Comcast 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

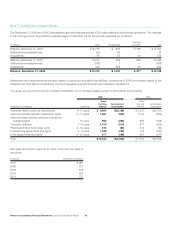

51 Comcast 2006 Annual Report Notes to Consolidated Financial Statements

The results of operations of the Susquehanna cable systems

have been included in our consolidated financial statements since

the acquisition date and are reported in our Cable segment. We

allocated the purchase price to property and equipment, franchise-

related customer relationship intangibles, nonamortizing cable

franchise rights and goodwill. The acquisition of the Susquehanna

cable systems was not significant to our consolidated financial

statements for 2006.

Motorola

In March 2005, we entered into two joint ventures with Motorola

under which we are developing and licensing next-generation

programming access security (known as “conditional access”)

technology for cable systems and related products. One of the

ventures will license such products to equipment manufactur-

ers and other cable companies. The other venture will provide us

greater participation in the design and development of conditional

access technology for our cable systems. In addition to funding

approximately 50% of the annual cost requirements, we have paid

$20 million to Motorola and have committed to pay up to $80 mil-

lion to Motorola over a four-year period based on the achievement

of certain milestones. Motorola contributed licenses to conditional

access and related technology to the ventures.

These two ventures are both considered VIEs and we have con-

solidated both of these ventures as we are considered the primary

beneficiary. Accordingly, we have recorded approximately $190

million in intangible assets, of which we recorded a charge of

approximately $20 million related to in-process research and devel-

opment in 2005 that has been included in amortization expense.

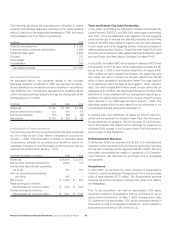

Liberty Media Exchange Agreement

In July 2004, we exchanged approximately 120 million shares of

Liberty Media Corporation (“Liberty Media”) Series A common

stock that we held, valued at approximately $1.022 billion based

upon the price of Liberty Media common stock on the closing date

of the transaction with Liberty Media for 100% of the stock of Lib-

erty’s subsidiary, Encore ICCP, Inc. Encore’s assets consisted of

cash of approximately $547 million, a 10.4% interest in E! Enter-

tainment Television and 100% of International Channel Networks

(which operates AZN Television). We also received all of Liberty

Media’s rights, benefits and obligations under the TCI Music con-

tribution agreement, which resulted in the resolution of all pending

litigation between Liberty Media and us regarding the contribution

agreement. The exchange was structured as a tax-free transaction.

We allocated the value of the shares exchanged in the transaction

among cash, our additional investment in E! Entertainment Tele-

vision, International Channel Networks and the resolution of the

litigation related to the contribution agreement. The effects of our

acquisition of the additional interest in E! Entertainment Television

and our acquisition of International Channel Networks have been

reflected in our consolidated statement of operations from the date

of the transaction.

TechTV

In May 2004, we completed the acquisition of TechTV Inc. by

acquiring all outstanding common and preferred stock of TechTV

from Vulcan Programming Inc. for approximately $300 million in

cash. Substantially all of the purchase price has been recorded

to intangible assets and is being amortized over a period of 2 to

22 years. On May 28, 2004, G4 and TechTV began operating as

one network. The effects of our acquisition of TechTV have been

reflected in our consolidated statement of operations from the date

of the transaction. We have classified G4 as part of our Program-

ming segment.

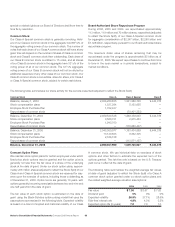

Gemstar

In March 2004, we entered into a long-term, non-exclusive patent

license and distribution agreement with Gemstar-TV Guide Inter-

national (“Gemstar”) in exchange for a one-time payment of $250

million to Gemstar. If our total subscribers exceed a specified

threshold, we will be required to make additional one-time pay-

ments to Gemstar for each subscriber in excess of such threshold.

This agreement allows us to utilize Gemstar’s intellectual property

and technology and the TV Guide brand and content on our inter-

active program guides. We have allocated the $250 million amount

paid based on the fair value of the components of the contract to

various intangible and other assets, which are being amortized over

a period of 3 to 12 years. In addition, we and Gemstar formed an

entity to develop and enhance interactive programming guides.

Note 6: Investments

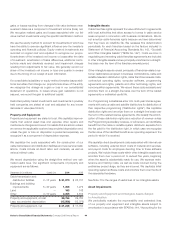

December 31 (in millions) 2006 2005

Fair value method

Cablevision Systems Corporation $ 146 $ 120

Discovery Holding Company 161 152

Embarq Corporation 69 —

Liberty Capital 490 —

Liberty Global 439 336

Liberty Interactive 539 —

Liberty Media — 787

Sprint Nextel 493 614

Time Warner 1,052 994

Vodafone 61 54

Other 63 90

3,513 3,147

Equity method, principally cable-related 5,394 2,823

Cost method, principally AirTouch as of

December 31, 2006, and

Time Warner Cable and AirTouch as of

December 31, 2005 1,675 6,853

Total investments 10,582 12,823

Less current investments 1,735 148

Noncurrent investments $ 8,847 $ 12,675