

should be disclosed. The provisions of EITF 06-3 will be effective

for us as of January 1, 2007. We do not expect EITF 06-3 to have

a material impact on our consolidated financial statements.

SAB No. 108

In September 2006, the Securities Exchange Commission Staff

issued Staff Accounting Bulletin No. 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in

the Current Year Financial Statements” (“SAB No. 108”). SAB No.

108 requires the use of two alternative approaches in quantita-

tively evaluating materiality of misstatements. If the misstatement

as quantified under either approach is material to the current year

financial statements, the misstatement must be corrected. If the

effect of correcting the prior year misstatements, if any, in the

current year income statement is material, the prior year finan-

cial statements should be corrected. In the year of adoption (fiscal

years ending after November 15, 2006, or calendar year 2006 for

us), the misstatements may be corrected as an accounting change

by adjusting opening retained earnings rather than including the

adjustment in the current year income statement. Upon completing

our evaluation of the requirements of SAB No. 108, we determined

it did not affect our consolidated financial statements.

Note 4: Earnings Per Share

Basic earnings for common stockholders per common share

(“Basic EPS”) is computed by dividing net income for common

stockholders by the weighted-average number of common shares

outstanding during the period.

Our potentially dilutive securities include potential common shares

related to our stock options and restricted share units. Diluted

earnings for common stockholders per common share (“Diluted

EPS”) considers the impact of potentially dilutive securities except

in periods in which there is a loss because the inclusion of the

potential common shares would have an antidilutive effect. Diluted

EPS excludes the impact of potential common shares related to

our stock options in periods in which the option exercise price

is greater than the average market price of our Class A common

stock and our Class A Special common stock during the period

(see Note 10).

Diluted EPS for 2006, 2005 and 2004 excludes approximately

116 million, 126 million and 154 million, respectively, of potential

common shares related to our share-based compensation plans

because the inclusion of the potential common shares would have

an antidilutive effect.

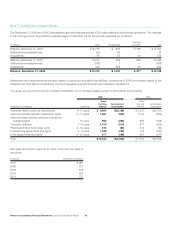

The following table reconciles the numerator and denominator of the computations of Diluted EPS from continuing operations for the years

presented (adjusted to reflect the Stock Split):

2006 2005 2004

Per Per Per

Year Ended December 31 Share Share Share

(in millions, except per share data) Income Shares Amount Income Shares Amount Income Shares Amount

Basic EPS $ 2,235 3,160 $ 0.71 $ 828 3,295 $ 0.25 $ 928 3,360 $ 0.28

Effect of Dilutive Securities

Assumed exercise or issuance of

shares relating to stock plans 20 17 15

Diluted EPS $ 2,235 3,180 $ 0.70 $ 828 3,312 $ 0.25 $ 928 3,375 $ 0.28